Many people have been talking about this lately, including JP Morgan. And today this relationship was confirmed by billionaire Peter Thiel. In light of the recent rally of the main cryptocurrency and its current trading near $60,000, he is pessimistic about the prospects for the global economy.

While the Fed condones inflation, investors are going to Bitcoin

Thiel rebukes the Fed for not coping well with a problem that could snowball into a larger crisis.

The growing threat of inflation has been cited more than once as the reason for the significant adoption of cryptocurrency in 2021. The founder of Paypal believes that the global economy is already knee-deep in crisis, and this is especially striking when you look at the recent BTC prices.

Is it all about the Fed?

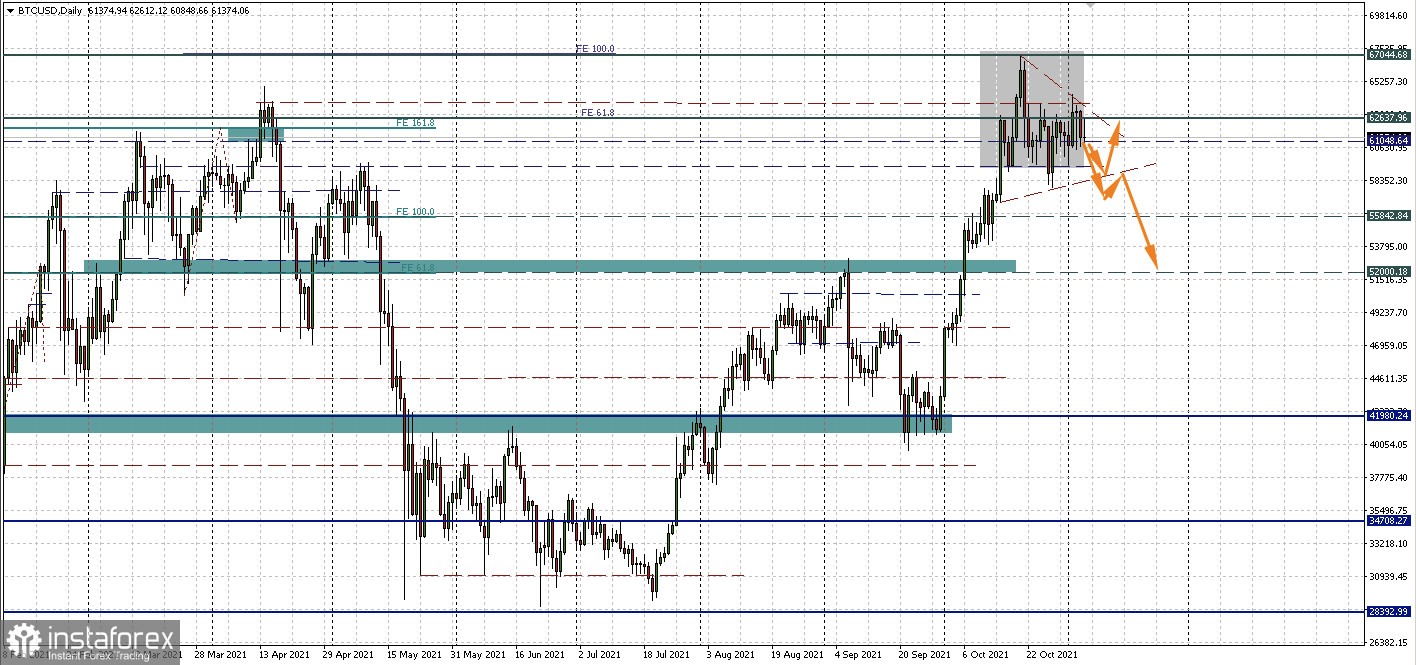

Thiel, whose statements we will consider as bitcoin continues to technically decline in the triangle, largely blames the American Central Bank. The investor believes that the Fed is in a "closed" state as a result of its seemingly narrow-minded approach to this issue.

There have been a lot of criticisms lately from cryptocurrency enthusiasts for allegedly printing money "without limits," especially with the proposed $2 trillion stimulus package. The inflationary implications of such a move are already being discussed in cryptocurrency circles.

"Canary in the coal mine"

This is what Thiel recently called Bitcoin, explaining that its price is a good indicator of what is happening in the economy now. If investors are fleeing traditional assets and even gold, then things are not going well. Does this mean that as soon as the Fed starts raising rates, Bitcoin will fall? I think you shouldn't get ahead of yourself so much because it is unlikely to happen quickly. The American central bank, like many others, is likely to fail to curb inflation quickly.

On Wednesday, the Fed began to taper QE. However, Fed Chair Jerome Powell spoke very carefully about the rate hike. And the Bank of England on Thursday did not raise the rate, despite the off-scale inflationary pressure.

According to October data, the annual inflation rate in the United States reached 5.4%. In 2020, the average inflation rate was fixed at 1.2%.

Given the current caution of world central banks in tightening monetary policy due to the employment situation, prices will continue to rise for a long time. At the same time, the emergence of new instruments such as Bitcoin ETFs will intensify the flight into digital assets.

Don't forget the side triangle

Meanwhile, the technical benchmarks for BTCUSD have not changed. The hypothetical triangle and the consolidation range 59,383.67 - 62,637.96 inside it are still relevant. There is still a reserve of motion to the lower boundaries of the figures, and, possibly, after the weekend, there will be more clarity on the issue of the further medium-term direction of the main cryptocurrency.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română