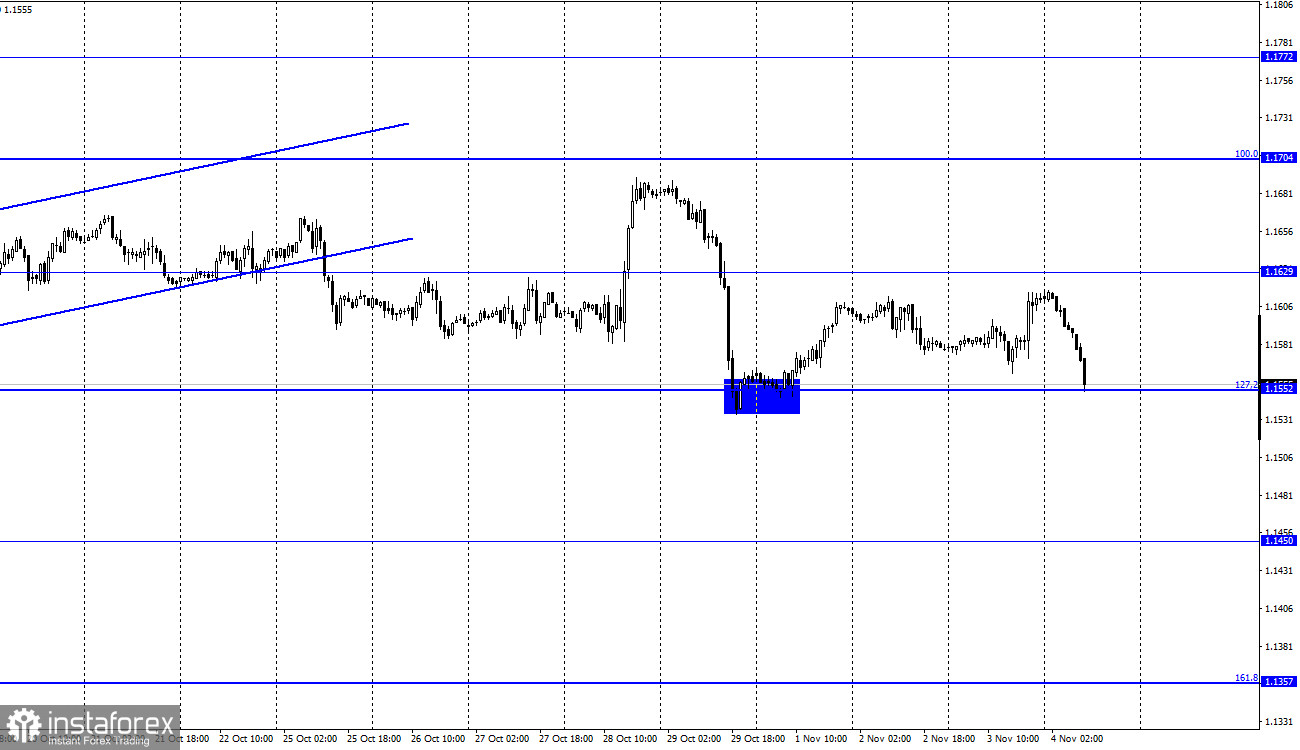

EUR/USD – 1H.

Hello dear traders! The EUR/USD pair was trading quite actively on Wednesday. It was predictable as the Fed meeting is one of the most significant events for the currency market. Therefore, it is not surprising that the pair went up at first, and then started to plunge. Consequently, the quotes have fallen to the 127.2% correction level at 1.1552. The pair's rebound from this level is a sign to expect a reversal in favor of the EU currency and a rise towards 1.1629. Closing under 1.1552 will raise the probability of further decline towards 1.1450. According to the Federal Reserve meeting, tapering was the key decision, i.e. the reduction of the bond purchases concerning QE program. Notably, traders had been awaiting this decision since September and were afraid that the Fed would postpone it till December. That is, on the one hand, this decision was highly expected, but on the other hand it was impossible to ignore it.

Hello dear traders! The EUR/USD pair was trading quite actively on Wednesday. It was predictable as the Fed meeting is one of the most significant events for the currency market. Therefore, it is not surprising that the pair went up at first, and then started to plunge. Consequently, the quotes have fallen to the 127.2% correction level at 1.1552. The pair's rebound from this level is a sign to expect a reversal in favor of the EU currency and a rise towards 1.1629. Closing under 1.1552 will raise the probability of further decline towards 1.1450. According to the Federal Reserve meeting, tapering was the key decision, i.e. the reduction of the bond purchases concerning QE program. Notably, traders had been awaiting this decision since September and were afraid that the Fed would postpone it till December. That is, on the one hand, this decision was highly expected, but on the other hand it was impossible to ignore it.

Thus, the movements in different directions of the US currency last night and today are also quite evident. In those few hours, when the Fed announces its meeting's results, the pair usually demonstrates a bullish trend and then a bearish one. However, now it is clear that the dollar rose at the end of the meeting. Though it has added a little. The Fed will now decrease the volume of its QE program by $15 billion a month until it reaches zero. Besides, this factor may satisfy the demand for the US currency. However, there was a serious obstacle. Jerome Powell said that inflation could remain high and interest rates were unlikely to be raised in the near future. There is no hidden meaning or hint in these statements either. It is unlikely that any traders expected a rate hike until QE was complete. Consequently, the Fed will definitely not raise the rate in the next six months. Besides, it is impossible to predict what will happen in six months amid the global COVID-19 pandemic and considering the fact that Jerome Powell may resign his post in February 2022.

EUR/USD – 4H.

