If before the report on US inflation, some had doubts about the continuation of the downward trend in EURUSD, then the published statistics finally freed the bulls from illusions. The acceleration of US consumer prices to 6.2% made many investors clutch their heads in surprise - what is the Fed waiting for? It's time to tighten monetary policy to prevent the further acceleration of CPI and a final change in the inflationary regime. For example, the comeback of the 1970s. In such circumstances, it is not surprising that the US dollar is ready to show the best weekly dynamics over the past 5 months.

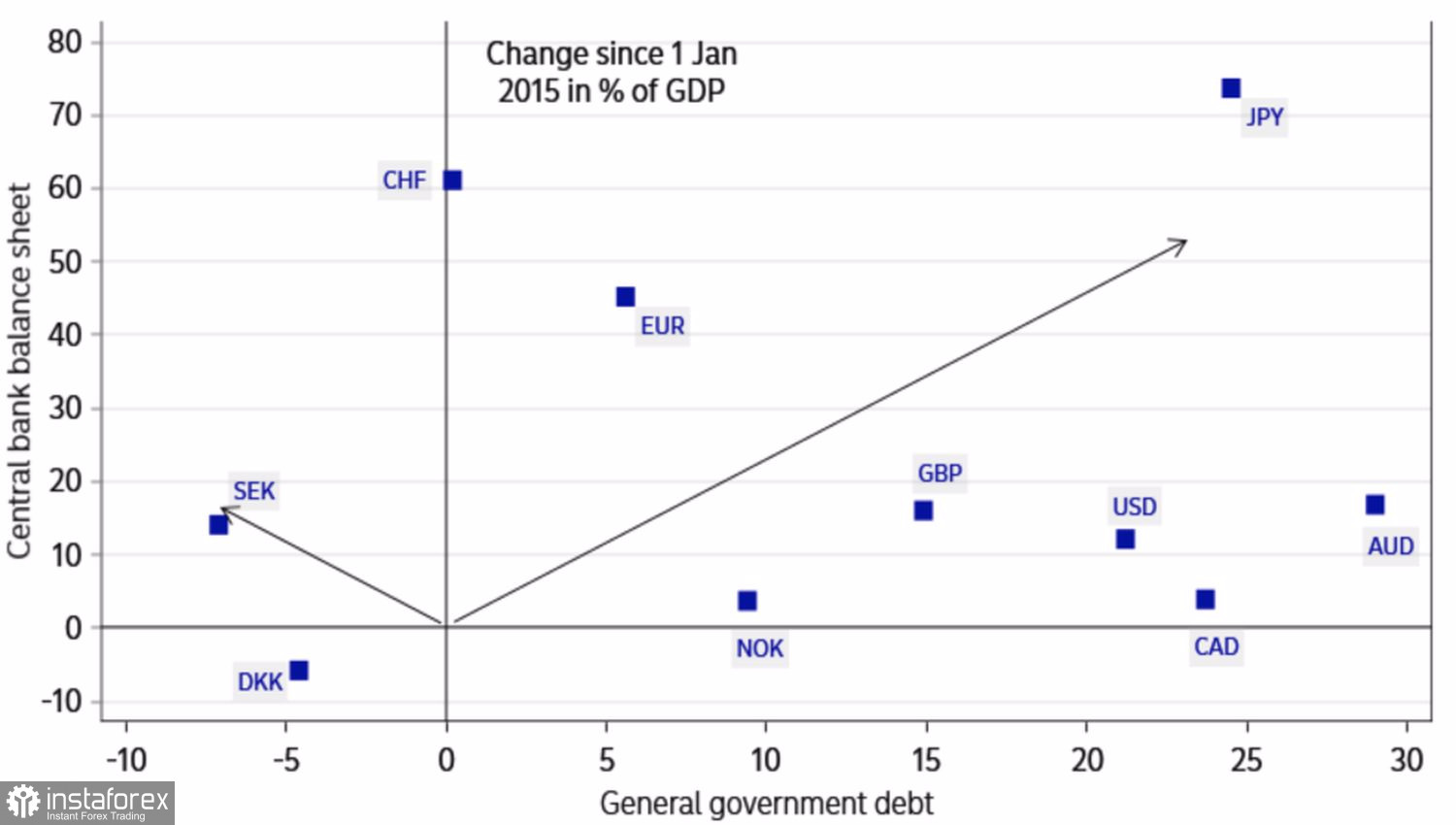

Monetary policy drives the exchange rates on Forex in one direction or another like a herd. The faster central banks' balance sheets grow, the worse it is for their currencies. In this regard, the increase in assets in the accounts of the ECB, the Swiss National Bank, and the Bank of Japan has serious negative consequences for the euro, franc, and yen. At the same time, despite large-scale monetary incentives, the Fed's balance sheet in relative terms is not expanding as fast as that of competitors.

Dynamics of growth of balance sheets of central banks and public debt

The Fed began tapering asset purchases in November and is ready to complete QE in eight months, while the European regulator plans to end the pandemic emergency purchase program (PEPP) in March, but is expected to step up the regular quantitative easing program through APP in December. And although the "hawks" of the Governing Council would like to see a complete abandonment of QE by September, it is yet to be written in stone.

