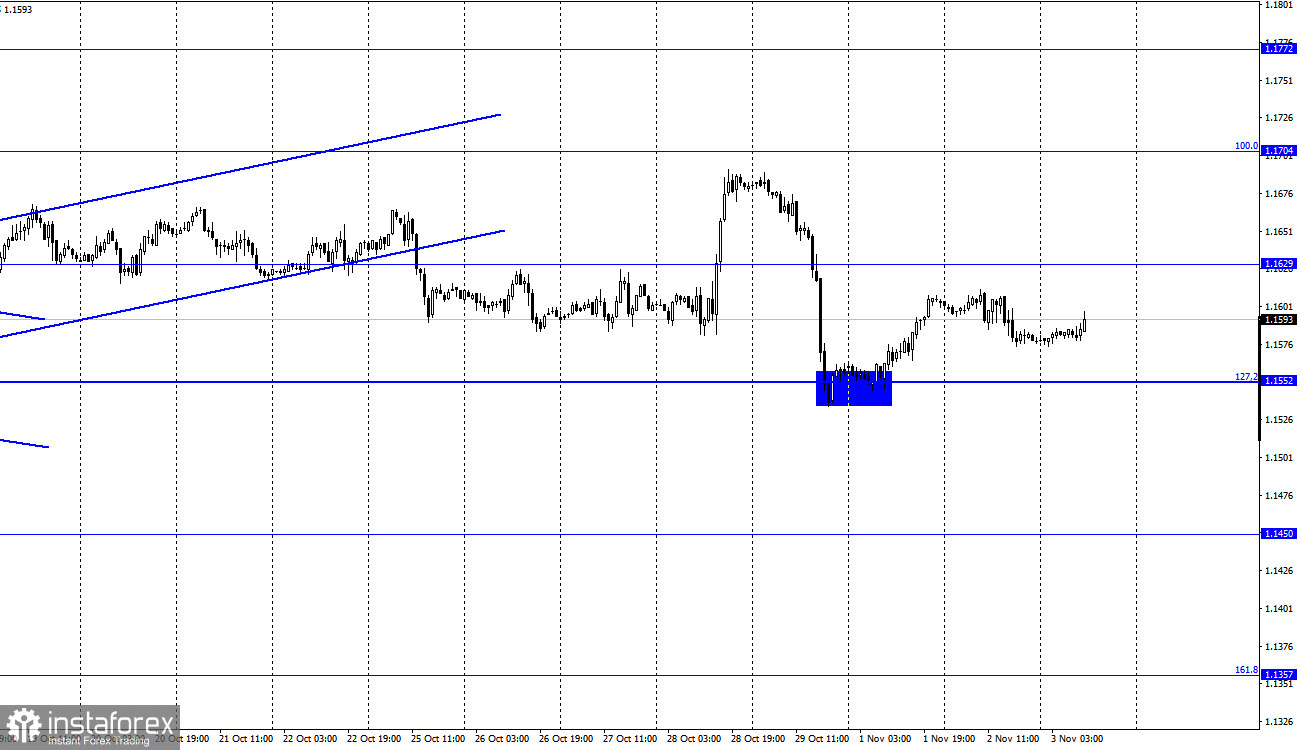

EUR/USD – 1H.

The EUR/USD pair performed a reversal in favor of the US currency on Tuesday and a slight drop in the direction of the corrective level of 127.2% (1.1552). However, this morning, the quotes turned in favor of the euro and resumed the process of growth towards the level of 1.1629. However, in general, all these movements are weak. The information background of yesterday was just as weak. However, today, the calendars of economic events of the European Union and the United States contain quite a large number of important and interesting entries. Everything will start in just a few minutes with a speech by ECB President Christine Lagarde. The probability that Ms. Lagarde will make one or more high-profile statements is not too high. And the probability that traders will track Lagarde's speech at all is even lower. There will be more important events today. And Christine Lagarde already spoke last week, right after the ECB meeting.

Thus, in one week hardly anything has changed dramatically. A few hours after Lagarde's speech, a report on the change in the number of ADP employees in October will be released in the United States. This report is quite interesting, but at the same time very contradictory. To begin with, its value almost never coincides with the value of Nonfarm Payrolls. The ADP report may turn out to be strong, but this does not guarantee that the Nonfarm report will turn out to be strong. And the second report is more important for traders. The same can be said about the ISM index for the US services sector. By itself, this index is considered quite important, but everything will depend on what its value will be. If it does not differ much from the value of the previous month, then it is not worth waiting for the reaction of traders. Well, the most important event of the day and the whole week is the Fed meeting and its results, as well as Jerome Powell's speech at a press conference. Before this event (which will take place in the evening), traders may trade rather reluctantly.

EUR/USD – 4H.

On the 4-hour chart, the quotes closed under the corrective level of 100.0% (1.1606). Thus, the process of the fall in the quotes of the euro can be resumed in the direction of the next Fibo level of 127.2% (1.1404). However, the pair has been spinning around the level of 1.1606 for a long time, and the movements in the last two days of the past week do not fit into the current picture of things. Thus, the level of 1.1606 is not suitable as a benchmark right now. Also today, the information background will be very strong.

News calendar for the USA and the European Union:

EU - unemployment rate (10:00 UTC).

EU - ECB President Christine Lagarde will deliver a speech (10:00 UTC).