On the 4-hour chart, the quotes performed two rebounds from the 100.0% correction level at 1.1606. Consequently, there was a new reversal in favor of the US currency and a new fall towards the 127.2% Fibo level at 1.1404. The indicators demonstrate no divergences today. By closing the quotations above the level of 1.1606 it is possible to expect a slight rise in the pair towards the 76.4% correctional level at 1.1782.

US and EU news calendar:

EU - Economic Forecast from the European Commission (10-00 UTC).

US - Initial and Repeated Jobless Claims (12-30 UTC).

EU - ECB President Christine Lagarde will deliver a speech (13-00 UTC).

On November 4, the EU and US economic calendars do not record as many events as they did yesterday. However, I still recommend drawing attention to European events, especially Christine Lagarde's speech. The information background today may be average.

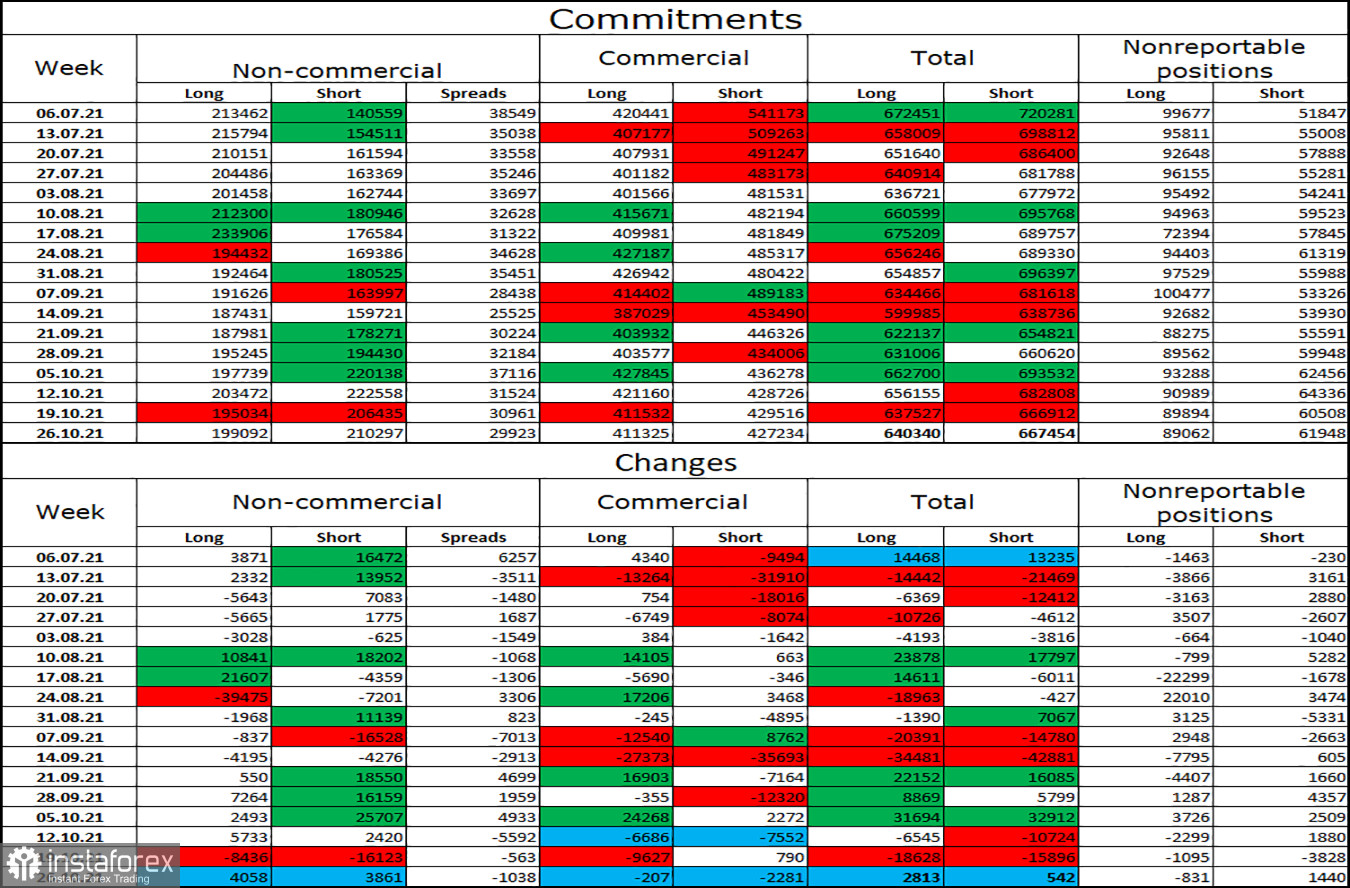

COT report (Commitments of traders):

The latest COT report showed that the sentiment of the "non-commercial" traders did not change during the reporting week. Speculators opened 4058 long euro contracts and 3861 short contracts. Consequently, the total number of long contracts held by speculators has increased to 199,000. Besides, the total number of short contracts went up to 210,000. During the last several months "non-commercial" traders tend to divest of long euro contracts and increase short-contracts or to expand short contracts at a higher rate than long ones. Overall, this process is going on now. However, during the last three weeks the European currency is inclined to demonstrate weak growth (not taking into account the last day of the previous week). On the whole, the fall of the euro is still considered more preferable.

EUR/USD forecast and recommendations for traders:

I recommend buying the pair if a rebound from 1.1552 with a target of 1.1629 is performed on the hourly chart. I recommend selling the pair if a closing under 1.1552 with a target of 1.1450 is completed.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for ensuring current activities or export-import operations.

"Non-reportable positions" - small traders who have no significant influence on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română