Wave pattern

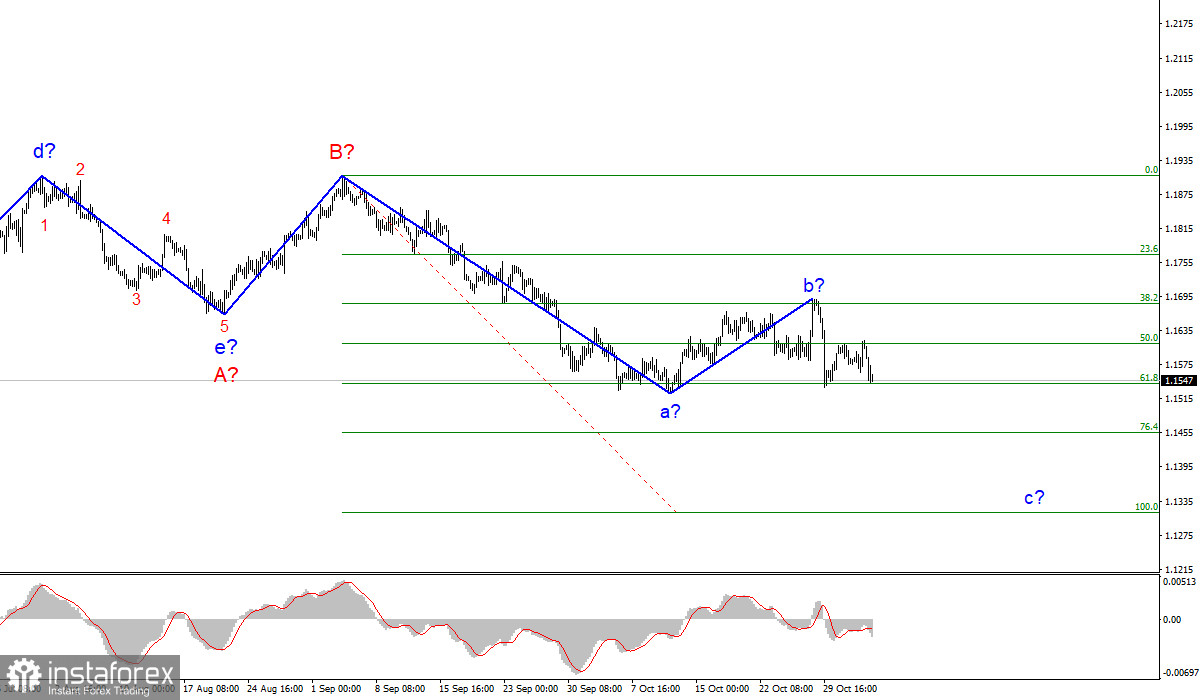

The wave counting of the 4-hour chart for the Euro/Dollar instrument looks quite holistic now. The plot a-b-c-d-e, which has formed since the beginning of the year, is interpreted as wave A, and the subsequent increase in the instrument is interpreted as wave B. If this assumption is correct, then the construction of the proposed wave C, which can take a very extended form, is now underway.

The corrective wave b took a more complex form due to the sales of the US currency last Thursday, but on Friday the decline in quotes resumed, which could be the beginning of a new extended wave c to C. Thus, wave b is currently considered completed.

The proposed wave c can take no less extended form than wave a. Its targets are located below the 15th figure, up to the 13th. However, in order for this wave to continue its construction, a successful attempt to break through the 1.1541 mark is required, which corresponds to 61.8% Fibonacci level.

The USD initially experienced problems, but eventually began to rise.

The news background for the EUR/USD instrument remained very strong on Thursday. There were fewer news and reports than on Wednesday, but all this time the markets were digesting the information received from the Fed the day before. In its meeting on Wednesday, the Federal Reserve already decided to taper QE later this month. And earlier, for a couple of months, the markets were actively discussing inflation in America, and when the regulator will start raising the rate, as well as what measures will be taken to prevent the growth of inflation in the future. All these questions were answered by the markets on Wednesday evening.

The quantitative easing program will be reduced by $15 billion per month, however, as Jerome Powell said, this does not mean that the Fed will start raising the interest rate in the near future. Powell once again stated that inflation is temporary and will begin to decline next year. There were also hints that the Fed may not reduce the volume of assets being bought every month. Everything will be the envy of economic conditions in the US in the coming quarters. But Powell pointed out that the Fed will continue to maintain the financial conditions that are required for a full recovery of the labor market.

Thus, after the Fed meeting, there were two feelings. On the one hand, the QE program began to shrink, and on the other, Jerome Powell's rhetoric was very soft and not aggressive. In the end, the markets nevertheless increased the demand for the dollar, as they considered that now the beginning of QE tapering is quite enough, and then it will be seen. Thus, the construction of the proposed wave c should continue.

General conclusions

Based on the analysis, I conclude that the construction of the downward wave C will continue, and its internal corrective wave has completed its construction. Therefore, now I advise you to sell the instrument for each "downward" signal from the MACD, with targets located near the calculated marks of 1.1454 and 1.1314, which corresponds to 76.4% and 100.0% Fibonacci levels.

The wave counting of the higher scale looks quite convincing. The decline in quotes continues and now the downward section of the trend, which originates on May 25, takes the form of a three-wave corrective structure A-B-C. Thus, the decline may continue for several more months until wave C is fully completed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română