Markets are reacting today to unexpectedly high inflation in the USA. Consumer prices rose in annual terms to their highest level since 1990. The indicator accelerated to 6.2%. Markets expected CPI to rise by 5.8%.

The published data indicate that inflation is not yet at its peak and will be sustained. Structural inflation is rising. Also, an underestimation of inflation risks could have consequences. There are also increasing fears in the markets that the inflation situation will be much tougher than Fed policymakers expect.

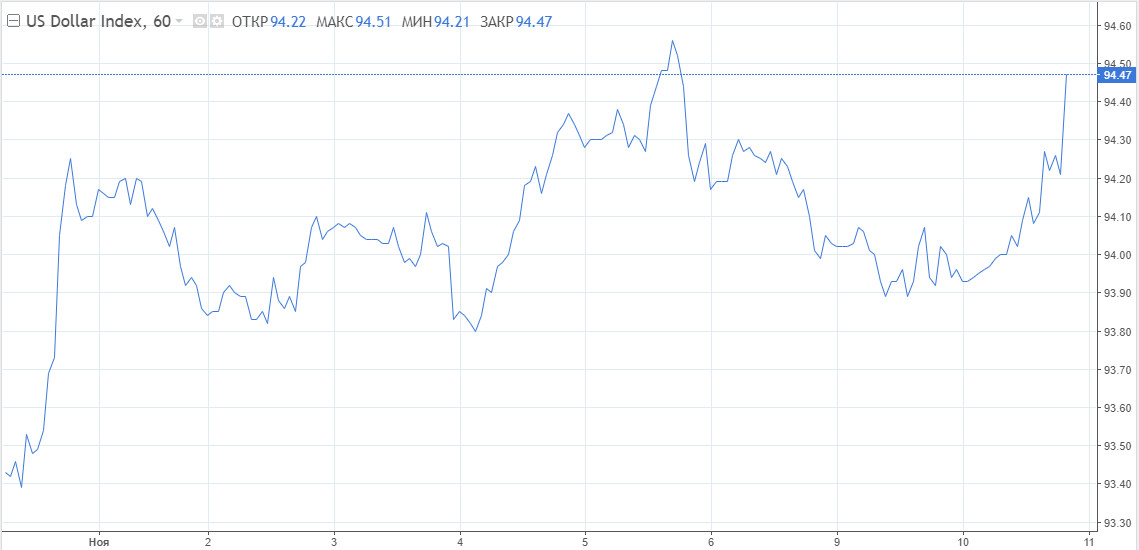

The US currency index reversed back up after a brief pause and broke above 94.00 points. At this level, it was able to attract buyers. With further upward momentum, buyers will be able to test the 94.62 level, the high of November 5. The next target is last September's high of 94.74, followed by the round-number level of 95.00.

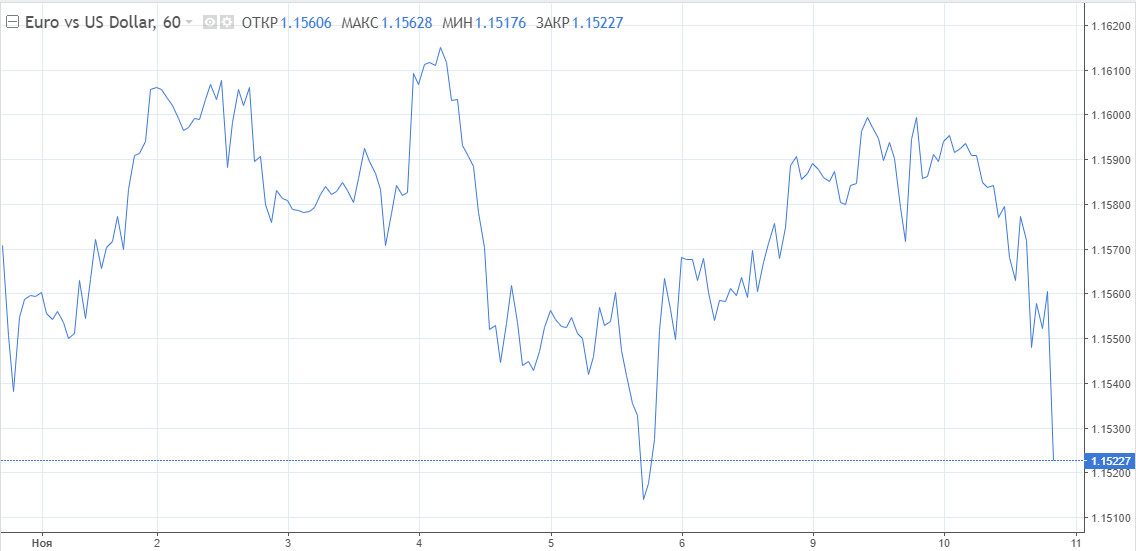

EUR/USD continued its intraday pullback, testing weekly lows. The dollar went up under the influence of US statistics. In addition, investors are not interested in the euro due to a lack of positive fundamentals and macroeconomic data. ECB officials have consistently stated that the conditions for a rate hike are unlikely to be met next year. They want to break down the current market forecast for a rate hike in 2022.

The pair is likely to continue to trade lower in the short term. The dollar, apart from Wednesday's macro data, is also helped by the overall cautious market sentiment. This makes it even more difficult for the euro to recover.

Global analysts are mostly negative about the EUR/USD pair's future prospects. Credit Suisse expects a resumption of the underlying downtrend with a target of 1.1290 in the medium term.

EUR/USD remains in a short-term range, having found support above the important 1.1495 area. However, we remain bearish and expect a bearish breakdown, which promises a recent spirited rebound from key resistance at 1.1666, it says.

According to the analysts, an important top remains unbroken. This confirms the resumption of the underlying downtrend and a break of the October lows at 1.1524. A break of 1.1495 will target sellers for support at 1.1377 and 1.1300-1.1290, where the euro is expected to pause.

Scotiabank believes that weak eurozone economic underperformance will be a key driver of EUR decline. The old world will lag behind its main rivals next year, pushing the EUR/USD pair to the lower end of the 1.1000-1.2000 range. At the end of 2022, the forecast for the euro is 1.1200.

Deutsche Bank also lowered its estimate. By the end of the outgoing year, the mood for the dollar will remain favourable, the analysts believe. They worsened their previous forecast for the EUR/USD pair for the end of the year to 1.1600 with the possibility of a further decline.

Europe is upsetting markets with its stubborn dovishness, while rising US inflation expectations and a hawkish Fed attitude leave no room for the dollar to fall, the bank commented.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română