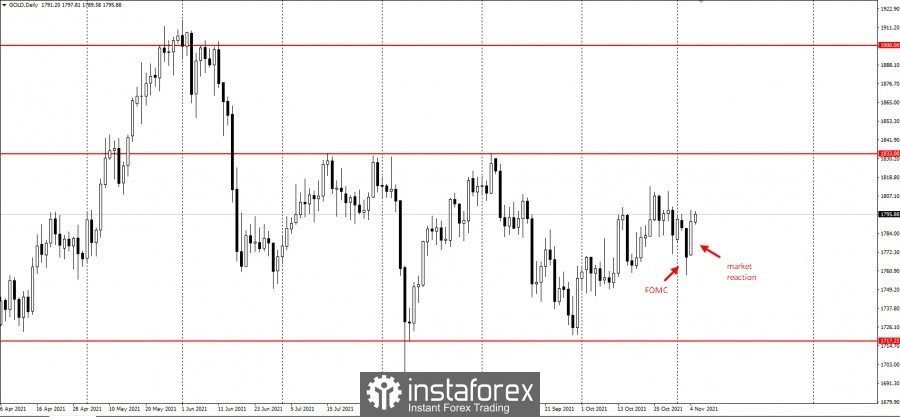

Gold is trading again near $ 1,800. But it could go higher because investors are likely to adjust their expectations on potential rate hikes by the Federal Reserve.

According to George Milling-Stanley, chief gold strategist at State Street Global Advisors, since June, investors and markets have been too aggressive when discussing a possible hike in interest rates. But in the words of Fed Chairman Jerome Powell, there was no relationship between the reduction in the balance sheet and potential hike in interest rates.

And as expected, the Federal Reserve began cutting monthly bond purchases and said it should end by mid-2022. Interest rates, meanwhile, are yet to be raised because the committee members are not considering it anytime soon. In Powell's words, this move is well suited to address a number of likely outcomes, and it would be premature to raise rates right now.

But even though the central bank is slow in increasing rates, markets continue to expect hikes by June next year. Milling-Stanley, however, said these projections may shift through the new year. This could be beneficial to gold, as equity markets may continue to hit record highs.

Of course, there are some uncertainties, but a small downtrend will be enough to bring gold's role in the portfolio back to the fore. After all, the metal is a good hedge against inflation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română