To open long positions on GBP/USD, you need:

Quite predictably, the pressure on the British pound remained in the first half of the day, especially after yesterday's statements made by the governor of the Bank of England. In my morning forecast, I paid attention to the level of 1.3084 and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. An instant breakout of this range without a reverse test from top to bottom did not allow us to form a convenient entry point into short positions with the aim of further falling of the pair, although it was possible to sell the pound without it, since, after yesterday's collapse, the trend was clearly on the side of the bears. As a result, we observed a decline of GBP/USD by more than 50 points to the support area of 1.3437.

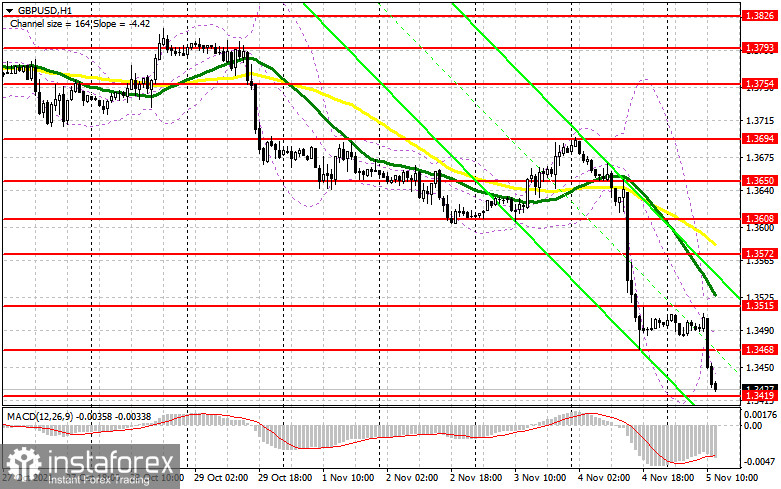

In the afternoon, all attention will be on the report on the US labor market, as the further direction of the pound depends on these data. Bulls will count on poor indicators, which will give them at least some hope for an upward correction at the end of the week. The primary task of the bulls is to regain control over the morning level of 1.3468. Weak data on the labor market will allow breaking above this range, and its reverse test from top to bottom will give an entry point into long positions. Such a scenario will lead to the demolition of several bears' stop orders and will open a direct road to today's maximum of 1.3515. Moving averages that limit the upward potential of the pair pass above this level. A breakthrough in this area will increase the probability of updating 1.3572 and 1.3608, but this is with very poor indicators for Non-Farm Employment Change. In the scenario of a further decline of the pair in the afternoon, an important task for buyers will be to protect the support of 1.3419. Only the formation of a false breakdown will increase the pound's chance of an upward correction of the pair within the day. In the scenario of the absence of active actions on the part of the bulls in the area of 1.3419, the best option for buying the pound will be a test of the next support - 1.3375. However, I advise you to open long positions against the trend there only after a false breakdown. You can watch GBP/USD purchases immediately for a rebound from the minimum of 1.3308 based on a correction of 25-30 points within a day.

To open short positions on GBP/USD, you need:

Sellers have plenty of chances to keep the market under their control - they just need a strong report on the US labor market. In this case, the bears will be able to push the pound below weekly lows. A breakout of 1.3419 and a reverse test from the bottom up will form a sell signal for GBP/USD in the expectation of a further drop in the trend to new lows this month: 1.3375 and 1.3308. A more distant target will be the 1.3254 area, where I recommend fixing the profits. However, such a scenario will be possible in the case of very strong data on the American labor market. In case of GBP/USD growth in the second half of the day, the bears will be set to defend the resistance of 1.3468. However, only the formation of a false breakdown there will give a good entry point to the market. If there is no activity of bears at 1.3468, I advise selling the pound only after the formation of a false breakdown in the area of 1.3515, above which the moving averages are playing on their side. I advise you to open short positions immediately for a rebound from the level of 1.3572, or even higher - from a new maximum in the area of 1.3608, counting on the pair's rebound down by 20-25 points inside the day.

The COT reports (Commitment of Traders) for October 19 recorded a reduction in short and an increase in long positions, which reflects the upward trend in the pound observed in the middle of this month. The decision of the Bank of England will determine the direction of the British pound in the near future. Most likely, after a downward correction, the bulls will take advantage of the chance and start buying the pound again at more attractive prices, even despite the decisions made by the regulator, which will affect the GBP /USD only in the short term. The speech of the Governor of the Bank of England, Andrew Bailey, may have a positive impact on the market, as the problem of inflationary pressure will force the Central Bank to act sooner or later. I advise you to count on the further strengthening of the pound and take advantage of any decline in the short term, which may form in the case of weak fundamental statistics. The COT report indicates that long non-commercial positions rose from the level of 46,794 to the level of 49,112, while short non-commercial positions fell from the level of 58,773 to the level of 47,497. This led to a change in the non-commercial net position from a negative value to a positive one. The delta was 1,615, against -11,979 a week earlier. The closing price of GBP/USD increased significantly: from 1.3591 to 1.3735.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 daily moving averages, which indicates the formation of pressure on the pound.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of growth, the average border of the indicator in the area of 1.3485 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română