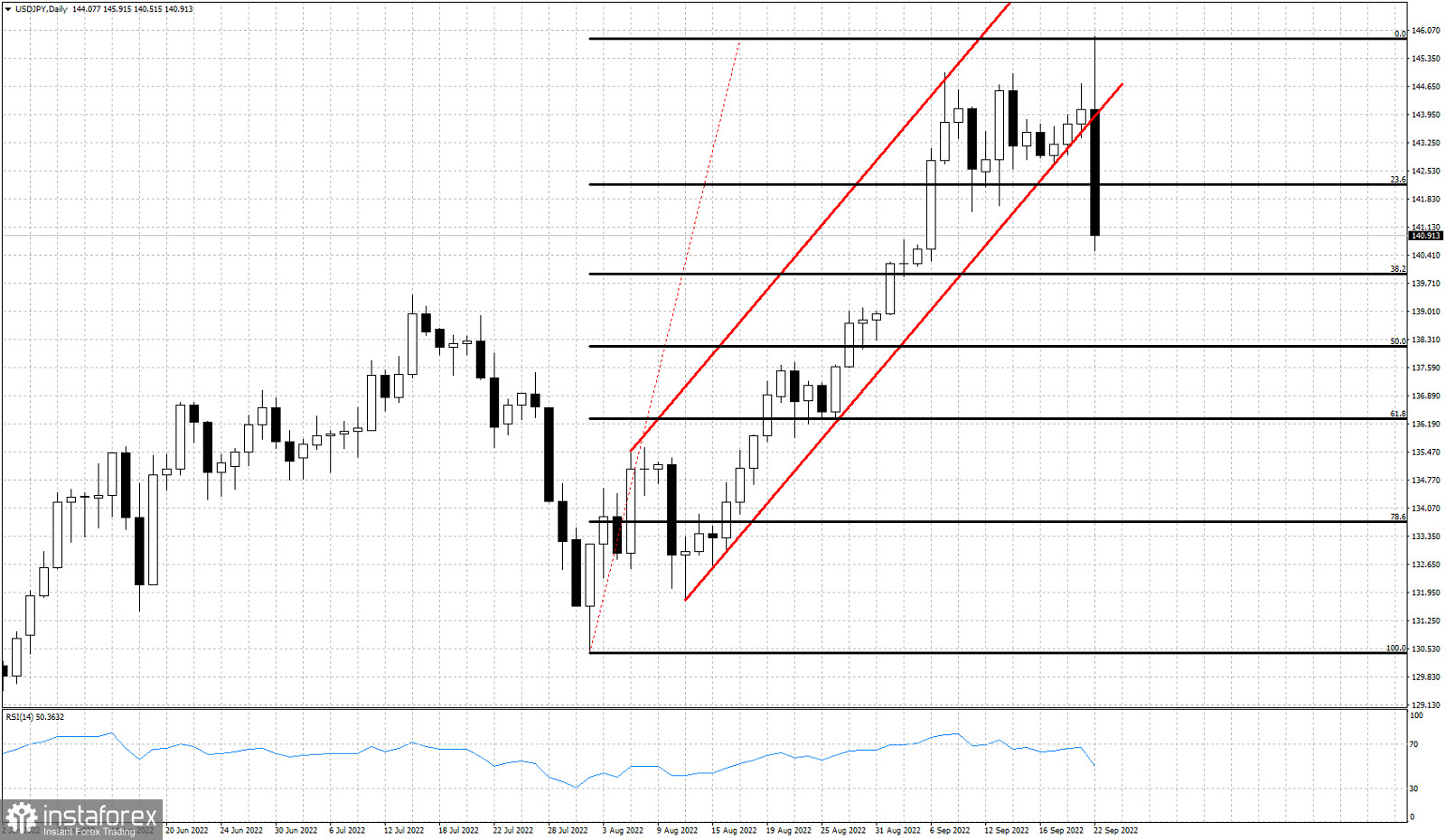

Red lines- bullish channel

Black lines- Fibonacci retracements

USDJPY has broken out of the short-term bullish channel it was in since the end of July. Price has so far retraced nearly 38% of the rise since July's lows. Combined with the fact that USDJPY is also providing bearish RSI divergence warning signals on higher time frames, we believe that there are increased chances of a bigger pull back. USDJPY is expected to continue lower after this break down out of the bullish channel. We expect price to reach 140 and over the coming days, most probably next week, to continue lower towards 137-136. We believe an important high was made yesterday at 145.91. At least a pull back towards 137-136 is very likely as the RSI is turning lower from overbought levels and after bearish divergence signals.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română