Over the past six months, the market may have had an erroneous idea about the problematic nature of the Ripple token, which, due to the SEC's prosecution, significantly slowed down the growth rate. However, if you look at the reporting of the issuing company, you can see a 400% increase in cryptocurrency sales, as well as large-scale plans for the development of the coin ecosystem and the system of cross-border payments.

The project is trying in every possible way to refresh the audience with local "rebranding" and distract it from litigation with the regulator. However, taking into account the latest news, there is a high probability that the dispute will end in 2021 with a settlement agreement.

Ripple CEO Brad Garlinghouse hinted at such an outcome back in September 2021 during an interview on Fox Business 24. The CEO said that the company was ready to meet the regulator halfway, but only if a point and a common ground for the status and plans for the future current on XRP. The entrepreneur compared the potential of the cryptocurrency to precious metals and emphasized that the project has ambitious plans to expand functionality and additional opportunities for adjacent digital fields.

According to a recent statement by a Bloomberg expert, the regulator and Ripple are at an advanced stage of concluding an amicable agreement, according to which the XRP issuer will pay the SEC a certain amount as a fine. It is reported that the litigation may be completed by the end of 2021.

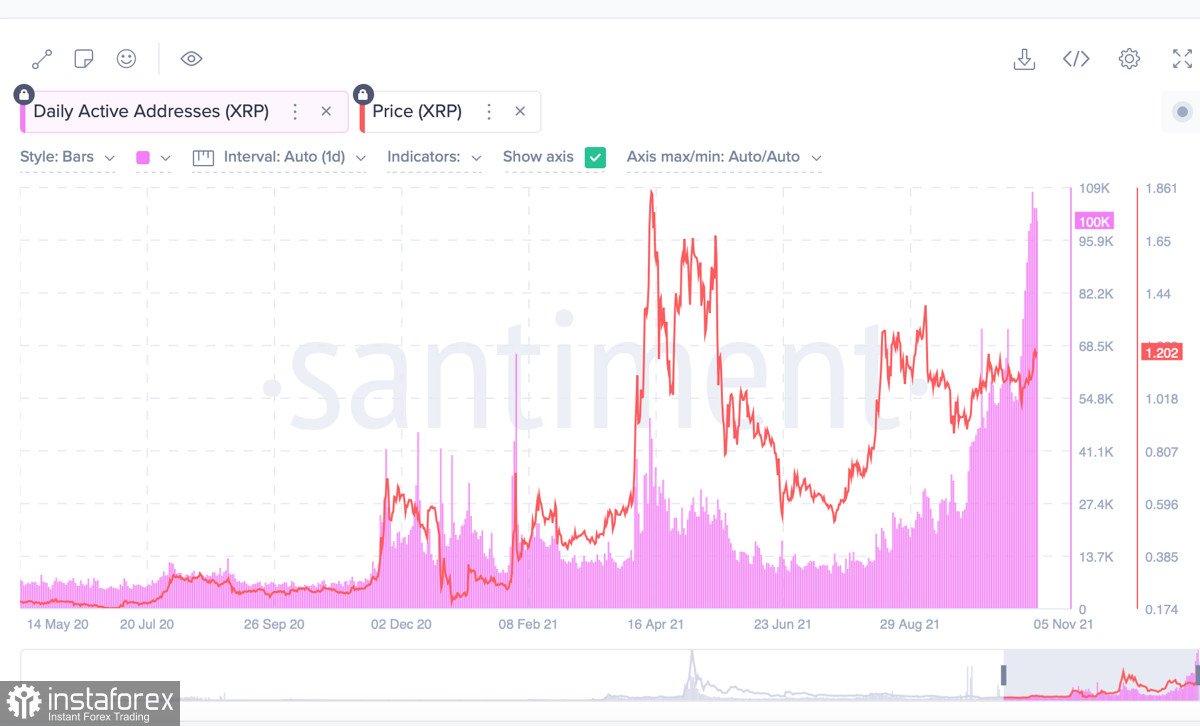

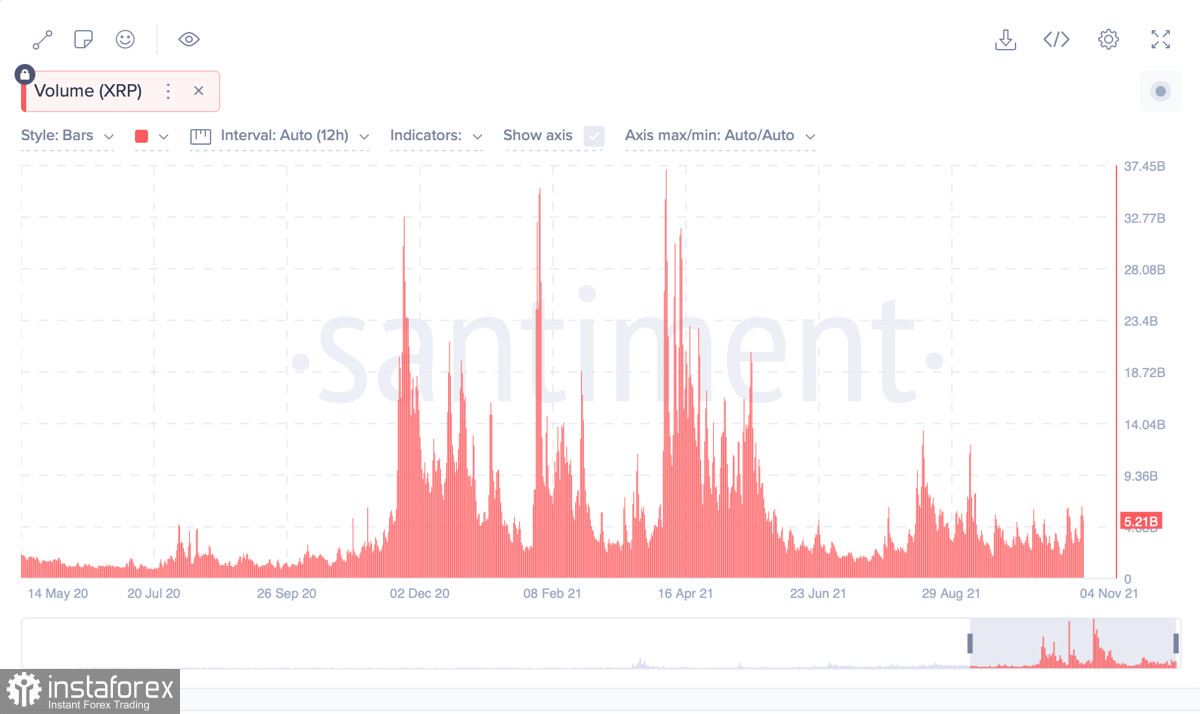

An important step towards resolving conflict between the regulator and the company Ripple could be the recent "rebranding" of the cryptocurrency, thanks to which the project managed to distance itself from the legal negativity. This is evidenced by the growth of on-chain activity in the coin network, as well as a 12% increase in the cost of the coin per day and after the announced changes.

