To open long positions on EURUSD, it is required:

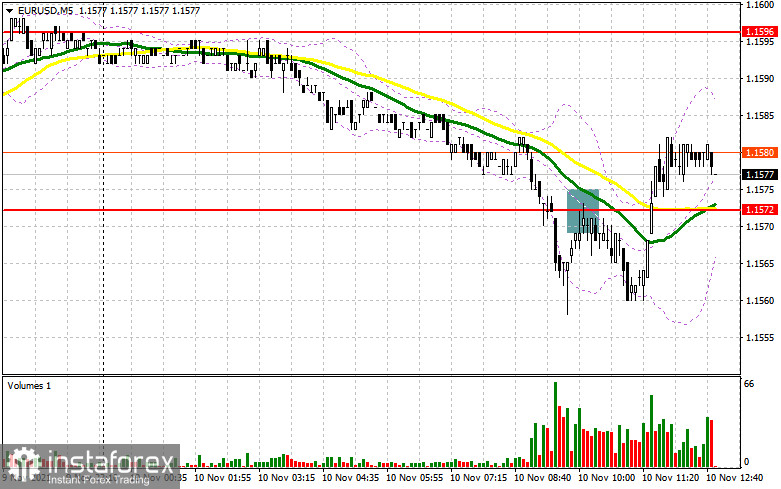

In the first half of the day, euro sellers tried to maintain the pressure that was formed after the release of inflation data in Germany. The report coincided with economists' forecasts, which led to a downward movement of the pair and a breakthrough of support at 1.1572. The test of this level from the bottom up formed a good entry point into short positions, but it never came to its realization. After the euro moved down by 10 points, the pressure on the pair eased. Now the whole focus will be shifted to American inflation. The technical picture has undergone some changes.

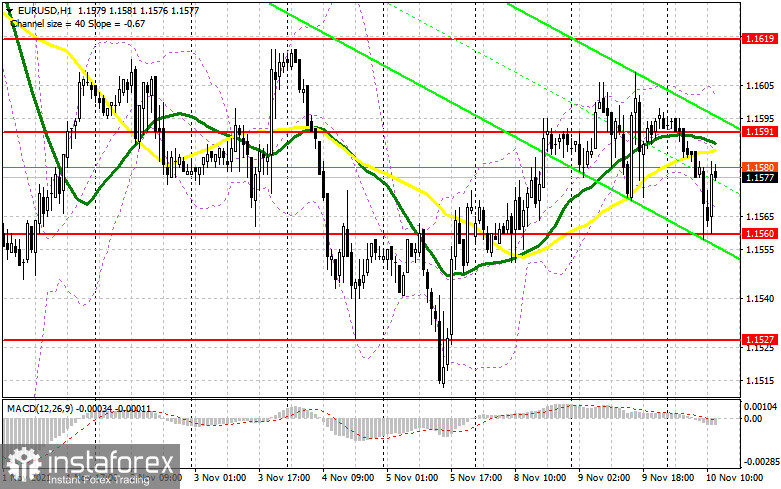

Bears need to try very hard to protect the support of 1.1560, which was formed based on the results of the first half of the day. Only the formation of a false breakdown there, together with weak inflation in the United States of America, will lead to the formation of a buy signal to restore the pair to the resistance area of 1.1591, just below which the moving averages are playing on the side of the bears. Going beyond this level will bring the market back under the control of buyers, and the 1.1591 test from top to bottom will form an additional signal to open long positions already to return to the maximum area of 1.1619, where I recommend fixing the profits. The 1.1646 area will be a more distant target, but we will be able to reach it only with the option of very weak American statistics. If the pressure on the pair persists and there is no bull activity at 1.1560, it is best to wait for the formation of a false breakdown in the area near the next low of 1.1527. It is possible to open long positions in EUR/USD immediately for a rebound from 1.1494, counting on a correction of 15-20 points within a day.

To open short positions on EURUSD, you need:

Sellers did their best in the first half of the day, and now their key task will be to break 1.1560. If the pair grows in the afternoon after the data on the US labor market and inflation, the bears will have to try to protect the resistance of 1.1591, which was formed by the results of today. There are also moving averages that play on the sellers' side. The formation of a false breakdown at 1.1591 and strong US statistics will lead to the formation of a sell signal for the pound, which will open a direct road to the 1.1560 area. A breakthrough and an update of 1.1560 from the bottom up will lead to the formation of an additional entry point into short positions in the continuation of the decline of EUR/USD to a minimum of 1.1527, the update of which will put an "end" to the upward correction of the euro. With a similar breakdown of 1.1527 on strong inflation data in the US, we can expect to reach fresh lows: 1.1494 and 1.1454, where I recommend fixing the profits. In the scenario of an upward correction of EUR/USD and the absence of bear activity at 1.1591, only the formation of a false breakdown at 1.1619 forms a new point for sales. It is possible to open short positions immediately for a rebound based on a downward correction of 15-20 points from a large resistance of 1.1646.

The COT report (Commitment of Traders) for November 2 recorded a reduction in both short and long positions, which led to a slight recovery of the negative delta, as more sellers left the market than buyers. The meetings of central banks, which last week fueled the markets, did not lead to significant changes, as the specific policy of the Federal Reserve System regarding measures to support the economy allowed investors to remain optimistic and believe in the continuation of the economic recovery. However, expectations that the European Central Bank, despite all its statements, will also be forced to resort to measures to tighten its policy in the near future due to high inflation, leave a chance for buyers of the euro to restore the trading instrument in the medium term. This leads to the fact that with each significant decline in the European currency, the demand for it returns quite actively. In the near future, we will get acquainted with important data on inflation in the United States, which will determine the future direction of the US dollar against several other world currencies. The COT report indicates that long non-commercial positions decreased from the level of 196,880 to the level of 191,496, while short non-commercial positions fell from the level of 208,136 to the level of 197,634. At the end of the week, the total non-commercial net position recovered slightly and amounted to -6,388 against -11,256. The weekly closing price decreased quite slightly, to the level of 1.1599 against 1.1608.

Signals of indicators:

Moving Averages

Trading is below 30 and 50 daily moving averages, which indicates an attempt by bears to bring the market back under their control.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A breakthrough of the lower limit of the indicator in the area of 1.1570 will lead to an instant fall of the euro. A break of the upper limit in the area of 1.1590 will lead to new growth of the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română