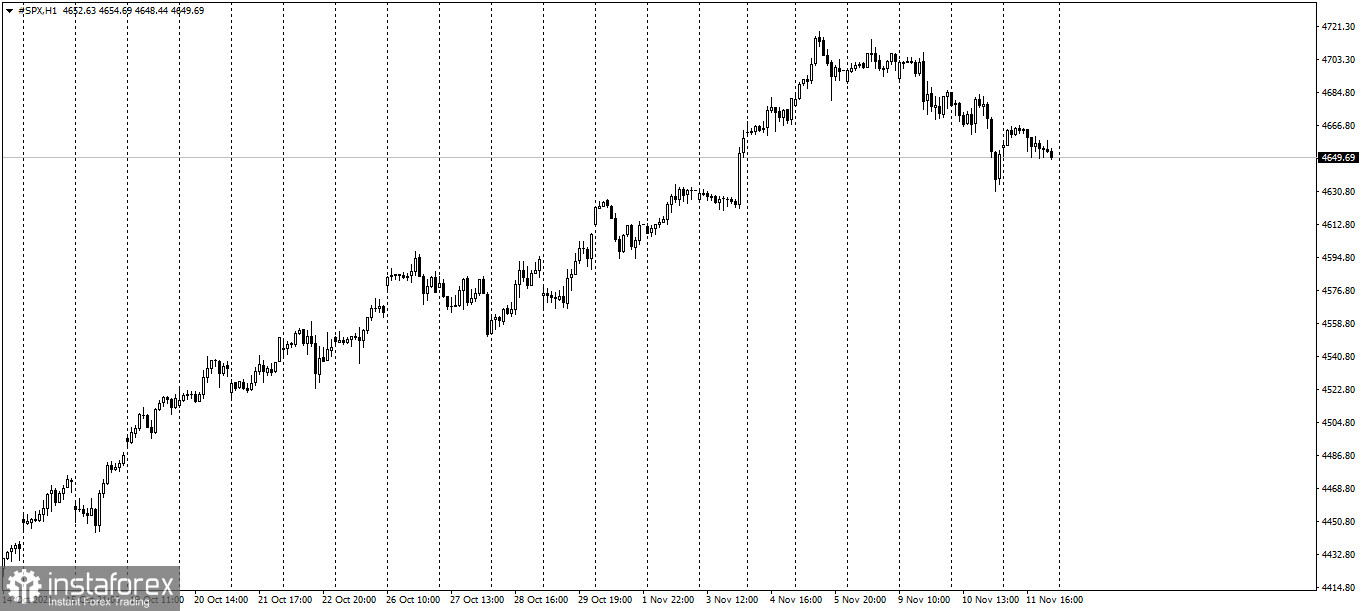

US stocks bounced back on Thursday, offsetting the losses that occurred when investors did a sell-off amid fears that higher inflation could spur monetary tightening.

The S&P 500 gained 0.2%, thanks to a slight surge in materials, energy and tech stocks. But Tesla still struggled in direction after CEO Elon Musk sold $ 5 billion worth of shares.

Clearly, investors are gearing up for potential changes in monetary policy, as they expect a hike to come sooner rather than later because the current high consumer prices indicate that inflation is not temporary. Having a persistently high inflation could force the Federal Reserve to change interest rates faster than expected.

At the same time, stocks are hovering around all-time highs as strong earnings and growth prospects have boosted the market. Jeff Schulze of Clearbridge Investments said the drop earlier "was a combination of profit taking after a good run from October lows, but also some concerns about margins and overall profits in 2022."

Meanwhile, Frank Cappelleri of Instinet LLC said: "November's weakest part has occurred in the middle of the month. The damage so far is slight, and this could very well be the start of the next bullish pattern, regardless if yesterday's dip encourages immediate dip buying or not."

Other key events for today are:

- release of data on EU industrial production;

- report on US employment;

- release of data on consumer expectations.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română