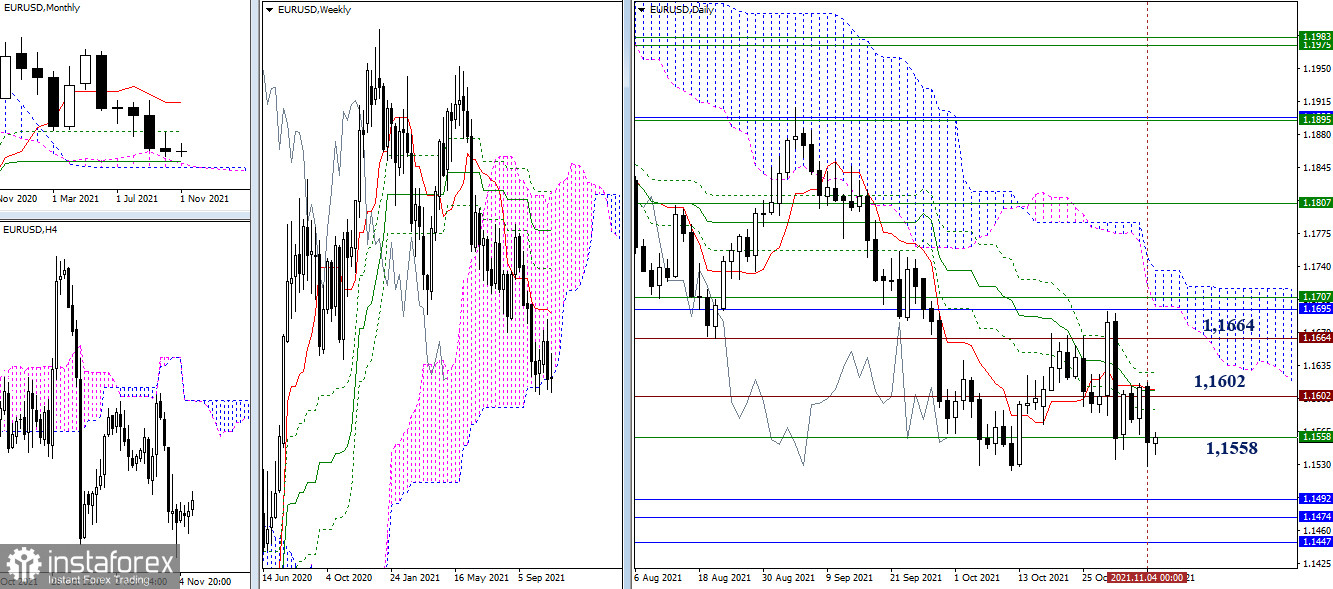

EUR/USD

The bears tried to leave the attraction zone of 1.1602 yesterday and go beyond the level of 1.1558. Today, the current week will be closing, and consolidation below the border of the weekly Ichimoku cloud (1.1558) in the weekly timeframe would be the best result for the bears. The strengthening of the bearish mood will lead the euro to the next accumulation of downward benchmarks, which are currently located at 1.1492 - 1.1474 - 1.1447.

The advantage in the smaller timeframes is on the side of the bears. The resistances are today's key levels, which keep their position in the area of 1.1556-81 (central pivot level + weekly long-term trend). Therefore, a consolidation above can affect the current balance of power. If growth occurs, we can consider the other upward targets: the classic pivot levels of 1.1604 - 1.1655 - 1.1693. On the contrary, the recovery of the downward trend (minimum extremum 1.1528) will allow further decline. Their intraday reference points will be 1.1515 - 1.1477 - 1.1426.