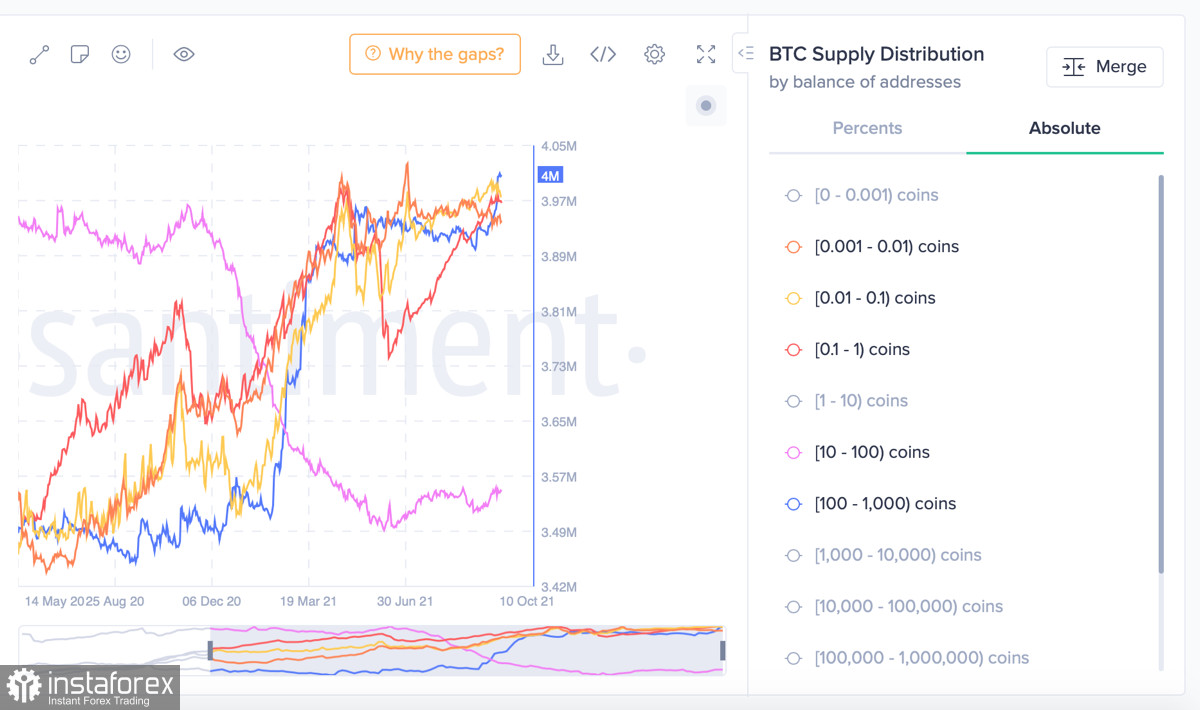

The market has always reacted positively to the local victories of the project over the SEC, which was reflected in the growth in quotes and gave confidence that investors are still interested in the XRP token. Thanks to the confident actions of Ripple, systematically expanding the possibilities for cryptocurrency, there was a positive trend in the growth of the number of institutional investors and long-term owners in the second half of 2021.

The conclusion of the trial could be a catalyst for the growth of a coin unencumbered by the uncertainty of the future. The XRP price continues to rise and over the past week, the asset has grown by 14.5%, which indicates the growing market interest in the coin.

As of 11:00 UTC, the cryptocurrency has risen in price by 1% over the past day and is trading at $1.23. On the hourly chart, the coin is in the framework of consolidation after a powerful upward impulse movement on November 8. The price is confidently moving above the supertrend line and has bounced off it more than once, which indicates the advantage of buyers.

At the same time, quotes have tried at least five times to break through the $1.28 milestone, which acts as a key resistance line for the current day, and if the coin manages to break through this milestone, it opens to further local highs.

However, first, the coin needs to push off from the support zone, as indicated by technical indicators: the MACD is declining beyond the zero mark and risks falling into the red zone, and the stochastic continues to decline after the formation of a bearish intersection, indicating a retest of the support zone.

The daily chart shows local signals for the weakening of the upward movement, but the formation of two confident green candles in a row indicates serious interest from investors. The coin is approaching the resistance zone, and therefore a local pullback and a planned decline look like a logical price movement. An important resistance level for XRP is the $1.39 mark, after which the operational space opens up to $1.59, which allows us to count on another influx of investors.

Technical charts are in the over-crowded zone, and therefore the current decline is logical within the framework of price stabilization. The nearest key support zone will be the $1.15 mark, from where the price will resume its upward movement. The MACD has formed a bullish intersection and is starting to move up, which indicates a large strength of the long-term upward momentum, and the stochastic and relative strength index are declining into the range of 50-70, which is a bullish zone.

And even if the cryptocurrency is far from establishing new ATHs, its progress is obvious compared to the spring of 2021. Investors are returning to an asset that is great for intraday trading by retail traders, as well as promising for long-term storage by institutions.

Therefore, we can say that the Ripple project is returning to the big arena and is ready to compete with leading assets and their ecosystems. With this in mind, there is every chance that in December 2021, the altcoin will finally get rid of the negativity that has plagued the project all year and will begin a full-fledged bullish rally to new historical highs.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română