Bitcoin is trading at $ 66,000 and is currently on its way to new all-time highs. Other cryptocurrencies, especially ether, are also in an uptrend.

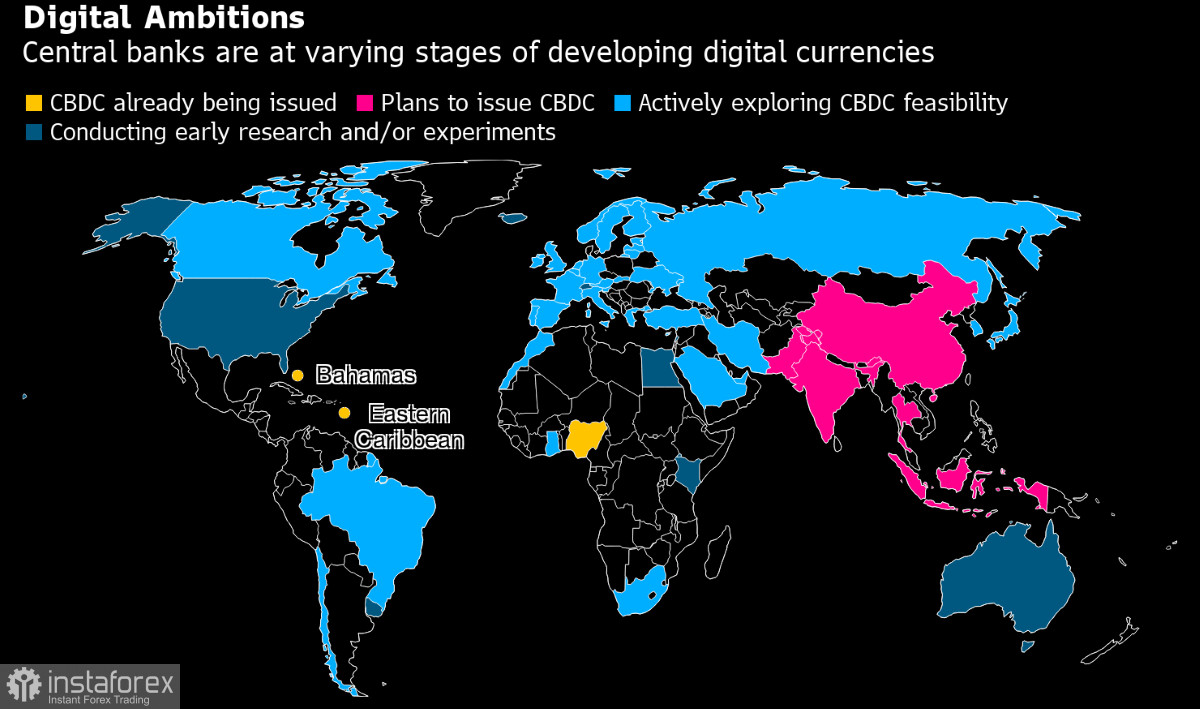

But before all that, it is important to note that the Bank of France is now dwelling on further research in the field of digital national currency. They decided to expand on it after discovering the benefits of market efficiency and CBDC payments.

According to their test results, CBDC can support securities settlement standards and make international payments faster, cheaper and more transparent. It also indicates that the findings are part of an active work by regulators seeking to keep up with the rapid development of crypto assets and digital payments.

Although there are still a number of risks associated with the sovereignty of the national currency and payments, France's study complements the ECB's two-year research project to issue digital euro.

But right now is too early to launch a new digital currency as additional work is needed to maximize the implementation of this new technology in monetary policy and the economy.

