To open long positions on GBP/USD, you need:

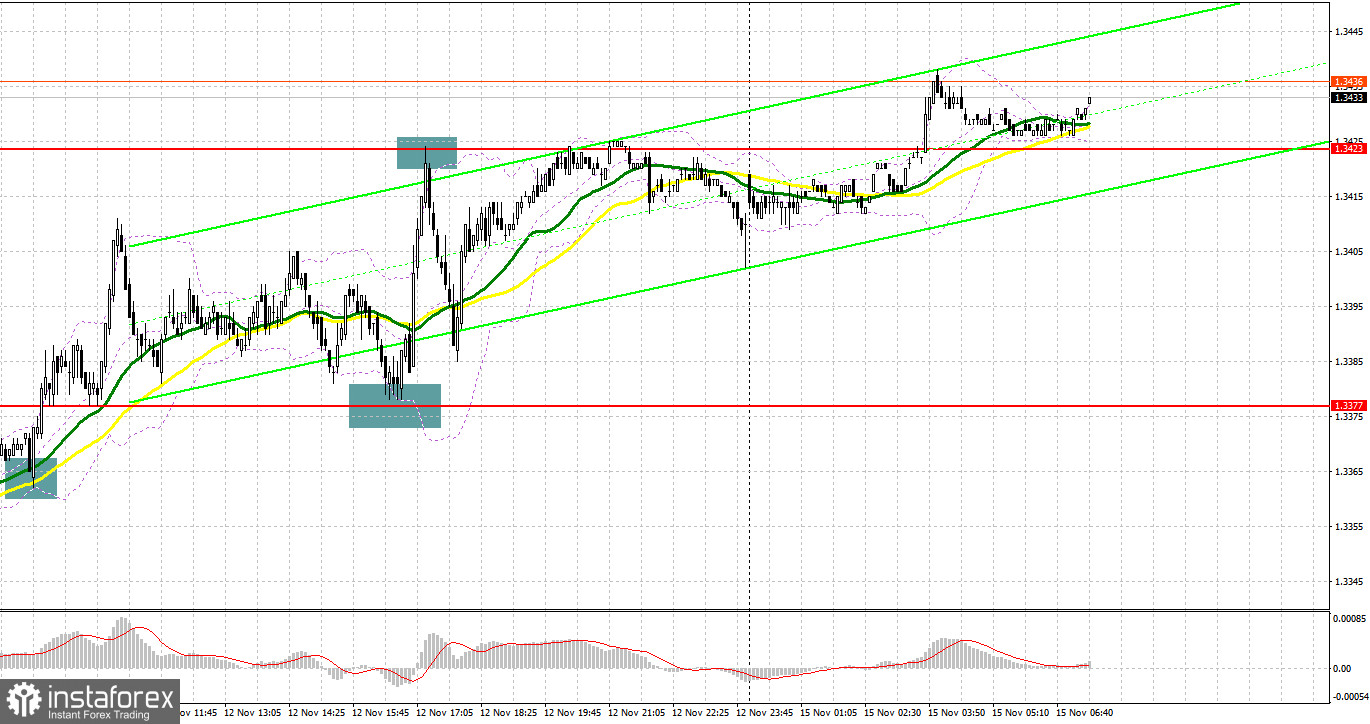

A lot of signals to enter the market were generated last Friday. Let's take a look at the 5 minute chart and deal with all of them. In my morning forecast, I drew attention to the 1.3368 level and advised you to open long positions from it. A breakthrough and reverse test of this area from top to bottom at the very beginning of the European session resulted in forming a signal to open long positions. As a result, the upward movement of GBP/USD was about 40 points, but quite a bit was not enough before the 1.3413 level was updated. Therefore, it was not possible to get a convenient entry point into short positions from there. In the second half of the day, after the pair's downward correction to the support area of 1.3377, the formation of a false breakout at this level gave a good entry point to buy the pound, which led to a rise to the area of the next resistance at 1.3423. There, an unsuccessful attempt by the bulls to gain a foothold above has already formed a sell signal. The downward movement was about 35 points.

