Wave pattern

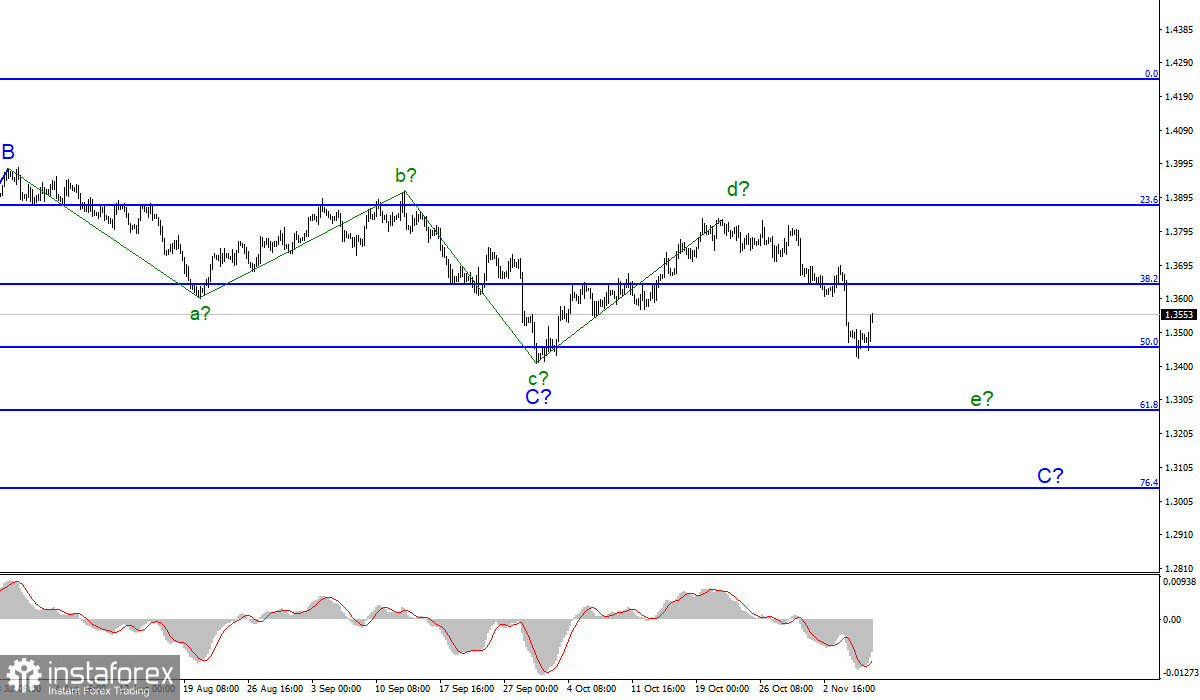

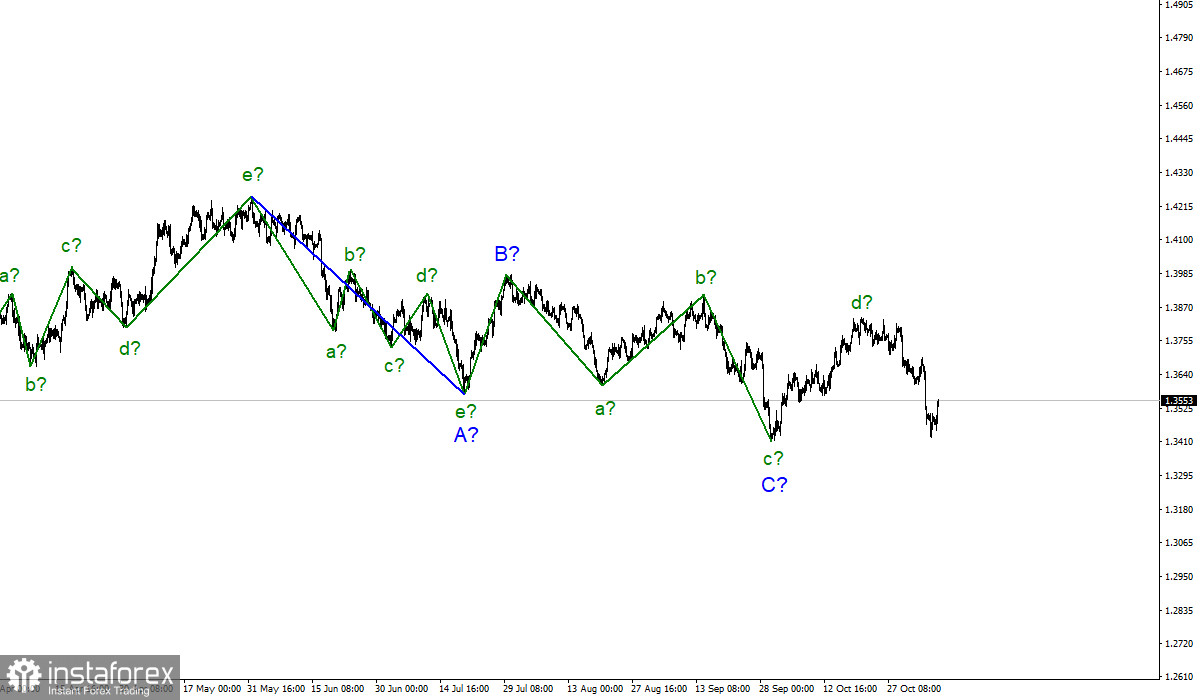

The wave counting for the Pound/Dollar instrument continues to look quite complicated due to deep corrective waves as part of the downward trend section, but at the same time, it is quite convincing. Even inside the last wave C, presumably five internal waves are visible, and each subsequent one is approximately equal in size to the previous one.

The assumption that wave C can already be completed has not been confirmed in practice. Most likely, this wave will still be a five-wave one. In this case, its internal wave d is completed, and now the construction of the wave e to C continues.

If this is indeed the case, then the decline of the instrument will continue with targets located around 34 figures, or lower. An unsuccessful attempt to break through the 50.0% Fibonacci level, which equates to 1.3458, led to a departure of quotes from the reached lows, which continues at this time. However, so far neither wave e nor wave C looks complete, since the last downward wave did not go beyond the low of the previous descending one.

It's not as bad as it could be.

The exchange rate of the Pound/Dollar instrument decreased by 80 basis points on Friday, but this is only in the first half of the day. On the second day, the instrument has already gained about 70 and has added the same amount on Monday. This means that the British pound is recovering quickly after the failure of last week. And such a strong increase in quotes even casts doubt on the ability of the markets to sell the instrument again in order to complete the construction of the wave e to C.

But I still advise selling the instrument on the sell signals from the MACD indicator. So far, there are none. The news background on Monday was rather weak, although Jerome Powell and Andrew Bailey made speeches that day.

Last Friday, European Commission President Maros Sefcovic and British Brexit Minister David Frost met in Brussels and held talks. It is reported that negotiations on this protocol have been going on for almost a month, but each time they end in nothing.

Sefcovic noted that London does not want to make concessions, and the European Union has already made every effort to reach a compromise, putting forward a comprehensive package of proposals in September, which London will later call "insufficient." Sefcovic also warned that if Britain applies Article 16 and suspends the entire protocol or its individual provisions, it will have serious consequences for Northern Ireland and significantly worsen relations between the EU and Britain.

The wave counting of the Pound/Dollar instrument looks quite convincing now. It has a downward form, but it is not impulsive. The expected wave e does not look complete yet, so I advise you to sell the instrument for each downward signal from the MACD indicator with targets located near the level of 1.3270, which equates to 61.8% Fibonacci level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română