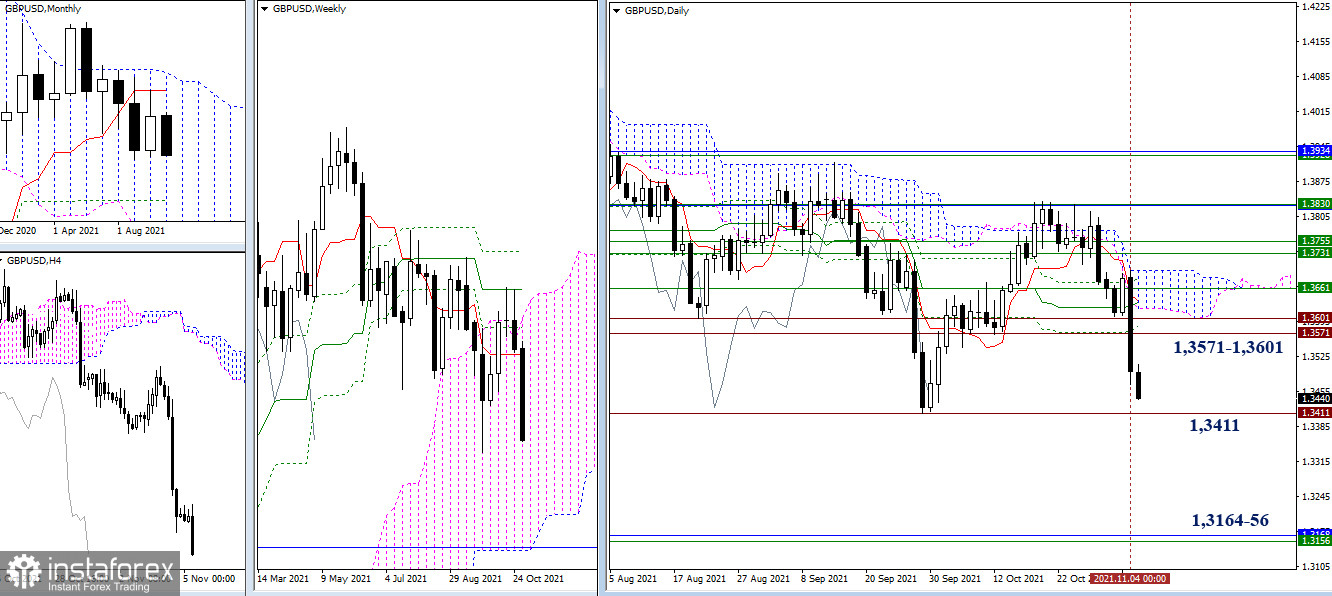

GBP/USD

Yesterday, bearish traders distinguished themselves by the effectiveness of the downward movement. Now, they are interested in updating September's minimum extreme (1.3411). The next pivot point after that will be the border of 1.3164-56 (lower border of the weekly cloud + monthly Fibo Kijun). The levels that were broken the day before now serve as resistances, which will now resist the recovery of bullish positions in the area of 1.3571 - 1.3601.

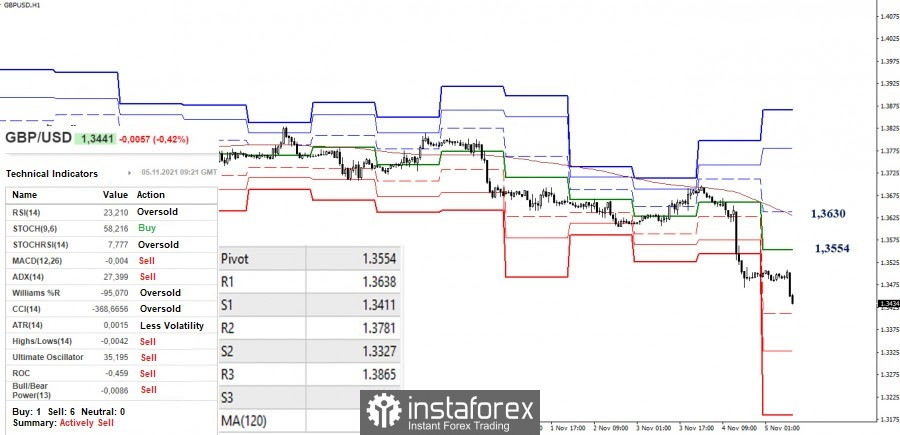

The bears, who are developing a downward trend, still have the advantage in the smaller timeframes. The intraday downward targets are now guided by the support of the classic pivot levels, which are set at 1.3411 - 1.3327 - 1.3184 today. The key levels are currently forming the borders to continue the upward correction. In case of recovery of bullish positions, the central pivot level (1.3554) will be the first to be considered, then the weekly long-term trend (1.3630) will be crucial in determining the advantages.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română