The position of ECB President Christine Lagarde and her supporters about the temporary nature of inflation acceleration looks too strong. The European Commission predicts that after rising to 2.2-2.4% in 2021-2022, consumer prices will slow down to 1.4% in 2023. Isn't there a reason to live with the asset purchase program forever?

On the contrary, supporters of monetary tightening in Europe are gaining the upper hand. St. Louis Fed President James Bullard speaks not only of two acts of monetary restriction next year, but would also like to see the Fed's balance sheet shrink. It would not be a surprise if even Jerome Powell, looking at the acceleration of inflation to 6.2%, will defect to the camp of "hawks." Unless, of course, he wants to be re-elected for a second term. Biden's anger about high prices suggests that the US president needs someone who will not hesitate to tighten monetary policy.

Key events of the week by November 19 will be the release of data on US retail sales, as well as the European GDP and inflation. In the last two cases, we are talking about the final assessment, so they are unlikely to cause a stir in the financial markets. As for the retail trade, its expansion by 0.7% MoM in October, as expected by Bloomberg experts, is good news for the US dollar.

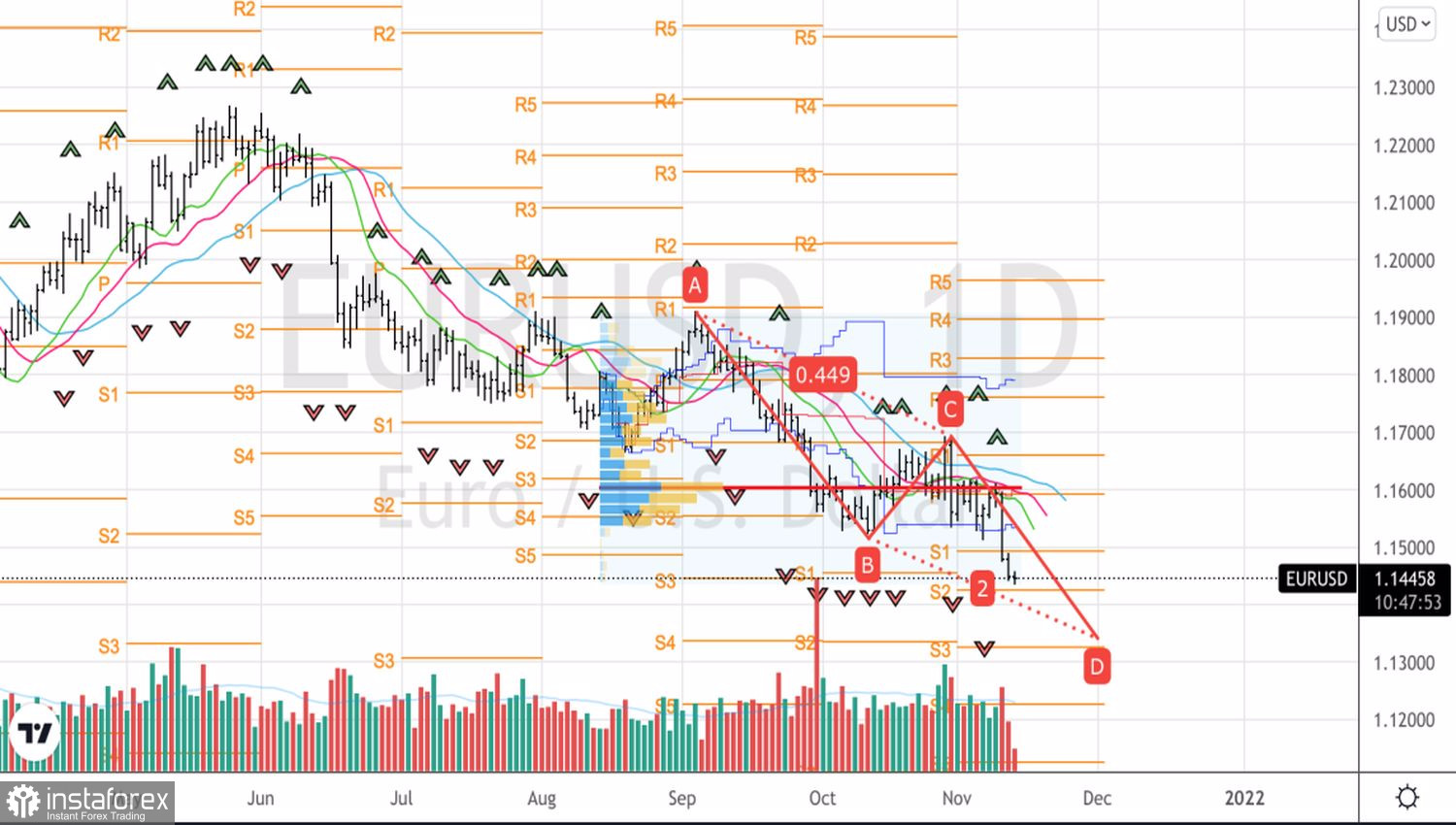

Technically, the implementation of the AB=CD pattern identified in the previous material with a target of 200%, which corresponds to 1.135, is going with a bang. Traders managed to build up the shorts formed from the level of 1.1595, and they continue to look for opportunities to sell. The breakout of the support at 1.1425 could be the reason.

EUR/USD, Daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română