U.S. inflation has brought dollar bulls back to life. The data published today is important not only "in the moment," but also in the context of the long-term prospects of the greenback.

Over the past few days, the market has been fluctuating, being between a "hammer and anvil": on the one hand, the restrained rhetoric of Fed Chairman Jerome Powell, on the other hand, the growth of key macroeconomic indicators in the United States.

The chairman of the Federal Reserve urges ignoring inflation, which, in his opinion, will begin to fade at the beginning of next year. But recent data suggest that the inflation spiral in the U.S. continues to unwind, contrary to earlier forecasts of the Fed. Hence a certain distrust of Powell, who continues to insist on the temporary nature of inflationary trends. Wednesday's data, in my opinion, will only strengthen this distrust.

The jump in the consumer price index suggests that the regulator will be forced to take appropriate measures to curb price pressure. This scenario is also supported by the latest Nonfarm Payrolls report, which turned out to be much better than the expectations of most experts. The "hawk puzzle" is slowly taking shape, while the rhetoric of the head of the Fed looks less and less convincing.

In other words, the market makes its own conclusions, which de facto run counter to the official position of the head of the Federal Reserve. Some representatives of the American regulator are also adding fuel to the fire, who, contrary to the opinion of their boss, agree that the time for the first round of rate hikes will come next year, since the inflation target has already been significantly exceeded. In other words, today the pendulum has swung towards the implementation of the "hawk scenario."

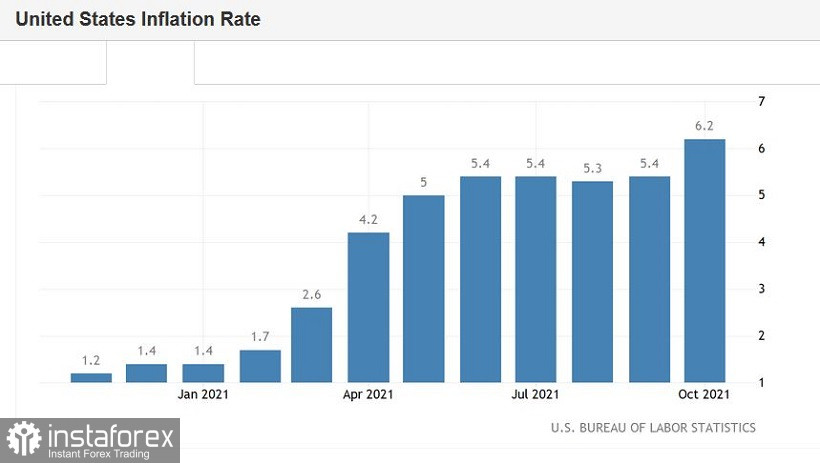

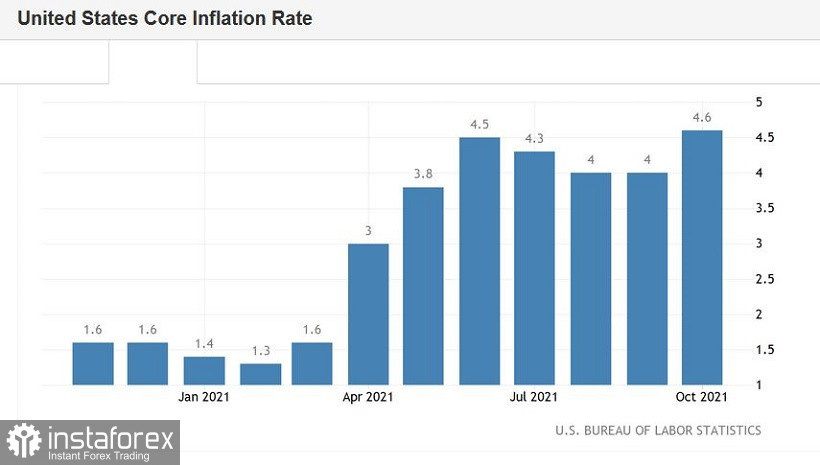

Thus, according to published data, the overall consumer price index in October accelerated to 6.2% YoY (with a forecast of growth to 5.8%). This is a long-term record. The CPI was last at these heights more than 30 years ago - back in 1990. On a monthly basis, the index also showed positive dynamics, rising to 0.9% (growth has been recorded for the second month in a row). The core CPI, excluding volatile food and energy prices, similarly surprised market participants with strong figures. In monthly terms, an increase of up to 0.6% was recorded, in annual terms - up to 4.6%. And here again, is a long-term record: the index last "gave out" such results in August 1991.

Note that the Fed's preferred inflation indicator, the Personal Consumption Expenditure Index (PCE), also significantly exceeds the regulator's target level. It is believed that this indicator is being closely monitored by members of the American regulator. The core PCE index, which does not take into account volatile food and energy prices, rose by 3.7% in September (in annual terms). It remained at the same high level as it was released in August, July, and June.

Such macro records are suggestive. First of all, that the Federal Reserve will be forced to "step on the throat of its own song," starting to implement "Plan B." In the opinion of the overwhelming majority of experts, high inflation in the United States may persist longer than the Fed believes. Persistent supply disruptions, heightened consumer demand, rising wages, and a recovery in the labor market - all of these factors contribute to the further unwinding of the inflationary spiral.

That is why the opinion is gradually taking root in the market that the Fed will stop the growth of inflation indicators next year by raising rates. And Jerome Powell himself theoretically admits the likelihood of such a scenario. During his speech in Congress back in late September, Powell said that the US regulator "should consider raising rates if it sees evidence that rising prices are forcing households and companies to wait for higher prices to take root, creating more stable inflation." Following the results of the last Fed meeting, he rephrased this position without changing its essence.

Thus, the latest macroeconomic reports suggest that subsequent events will not unfold according to the Fed's scenario. Especially considering the fact that representatives of the "hawk wing" of the Fed have recently been increasingly talking about the fact that the rate may be raised as early as next year (James Bullard even called for a double increase in 2022).

The European Central Bank, in turn, continues to "hold the line," voicing "dovish" rhetoric. Key figures of the ECB are taking a soft position, excluding the option of early tapering of QE and an earlier increase in the interest rate (as of today, the target is 2024). The uncorrelation of the ECB and the Fed rates will continue to put pressure on the EUR/USD pair.

In the wake of another strengthening of the greenback, the pair's bears are trying to gain a foothold below the support level of 1.1530 (the lower line of the Bollinger Bands indicator on the D1 timeframe). This is a key target for sellers of EUR/USD, since overcoming it will actually open the way to the area of the 14th figure. Any corrective surges are still advisable to use to open short positions.

If the pair closes the current trading day above the support level, the first target will remain at 1.1530. If the bears still manage to gain a foothold under this target, then the first target of the downward movement in the medium term will be the level of 1.1480 (the lower line of the Bollinger Bands on the weekly chart). The main target is 1.1440: at this price point, the upper and lower borders of the Kumo cloud on the monthly chart are connected.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română