Wave pattern

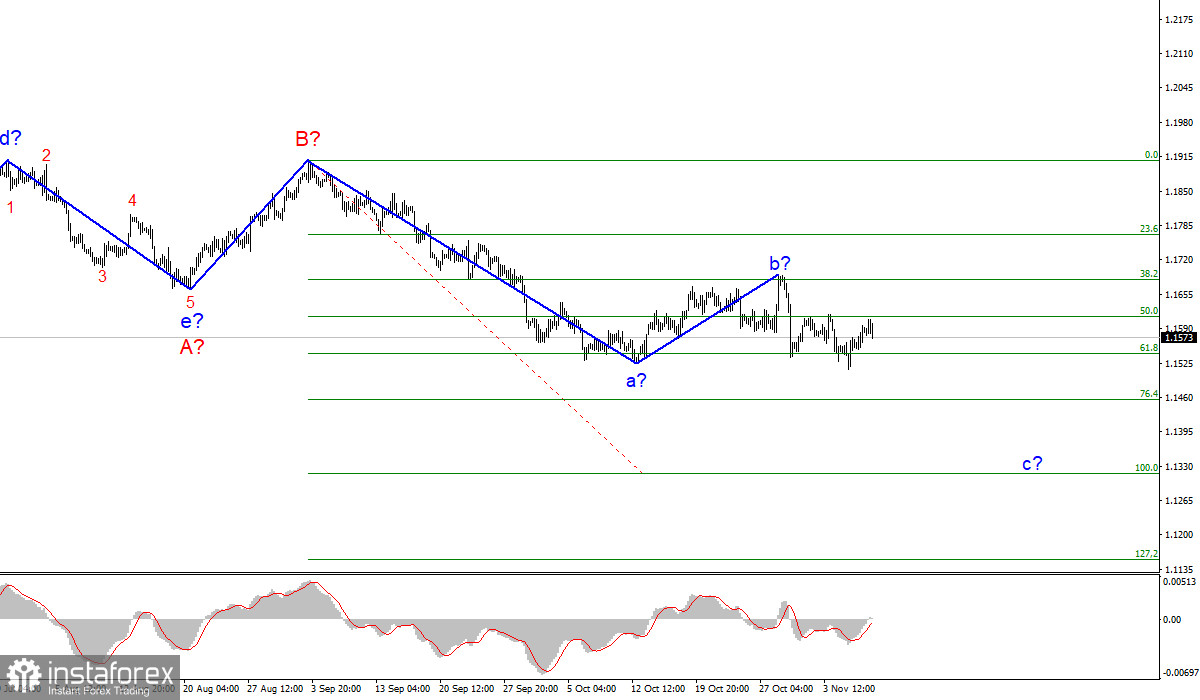

The wave counting of the 4-hour chart for the Euro/Dollar instrument looks quite holistic now. The plot a-b-c-d-e, which was formed at the beginning of the year, is interpreted as wave A, and the subsequent increase of the instrument is interpreted as wave B. Thus, the construction of the proposed wave C, which can take a very extended form, is now underway. Its internal corrective wave b has taken a more complex form than initially expected, but the subsequent decline in quotes, which is presumably wave c to C, preserves the integrity of the wave count.

The proposed wave c can take no less extended form than wave a. Its targets are located below the 15th figure, up to the 13th. However, in order for this wave to continue its construction, a successful attempt to break through the 1.1541 mark is necessary, which corresponds to 61.8% Fibonacci level, which is not yet available. The whole wave C can also take a shortened form, but for now, we can consider this option a backup.

Fed Chair Jerome Powell and ECB President Christine Lagarde's speeches do not change the weather.

The news background for the EUR/USD instrument in the first two days of the new week was in fact empty. On Monday, the instrument's amplitude was about 20 basis points, and on Tuesday it was about the same. Thus, the markets are very reluctant to trade the instrument at the current time.

In the USA, both Fed Chairman Jerome Powell, as well as Vice Chairman Richard Clarida, gave a speech. Clarida said that the conditions for raising interest rates can be reached no earlier than the end of next year. Meanwhile, Powell did not say anything interesting. So is ECB President Christine Lagarde.