BTC

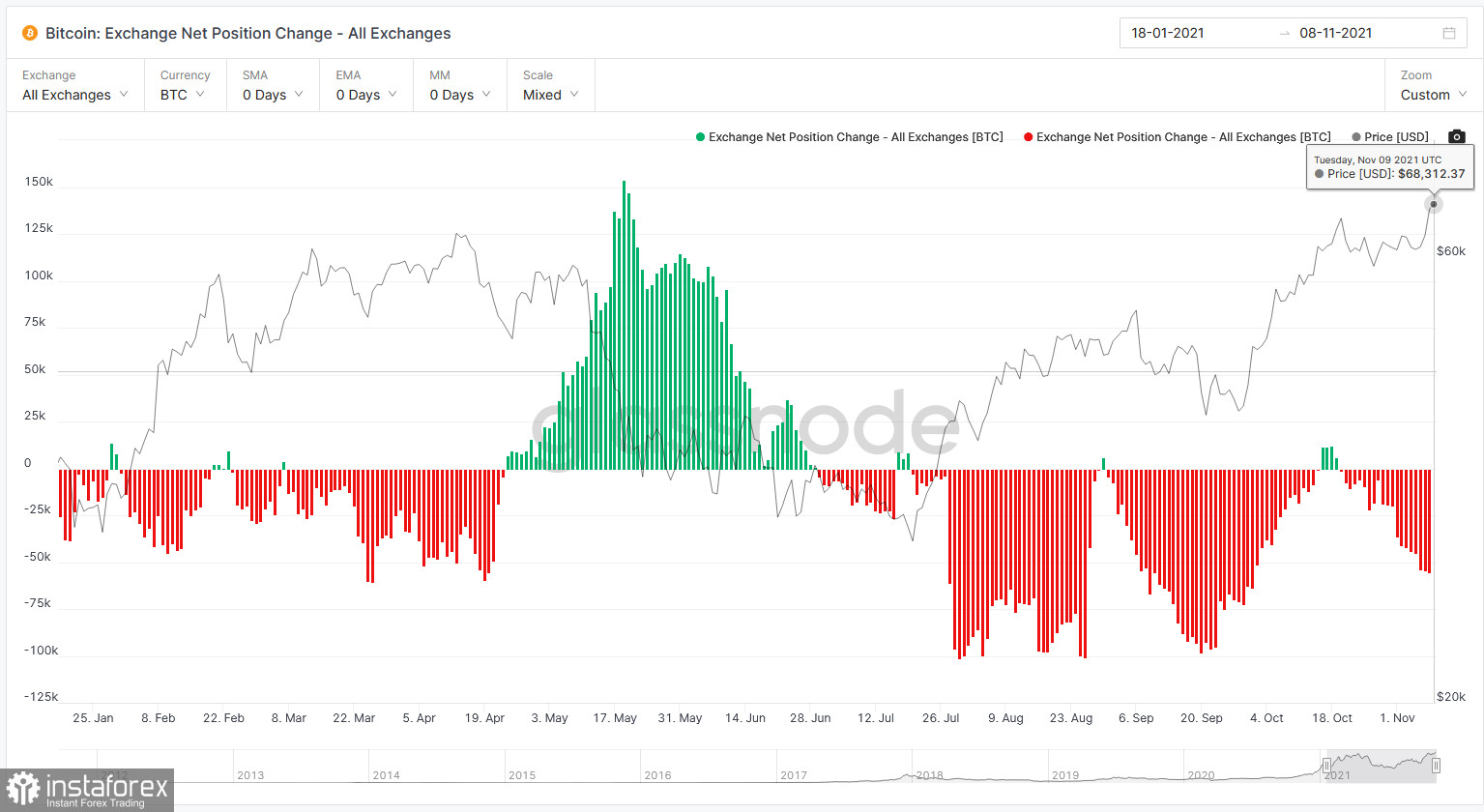

Bitcoin continues to rally amid high inflation and lower bond yields. Experts said that investors are concerned with rising inflation that is why they are shifting to safer instruments. However, in the pursuit of profitability, they also have to look for alternatives. Because of this, real yield on 10-year bonds fell to 1.09%, the lowest level since August 30.

The fact that Bitcoin is perceived as a store of value like gold also supports it.

Movement of funds from key cryptocurrency exchanges also indicates an optimistic outlook. The network hash rate of Bitcoin is steadily growing, not to mention the complexity of mining has increased eightfold. According to data, miners have accumulated over 3,000 BTC since September.

Now, a lot depends on $ 66,500 because a breakout will provoke a rise to $ 67,000 and $ 67,400. Meanwhile, a drop below the level will lead to a decline to $ 62,400 and $ 58,000.

As for ether, a lot depends $ 4,790 because a breakout will set off a jump to $ 4,900 and $ 5,000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română