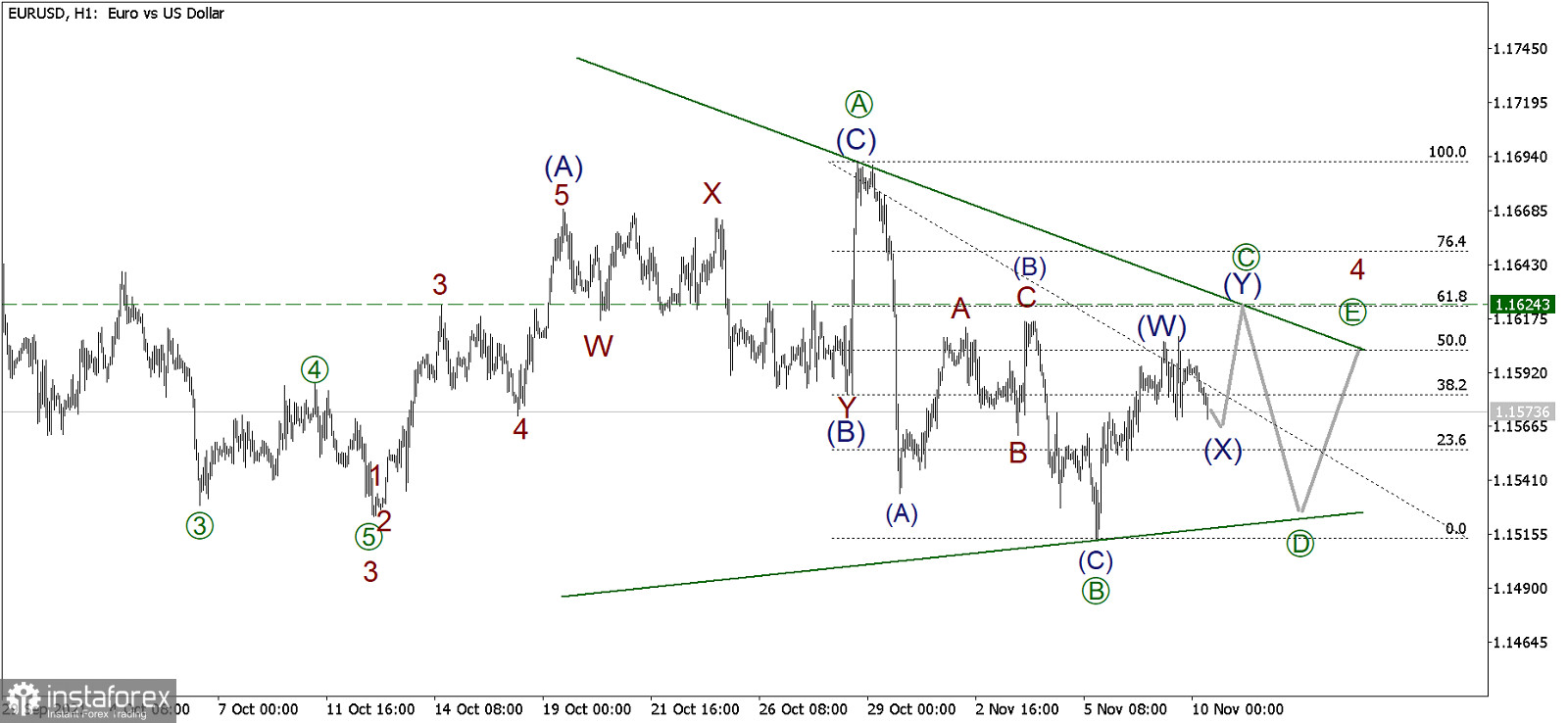

EUR/USD, H1 timeframe:

The development of a major downward trend in the EUR/USD pair continues. This trend takes a simple downward impulse form, in which a correction wave 4 is currently developing, taking the form of a long-term correction, namely, a converging horizontal triangle.

This triangle includes the sub-waves [A]-[B]-[C]-[D]-[E]. It should be noted that [A] and [B] are already fully done, while [C] is still being constructed. Wave [C] consists of sub-waves (W)-(X)-(Y) and is a double zigzag.

It appears that the first bullish zigzag (W) recently completed its development, after which the price began to move downwards in a small corrective wave of the bond (X). Soon after the completion of (X), the upward movement will continue in the zigzag (Y), within which we will see a price growth to the level of 1.1624. At this level, the value of the entire wave [C] will be 61.8% of wave [B], i.e. [C] may end at the level of the so-called golden section.

Based on all of the above, it is possible to open long positions today with a target at 61.8% along the Fibonacci lines, namely at the level of 1.1624.

Trading recommendations:

It is recommended to open long positions from the current level of 1.1573, with a target of 1.1624.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română