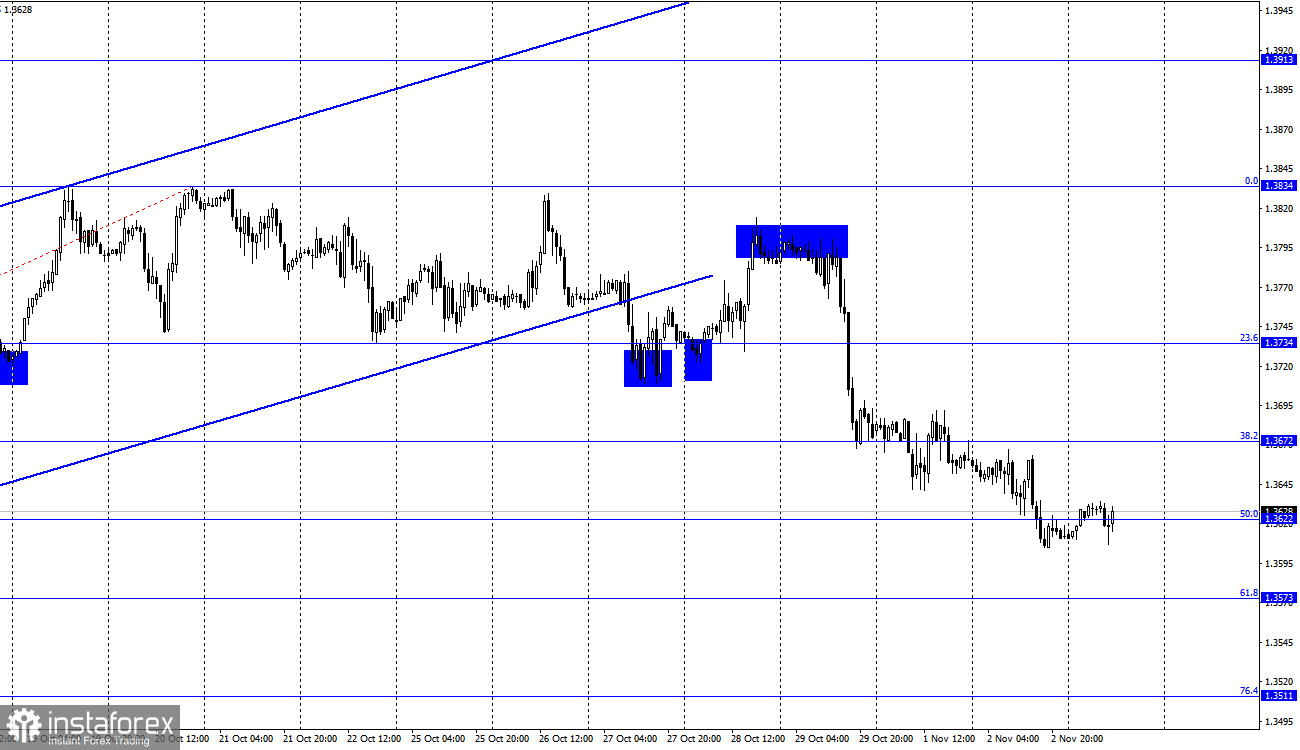

GBP/USD – 1H.

Hi dear traders!

On the 4-hour chart, GBP/USD is consolidating below a 50.0% Fibonacci level that is 1.3622. Thus, the currency pair could continue its decline towards the next Fibonacci level of 61.8% that is 1.3573. The information background for the sterling is going to be dense today. Hence, GBP/USD might reverse its trajectory more than once. The high impact of the Fed's policy meeting cannot be overestimated. Today, the US central bank is widely expected to launch tapering its stimulus programs. If this doesn't happen, the US dollar could fall in response. So, there is a slim chance for the pound sterling to gain bullish momentum in the coming days. The US dollar has been growing for the last 3 days as traders hope that the US Fed will tighten monetary policy. Besides, the UK has been engaged in a new Brexit-related conflict. This time, the Kingdom is in a standoff with France. For some time, London and Paris have been eager to settle the matters in the question about fisheries without entailing tough sanctions. Nevertheless, the sides are still in the gridlock because the UK cannot come to the common denominator with the EU authorities.

These jitters are taking a back seat today as traders are focused on the Fed's policy update. Any delay in tightening monetary policy could trigger sell-offs of the US currency. The Fed's move towards tighter policy has been already priced in. So, traders are not ready to admit another dovish decision or the fact of putting monetary policy on hold. Please beware of extreme volatility tonight! 2 hours before the Fed's announcements, Bank of England Governor Andrew Bailey will deliver a speech. Tomorrow, the Governor will also announce the outcome of the Bank of England policy meeting. Hence, the pound sterling could trade under market turbulence today and tomorrow. The move towards tighter policy in also in the cards with the Bank of England, albeit the chance is smaller in the UK than in the US. If things develop in line with the main scenario, the US dollar will extend strength.

