Investors continue to be impressed by the published US consumer inflation data as the new trading week begins. This main data as well as the coronavirus pandemic factor will influence investors' behavior in the markets.

Last week turned out to be quite volatile under the influence of extremely negative data on American inflation, which soared to the 1990 level – by 6.2%. This news caused a wave of reasonable fears that the Fed will be forced to start raising interest rates in the first half of the new year, despite the fact that the QE program will not be over yet. Here, it is clear that the main role will be played by inflation, the continued growth of which will force the Fed to start raising rates although there is a recession in the economy and the labor market is still weak.

Earlier, it was already pointed out the continued growth of inflation could be an unpleasant surprise for holders of treasuries and shares of companies, as it could stimulate an earlier increase in interest rates, for example, after a new Fed leader is appointed in February. Currently, two candidates are being considered – J. Powell, whose term as the head of the bank ends, and L. Brainard, a member of the Federal Reserve Board.

We believe that in conditions of increased inflationary pressure, regardless of who becomes chairman, the regulator will have to raise the key interest rate by at least 0.25% to 0.50%, after which a pause will be made in order to observe the dynamics of inflation.

How will the markets behave in conditions of a high probability of a rate increase in the near future?

We believe that the threat of an increase in the cost of borrowing by the Fed will definitely stimulate sales in the government debt market, which will support an increase in the yield of treasuries, and in turn, will contribute to the strengthening of the US dollar. If earlier, we believed that keeping inflation at around 5% to 5.4% would most likely keep the ICE dollar index in a sideways range, then after inflation breaks above 6.0%, we can say confidently that demand for the US dollar will only increase.

The fact that neither the ECB, nor the Bank of England, nor the Central Bank of Japan and other world central banks will rush to tighten their monetary policies continues to play an important role, which means that they will not support national currencies, which will eventually shift the balance of ratios in favor of the US currency.

Based on this, it can be assumed that the US dollar will continue to grow smoothly and correct from time to time. The publication of inflation figures for November and December will be important for its future movement. An increase in inflation or its stabilization at the current level will support the dollar rate in the currency market.

Forecast of the day:

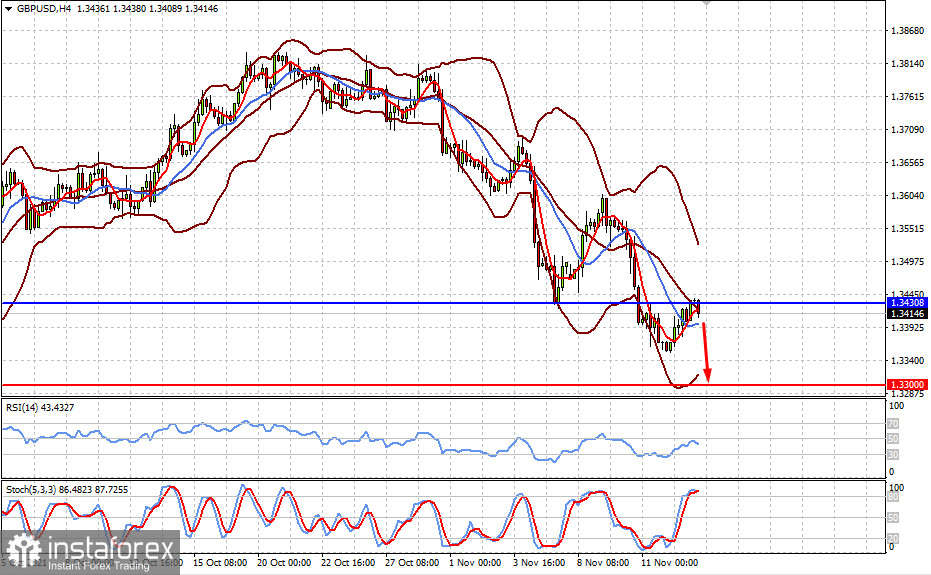

The GBP/USD pair made an upward correction towards the strong resistance level of 1.3430. If it fails to break through this mark, we can expect a local reversal and the pair's decline to the level of 1.3300.

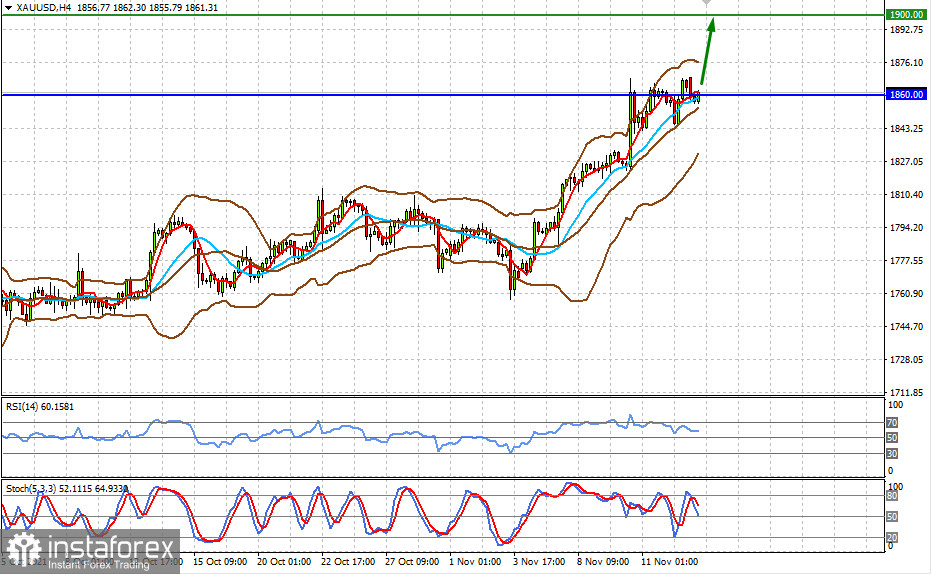

Spot gold is gaining support amid uncertainty over the timing of the Fed's rate hike. While this factor is present, the XAU/USD pair will most likely continue to rise to the level of 1900.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română