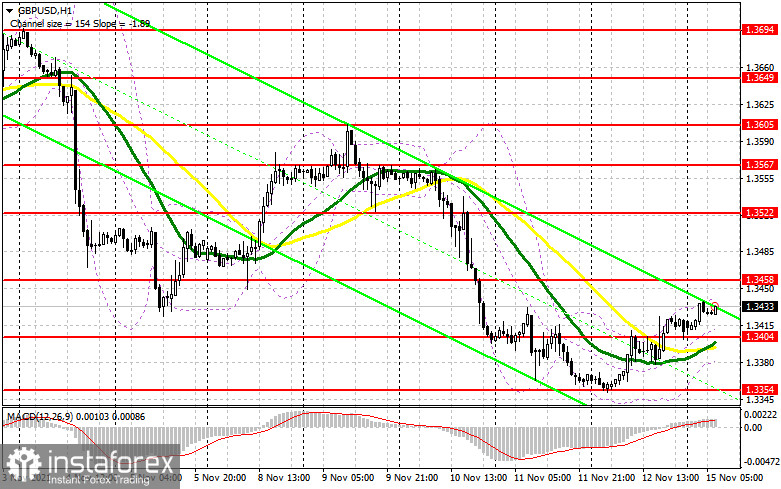

Important parliamentary hearings on the Bank of England's monetary policy report will take place today, as well as a speech by Bank of England Governor Andrew Bailey. All this can greatly affect the direction of the pound. In case of tougher rhetoric, further recovery of the pair can be expected. However, do not forget to monitor the situation developing around the Brexit agreement now, as this does not add confidence to the pound bulls. Until the EU and the UK find a common language in terms of compliance with the Northern Ireland protocol, the pressure on the pound will continue. Today the main task of the bulls in the first half of the day is to protect the level of 1.3404. Forming a false breakout there along with the test of the moving averages, which are located slightly lower, forms a signal to buy the pound against the trend. This will return the chance for an upward correction of the pair to the 1.3458 area. An equally important task is to regain control over this level. A breakthrough and reverse test from top to bottom at 1.3458 will provide another signal to buy the pound, which will lead to GBP/USD moving up to the 1.3522 area with the prospect of reaching a high like 1.3567, where I recommend taking profits. In case the pair falls in the first half of the day, the best option for buying the pound will be a test of the next support at 1.3354. However, I advise you to open long positions there only after a false breakout. You can watch buying GBP/USD immediately for a rebound from a new low like 1.3308, or even lower - from support at 1.3254, counting on a correction of 25-30 points within the day.

To open short positions on GBP/USD, you need:

The bears lost control of the market and now they need to work hard to get it back. If Bailey continues to pursue a soft policy, then the pressure on the pound is likely to return very quickly, since the situation with Brexit and growing inflation do not add confidence. A return to the downward trend requires protecting resistance at 1.3458, which the bulls were aiming for in today's Asian session. Forming a false breakout there will lead to creating an entry point into short positions, followed by a decline in GBP/USD to the 1.3404 area, where the pressure will be limited by the moving averages located below. Therefore, a breakthrough of this range will be no less important task for the bears. The test of 1.3404 from the bottom up creates another signal to open new short positions with the goal of falling to the lows: 1.3354 and 1.3308, where I recommend taking profits. In case the pair grows during the European session and there are no bears at 1.3458, it is best to postpone selling until the larger resistance at 1.3522. I advise you to open short positions immediately on a rebound from 1.3567, or even higher - from a new high in the 1.3605 area, counting on the pair's rebound down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) reports for November 2 revealed an increase in both short and long positions, reflecting the return of demand for the British pound ahead of the BoE meeting, which took place last week. Considering that there are more bulls and they continue to return to the market, we can count on the continued upward correction of the pair. Many BoE officials are speaking this week and are already starting to make converse statements disagreeing with BoE Governor Andrew Bailey's policies. Let me remind you that after the BoE's November meeting, monetary policy remained completely unchanged, although many traders were betting on tightening it by the end of the year. In this regard, sharp inflationary pressures will continue to support the demand for the British pound. Therefore, I recommend adhering to the strategy of buying the pair in case of very large falls, which will occur against the background of uncertainty in the policy of the central bank. The COT report indicated that long non-commercial positions rose from 51,912 to 57,255, while short non-commercials also strengthened slightly from 36,959 to 42,208. This led to an upward shift in the non-commercial net position. The delta was 15,047 against 14,953 a week earlier. The weekly closing price of GBP/USD dropped significantly as a result of the BoE's policy from 1.3763 to 1.3654.

Indicator signals:

Moving averages

Trading is carried out above 30 and 50 moving averages, which indicates the formation of an upward correction in the pair.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of a decline, the lower border of the indicator at 1.3380 will act as a support. A breakthrough of the upper border in the 1.3440 area will lead to a new wave of growth in the pound.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română