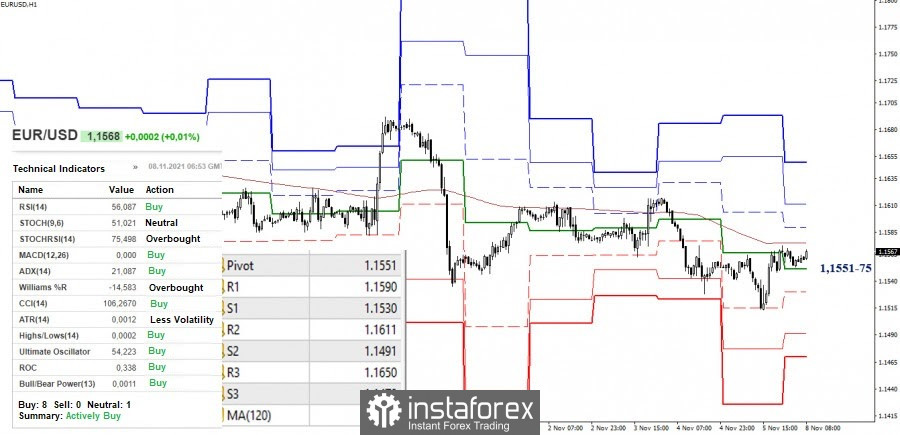

EUR/USD

The new trading week opened in the bearish zone outside the weekly Ichimoku cloud due to several factors at once. The benchmarks for the continuation of the decline and the emergence of new downward prospects remain the same and retain their location in the area of 1.1492 - 1.1474 - 1.1447 (monthly cloud + monthly medium-term trend) today. The attraction and resistance zone is now the accumulation of levels around 1.1576 - 1.1602-24 (lower border of the weekly cloud + the levels of the daily cross + the historical level).

A reliable consolidation above will also the bulls to return upwards and continue the restoration of their positions. In this case, the next upward pivot point will be the daily cloud, strengthened by the weekly Tenkan (1.1680) and the monthly Fibo Kijun (1.1695).

The development of a corrective rally in the smaller timeframes led the bulls to try breaking through the key levels, which are now joining forces in the 1.1551-75 area (central pivot level + weekly long-term trend). A consolidation above will give an advantage to the bulls on the hourly chart. The next upward pivot points are set at the borders of the classic pivot levels (1.1590 - 1.1611 - 1.1650).

On the contrary, the formation of a rebound from the met resistance will favor the bears. Their pivot points will be the support of the classic pivot levels (1.1530 - 1.1491 - 1.1470).

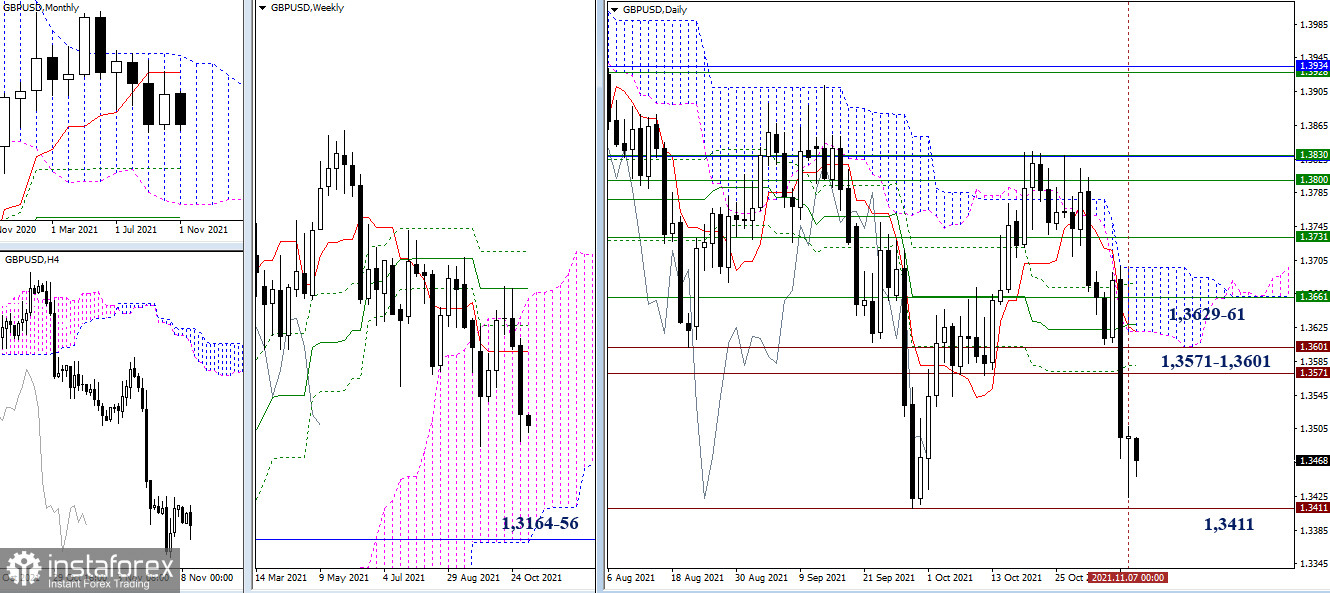

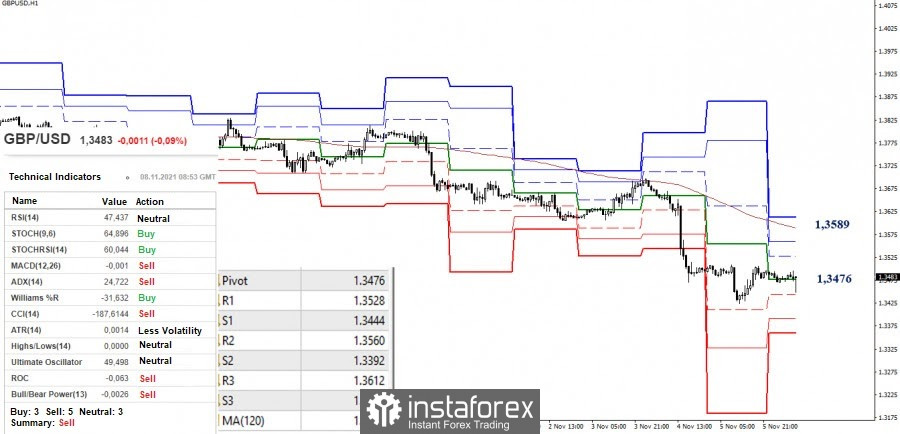

GBP/USD

The pair tested the minimum extremum (1.3411) and indicated a slowdown last Friday. A breakdown and a reliable consolidation below will open new bearish prospects, which suggest a decline to the area of 1.3164-56 (monthly Fibo Kijun and the lower border of the weekly cloud). If the deceleration and consolidation are prolonged, then the first resistance zone towards the restoration of bullish positions will be the area of 1.3571 - 1.3601 (historical and daily levels).

The bears have the main advantage in the smaller intervals. However, the pair is in the correction zone, and the central pivot level (1.3476) is being tested for strength. The upward target is the resistance of the weekly long-term trend (1.3589), and the nearest resistances along the way can be noted at 1.3528 (R1) and 1.3560 (R2). A consolidation above can change the balance of forces acting in the same timeframes. The downward intraday targets are located at 1.3444 - 1.3392 - 1.3360 (support for classic pivot levels) today.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română