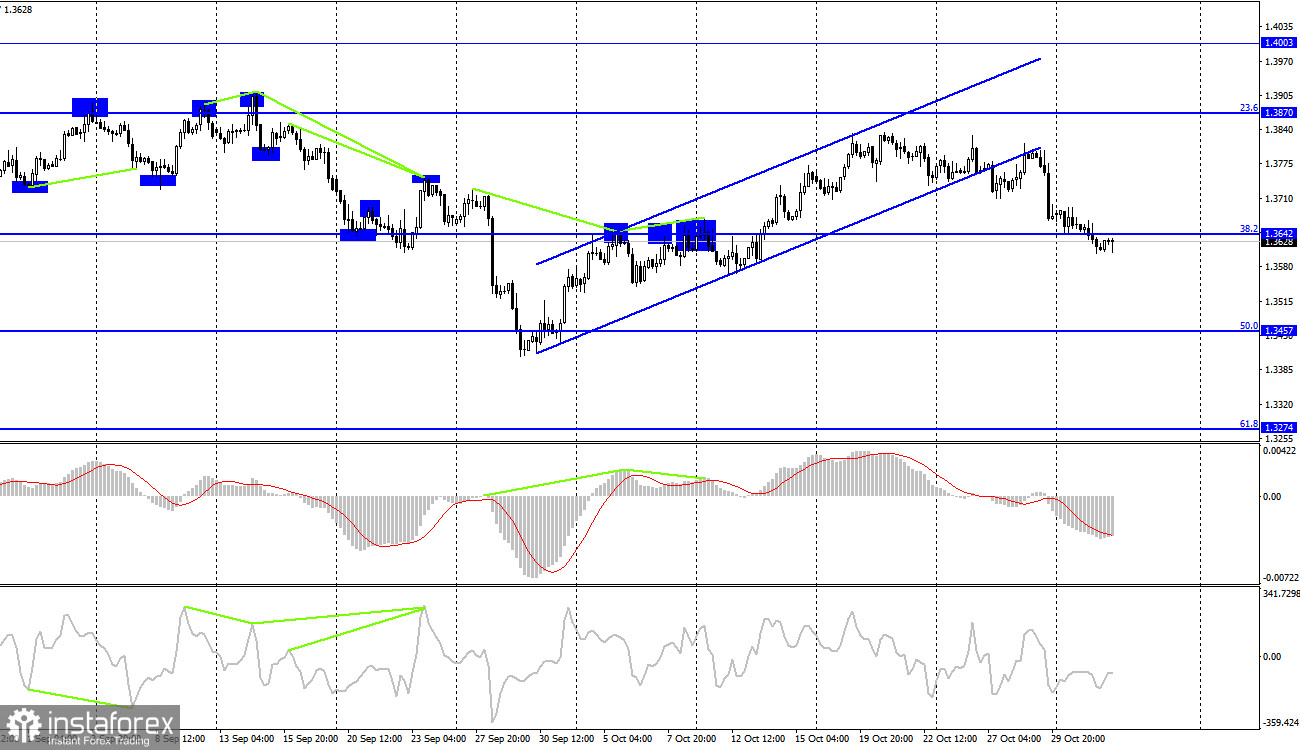

GBP/USD – 4H.

According to the 4-hour chart, GBP/USD consolidated below the bullish trend corridor and below a 38.2% Fibonacci level of 1.3642. It means that the trading instrument might continue its fall towards the next 50.0% Fibonacci level that is 1.3457. None of the indicators is signaling looming divergences today.

Economic calendar for US and UK

UK: services PMI (09-30 UTC)

US: ADP National Employment Report (12-15 UTC)

US: ISM Manufacturing PMI (14-00 UTC)

UK: Bank of England Governor Andrew Bailey speaks (16-00 UTC)

US: FOMC Interest Rate Decision (18-00 UTC)

US: FOMC statement (18-00 UTC)

US: FOMC press conference (18-30 UTC)

On Wednesday, traders got to know the UK services PMI for October. The index is a

bit stronger than expected. Nevertheless, crucial news and reports are ahead

today. The information background is full of newsworthy events for GBP/USD.

