A very eventful week is ending, approaching its logical result. Here, it became clear that after the outcome of the Fed meeting on monetary policy, the regulator will not yet determine clear and precise dates for the start of the process of raising interest rates despite the decision to start cutting stimulus measures (QE).

Today, the markets' focus will be the publication of employment data in America. The data for October will fully reflect the situation in the economy, considering the next increase in the size of public debt and the end of all kinds of vacations due to the end of summer and the "velvet season". According to the consensus forecast, the US economy was expected to receive 450,000 new jobs in October against the failed values of 194,000 a month earlier. The actual figures will be known at 12.30 Universal time.

How will the publication of data on the number of new jobs in the US non-agricultural sector affect the dollar exchange rate and the dynamics of markets in general?

We believe that investors understand perfectly well that the American economy is far from satisfactory especially after the Fed meeting and the speech of J. Powell, who made it clear that the regulator will take a very cautious and balanced position regarding the prospects for raising interest rates. The high inflation of 5.4%, a clear slowdown in economic growth from 6.7% in the second quarter to 2.0% in the third, an unsightly picture on the labor market, which continues to point to real problems, the impact of COVID-19, the unwillingness of a significant number of Americans to go to work and parasitize on benefits, as well as the disruption of ties in the supply of goods are the most important issues. In addition to them, there are other smaller influences but clearly fit into the outline of the general negative mainstream.

But let's return to the possible market reaction to the statistics. If they turn out to be noticeably lower than forecasts again, then the US dollar will traditionally play down locally, but then it may receive limited support again, as it was, for example, in October after the September figures were released. Such dynamics may be due to the fact that investors will again begin to "withdraw" into the US dollar in the wake of concerns about the prospects for the recovery of the American economy. We emphasize that this strengthening will be limited in nature, as new fears will encourage investors to buy Treasury government bonds, and this will lead to increased pressure on the US currency.

In this regard, stock markets can expect a resumption of the downward correction in stock indices both in America and in other regions of the world.

Commodity markets may also experience a local shock due to the expectation of weak production activity and, as a result, demand for these assets. The local increase in oil and gas prices before a cold winter may persist, or rather, prices will be supported by factors of continued high demand.

If the values show a noticeably greater increase in the number of new jobs – this will lead to a limited appreciation of the dollar, which will maintain a sideways movement in the dynamics of the ICE index as a whole. Stock markets will get a reason to rally, as well as the demand for commodity and commodity assets, will strengthen.

Assessing the situation in the market, we believe that neither positive nor negative employment data is unlikely to change the mood of investors. They will only contribute to the production of high volatility because the main factor, which is the prospect of the Fed raising interest rates, will be postponed indefinitely in the future.

Forecast of the day:

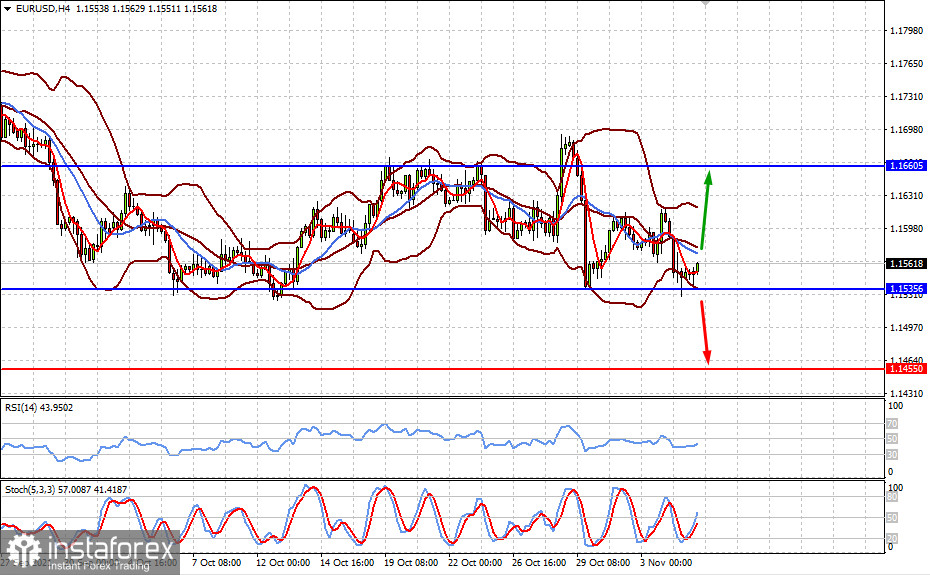

The EUR/USD pair is still in the range of 1.1535-1.1660. If the news is positive for the US dollar, the pair may break the support level of 1.1535 and fall to 1.1455. But if they turn out to be worse, then the pair's limited growth is possible to the level of 1.1660, and then its continuation in this range.

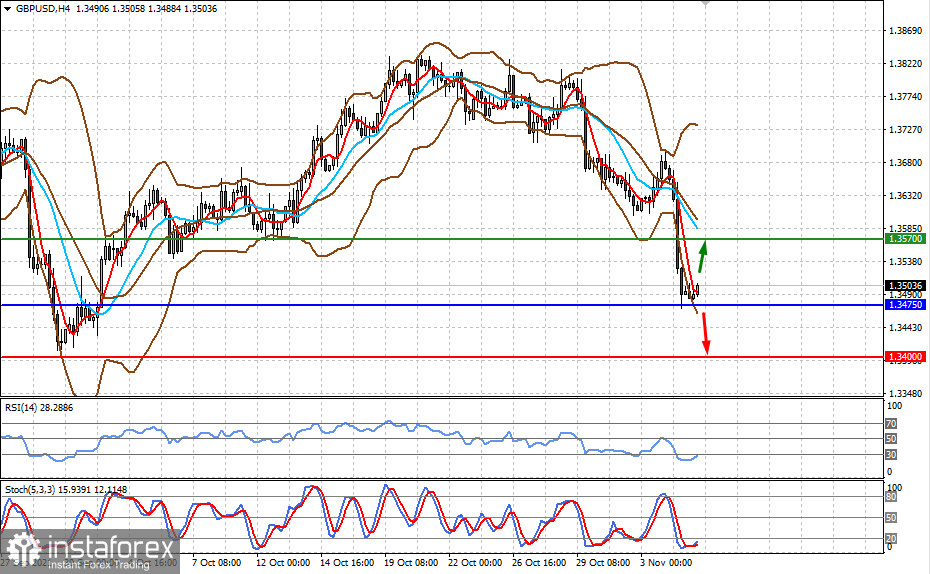

The GBP/USD pair is trading above the level of 1.3475 after the decline. Negative news for the US dollar will have to support the pair and push it to 1.3570 But if they are positive, the pair will decline to the level of 1.3400 after breaking through the support level of 1.347.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română