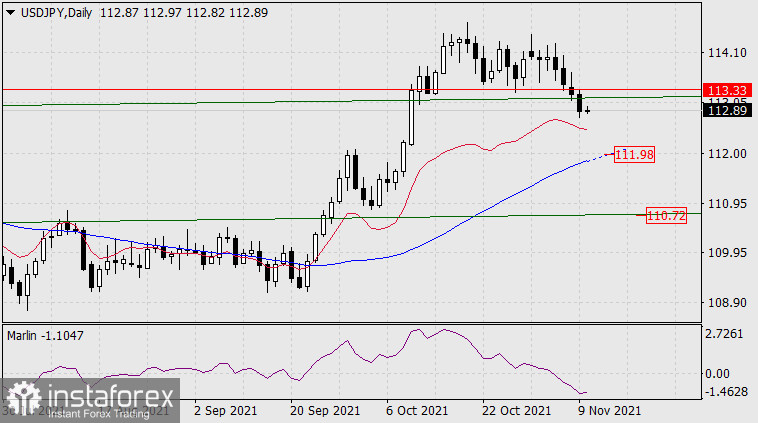

Yesterday, a significant event took place for the USD/JPY pair - the price broke through the support of the trend line of the price channel of the weekly timeframe (113.13) and, obviously, outlined a further decline towards the 111.98 target - to the MACD line on the daily chart. Overcoming this support will open the target along the lower line of the price channel at 110.72.

On a four-hour chart, the price is decreasing in a narrow price channel, at the moment the price is approaching its upper border, from which we expect a downward reversal. The Marlin Oscillator is growing in the negative area, which in the current conditions means the oscillator is discharging from the oversold zone before the subsequent decline.

To break the current trend, the price needs to go above the MACD indicator line, above 113.33, that is, above the price channel line on the daily chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română