The bullish trend is alive.

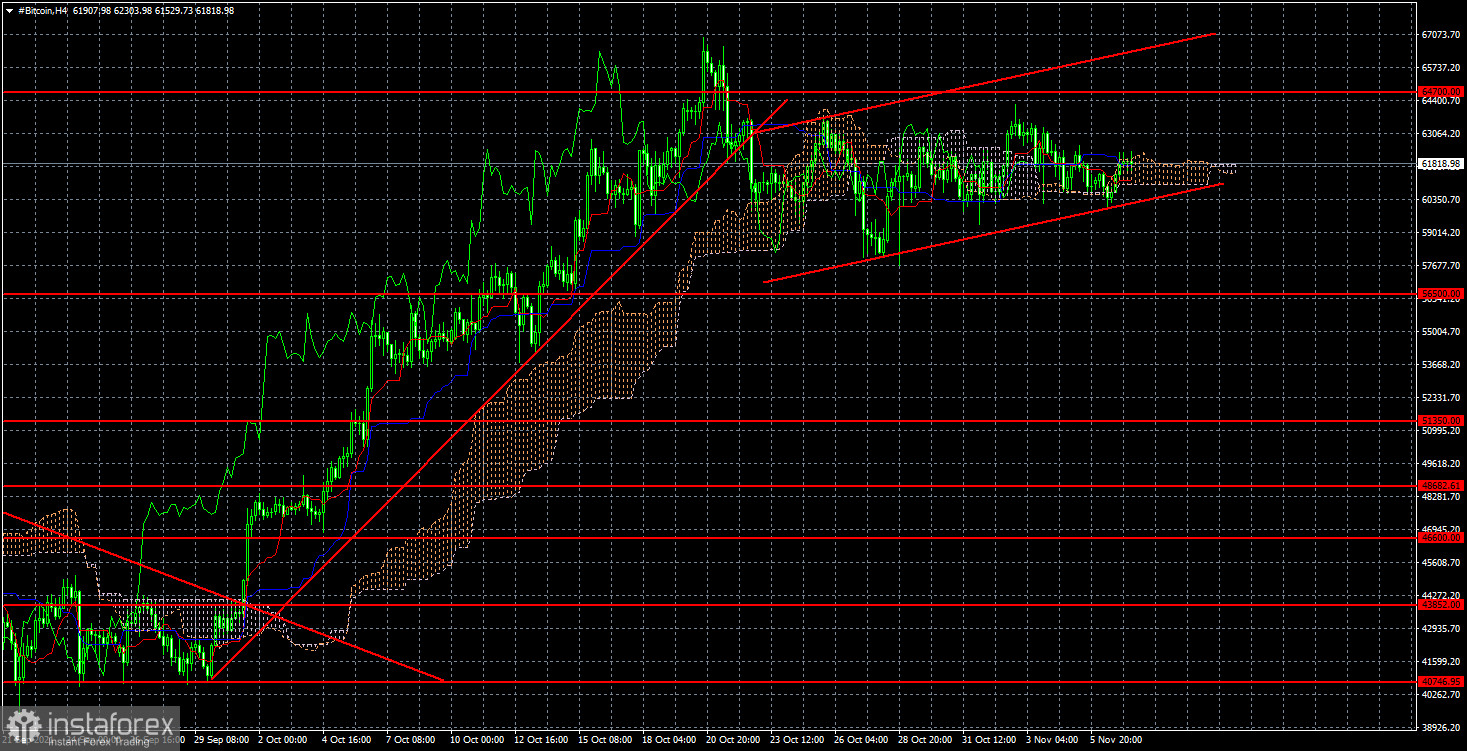

Bitcoin has been trying to restore an upward movement over the past few weeks. And it cannot be said that it was unsuccessful. The current growth of bitcoin is not as strong as before, but it occurs very close to the local and absolute maxima of the value of the cryptocurrency. And when the price is near its absolute highs, it doesn't matter what force the movement is. Moreover, the whole last segment of the trend looks very "hype". Once again, we remind you that there were no local reasons for the growth of cryptocurrency. Or at least there weren't any to grow from $ 29,000 to $ 67,000. At the same time, an ascending channel was formed, fixing below which may indicate a new round of downward correction. Also, the movement of recent weeks is very similar to the flat, but with a minimal upward bias. Thus, all the lines of the Ichimoku indicator are not valid now.

The Fed has started curtailing QE. What does this mean for Bitcoin?

For bitcoin, this means two things at once. Firstly, inflation will decrease over time. At least, that's what I want to believe, and that's what Jerome Powell, Janet Yellen, and many Fed representatives assure us. And since inflation will decrease, other, less profitable, but also less risky instruments will become more attractive to investors. Consequently, an outflow of investments from the cryptocurrency market may begin. Second, a reduction in QE means that the cash flows sent to the economy will be reduced. And if so, the flow of investments into the cryptocurrency market will also decrease. Of course, the quantitative incentive program will gradually decrease over the course of 8 months. Therefore, until the summer of 2022, the flow of money into the American economy will continue. However, every month it will become $ 15 billion less. What follows from all this? The fact that in the next 8 months, the upward trend in bitcoin may end. Let's remember that this whole trend began in March 2020, when the pandemic took over the whole world, and central banks began pouring hundreds of billions of dollars into supporting the economy. It was then that the growth of the US stock indices, as well as the cryptocurrency market, began. But this can't go on forever. Sooner or later, the Fed will stop ruthlessly exploiting the printing press, and will also start raising rates, which is always unprofitable for either the stock market or the cryptocurrency. Consequently, the investment conditions will worsen now. Consequently, bitcoin may rise in price for several more months and even until the middle of next year, but after this period, a new down trend is likely to begin. Thus, the goal of $ 100,000 per coin, which many experts continue to talk about, is still relevant, but the upward trend in bitcoin is unlikely to continue indefinitely. We expected its completion even when the price was about $29,000. But then large investors and institutions simply did not let the "cue ball" fall lower.

The trend on the 4-hour timeframe continues to be upward. Therefore, at the moment, bitcoin purchases with the goals of $64,700 and $67,000 remain more preferable. But closing the price below the ascending channel will allow us to expect a new round of corrective movement, within which the rate may fall to the level of $ 56,500. By the way, this consolidation may happen in the near future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română