US - change in the number of employees from ADP (12:15 UTC).

US - ISM Index of business activity in the service sector (14:00 UTC).

US - FOMC decision on the main interest rate (18:00 UTC).

US - accompanying FOMC statement (18:00 UTC).

US - FOMC press conference (18:30 UTC).

On November 3, the calendars of the European Union and the United States are full of important records and events. The information background can be very strong today.

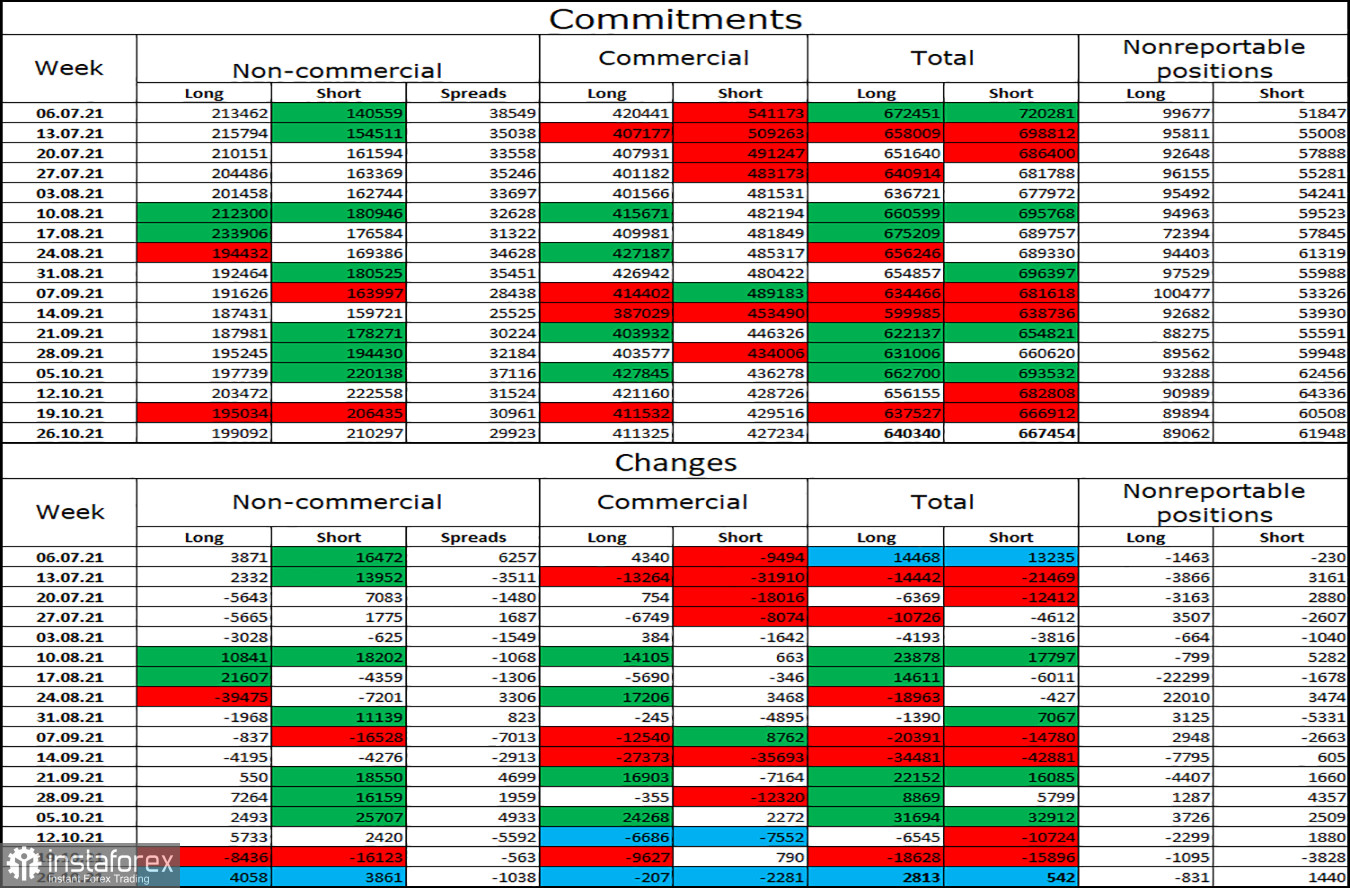

COT (Commitments of Traders) report:

The latest COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders did not change. Speculators opened 4,058 long contracts on the euro and 3,861 short contracts. Thus, the total number of long contracts in the hands of speculators has grown to 199 thousand, and the total number of short contracts - up to 210 thousand. Over the past few months, the "Non-commercial" category of traders has tended to get rid of long contracts on the euro and increase short contracts. Or increase short at a higher rate than long. In general, this process continues now, but in the last three weeks, the European currency has been leaning towards weak growth (if we do not take into account the last day of last week). In general, the fall of the euro still looks more preferable.

EUR/USD forecast and recommendations to traders:

Traders are still not trading the pair too actively, but today everything may change. I recommended buying a pair if a rebound from the 1.1552 level on the hourly chart is performed, with a target of 1.1629. Now, these deals can be kept open. I recommend selling the pair if there is a rebound from the level of 1.1629, with a target of 1.1552. Traders should take into account the information background today.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română