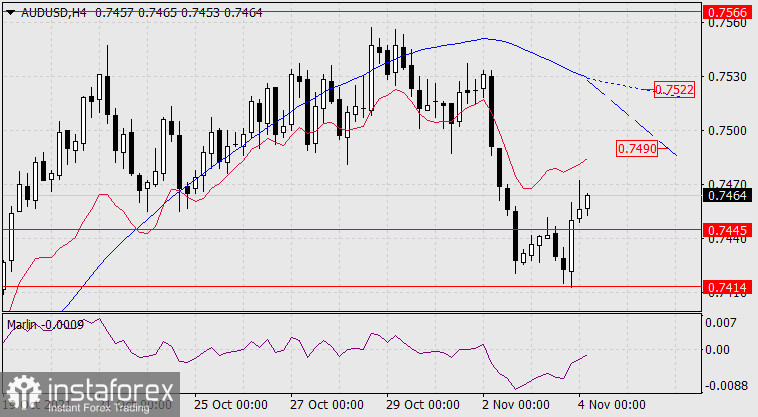

The Australian dollar did not develop the downward movement yesterday, which was given a strong impetus on Tuesday. The price left the target level of 0.7414/45, and now, if it consolidates above it, that is, when today's daily candle closes above 0.7445, a medium-term growth may develop. The Marlin Oscillator turned up from its own zero line.

If the US dollar goes on the offensive, the aussie may once again try to go under the 0.7414/45 range. Then the target will open at 0.7320 along the MACD indicator line.

On the four-hour chart, the situation remains mostly decreasing. The Marlin Oscillator is still in the negative zone, the price is below both indicator lines - the balance line and the MACD line. The main difficulty is that the MACD line on H4 is high above the price. To fully consolidate the upward trend, the price needs to rise above it (above 0.7522). This is not a matter of one day. And to make it easier for the price to overcome the MACD line, the market may go sideways. During this time, the MACD line will decline, approaching the price. This option is marked with a dotted line with an indicative level of 0.7490.

Summary: the current situation is prone to the development of sideways movement, even in the event of the potential development of a downtrend scenario, since the Australian dollar is already moving under the influence of external markets.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română