The GBP/USD pair rallied after reaching 1.0356 in the morning. After its massive drop, a rebound was natural. The price increased only because the Dollar Index slipped lower after reaching the 114.52 new high.

Fundamentally, the GBP took a serious hit from the Flash Services PMI on Friday which dropped from 50.9 to 49.2 below the 49.9 estimated signaling contraction. Today, the Rightmove HPI rose by 0.7% versus the 1.3% drop registered in the previous reporting period.

Tomorrow, the fundamentals will drive the price. The CB Consumer Confidence is seen as a high-impact event and is expected at 104.0 points above 103.2 in the previous reporting period. The New Home Sales, Durable Goods Orders, and Core Durable Goods Orders indicators will be released as well. The better-than-expected US data could boost the USD.

GBP/USD Bearish Pattern!

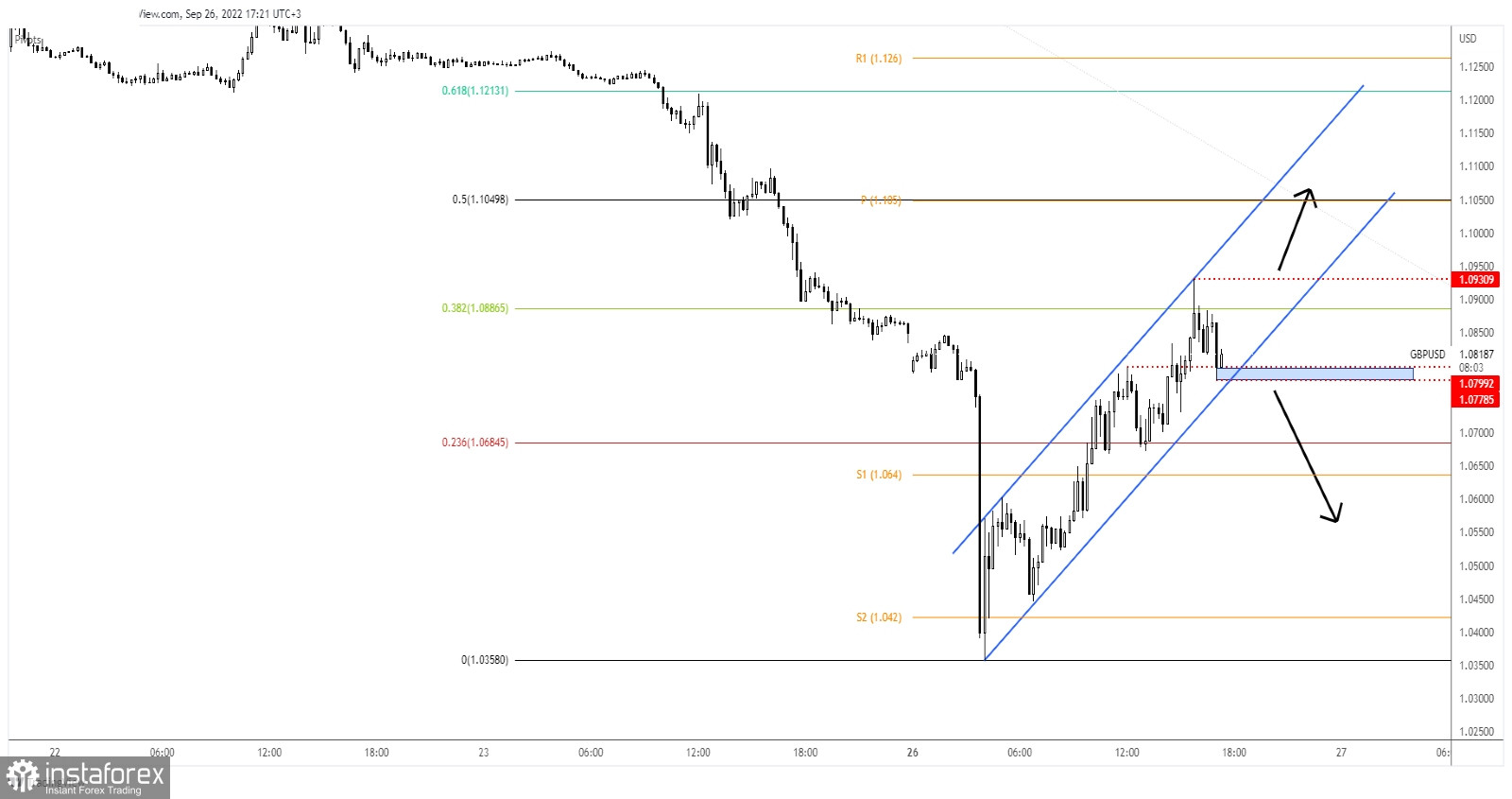

As you can see on the H1 chart, the GBP/USD pair increased within an up-channel pattern. As long as it stays above the uptrend line, it could extend its short-term rebound. Today's high of 1.0930 represents an upside obstacle.

The 38.2% (1.0886) is seen as a static resistance as well. Technically, the current channel could represent a bearish pattern.

GBP/USD Forecast!

Staying below the 38.2% retracement level and under the 1.0930 and making a valid breakdown through the uptrend line and below 1.0778 could activate a new sell-off. This scenario brings new short opportunities as the leg higher could be over after escaping from the up-channel pattern.

A new higher high activates a larger swing higher in the short term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română