The issue of the first interest rate increase in the United States is now one of the most important and interesting for the markets. Why? Because there is no consensus on this issue. The ECB has already clearly stated that the probability of a rate hike next year is negligible. And the UK, on the contrary, may raise the rate in December (although it is still hard to believe). While it is still very difficult to say how everything will be in the USA.

According to the general "average" opinion, the rate will be raised next year. Maybe even twice. But some analysts believe that this will happen in the summer, and some - not earlier than the winter of 2022. The lack of consensus is also observed in the ranks of the Fed itself. Its members, such as James Bullard or Rafael Bostic, advocate tightening monetary policy as soon as possible and support a rate hike next year. But the average value of opinions in the board suggests that about half are not ready to unequivocally support a rate hike in 2022.

General conclusions

Based on the analysis, I conclude that the construction of the downward wave C will continue, and its internal corrective wave b has completed its construction. Therefore, now I advise you to sell the instrument for each downward signal from the MACD, with targets located near the calculated marks of 1.1454 and 1.1314, which corresponds to 76.4% and 100.0% Fibonacci levels.

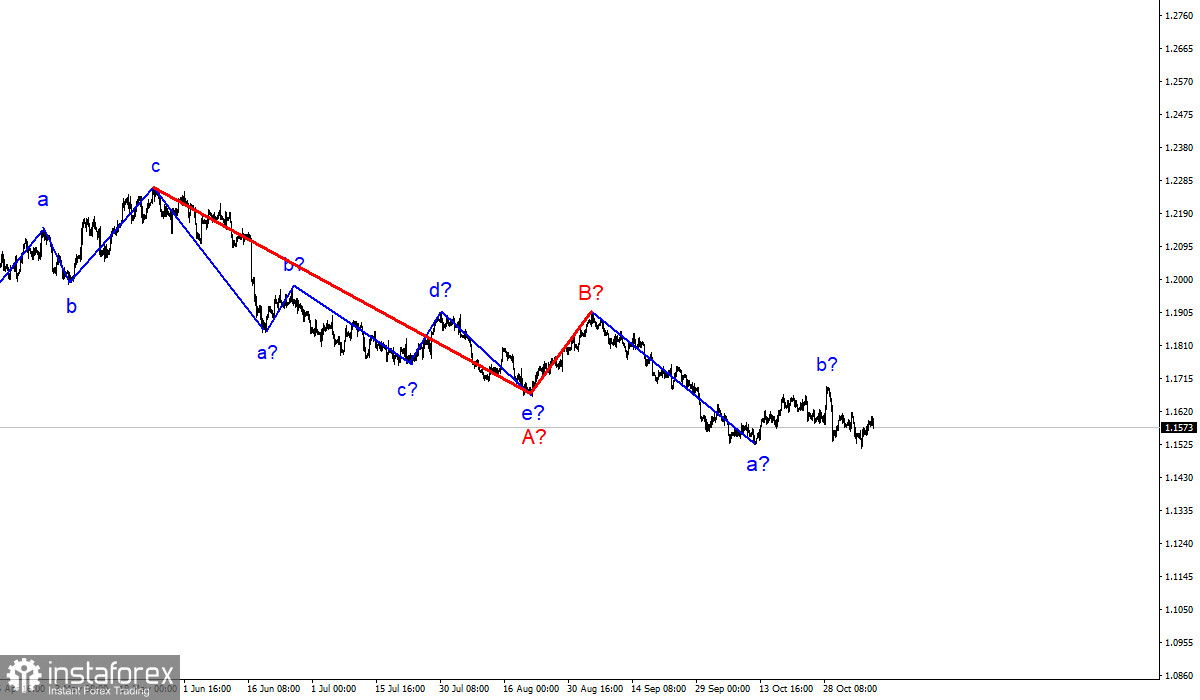

The wave counting of the higher scale looks quite convincing. The decline in quotes continues and now the downward section of the trend, which originates on May 25, takes the form of a three-wave corrective structure A-B-C. Thus, the decline may continue for several more months until wave C is fully completed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română