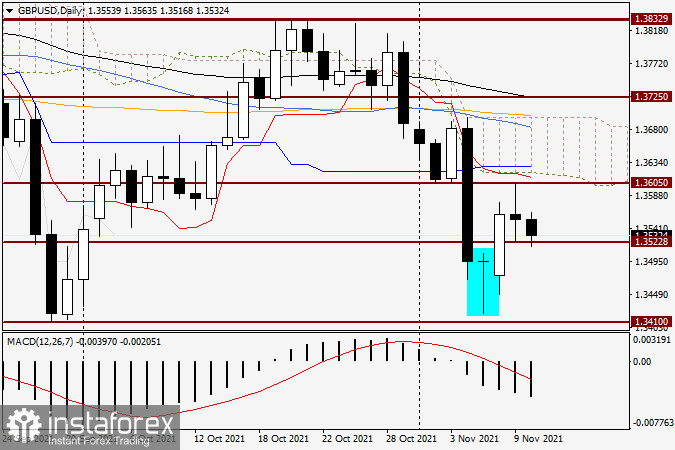

Daily

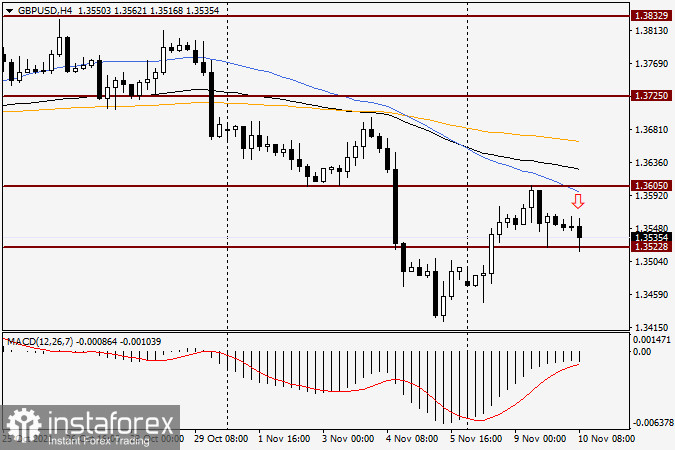

It would seem that after the highlighted reversal candle for November 5, the pair had only to turn northwards. That's exactly what happened the day before yesterday. However, at the end of yesterday's trading, the rally came to a complete halt and a "Long-legged Doji" candle with a small bearish body was formed on the daily chart. The strength and significance of the 1.3600 level have been mentioned many times in previous articles on GBP/USD. Yesterday's trading once again confirmed the validity of such assumptions. After reaching the 1.3605 level, the bulls on the pound seem to have lost all their strength, which was immediately taken advantage of by their bearish opponents. Today the pair has already been below yesterday's minimum of 1.3522, but it bounced back up and is now trading near 1.3535.

It is difficult to predict how today's trading will end up. At the moment, the US dollar is in demand and is strengthening against both the European currency and against the British pound. If this dynamic continues, the Pound/Dollar runs the risk of falling to the psychological level of 1.3500, where market participants will decide on the further direction of the exchange rate. With the Tenkan red line and the lower boundary of the Ichimoku cloud indicator running slightly above 1.3605 resistance, a rate hike is more difficult and less realistic to achieve. Therefore, a continuation of the downside scenario is likely, which would make selling the GBP/USD pair the main trading idea.

H4

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română