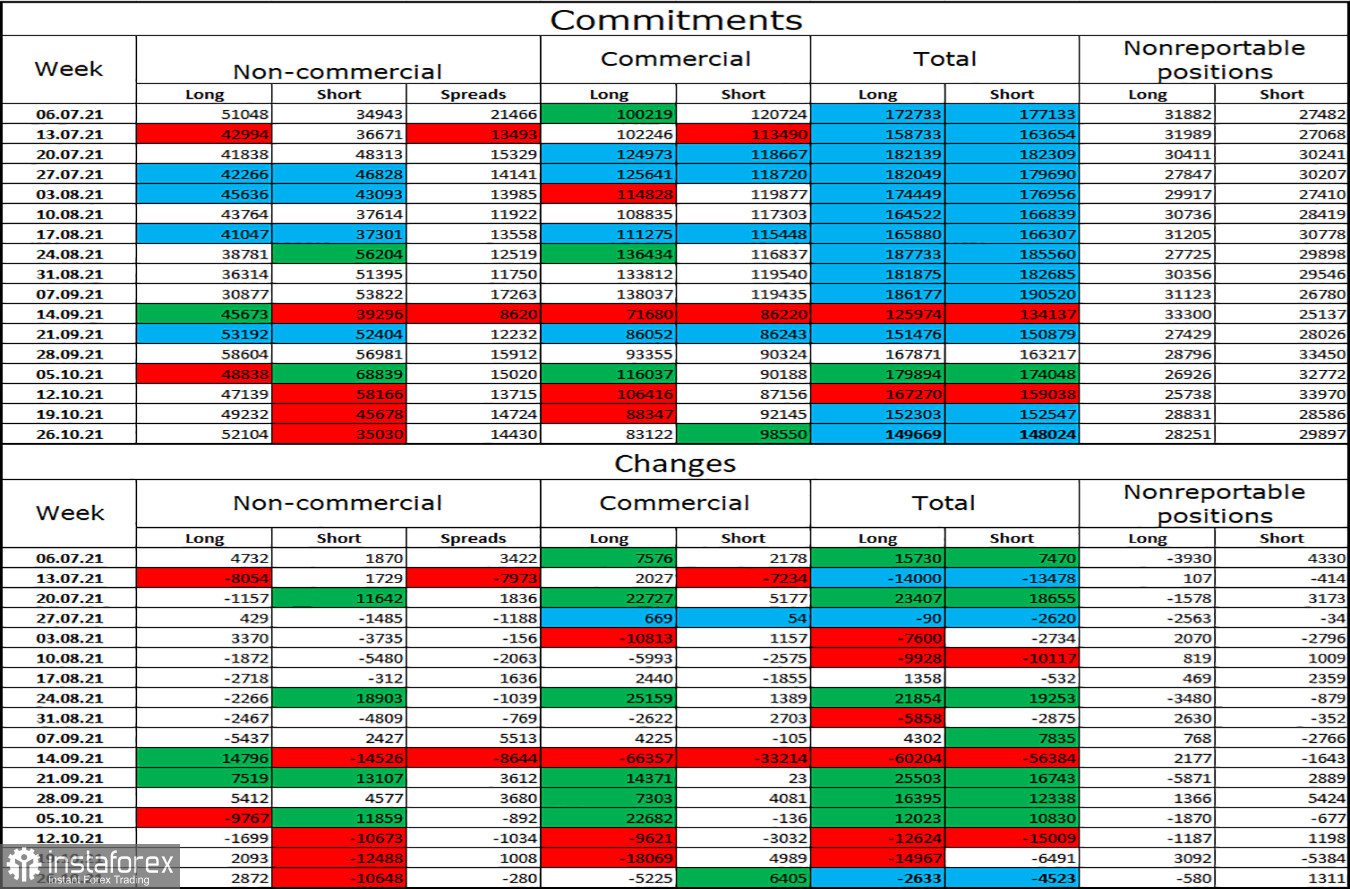

COT report (Commitments of traders):

The last COT report on GBP/USD from October 26 revealed that large market players were getting more bullish. Last week, speculators opened 2,872 long contracts and closed 10,648 short contracts. All in all, the number of long contracts kept by large market players is 17,000 bigger than the number of short contracts. Now we can conclude that market sentiment among non-commercial traders has turned into bullish. At the same time, technical analysis warns about weakness of the pound sterling because two trend corridors have been left.

In the recent weeks, market sentiment on GBP/USD is uncertain. Large market players are going long and then going short. The overall number of long and short contracts for all categories of traders is roughly the same. Traders were increasing long positions for 4 weeks in a row. Now the time could be right to go short on GBP/USD.

Outlook for GBP/USD and trading tips

I would recommend buying GBP/USD on condition that the pair closes above a 38.2% Fibonacci level (1.3642) on the 4-hour chart. The target could be set at 1.3722. The selling strategy would be recommended in case the pair closes below 1.3642 on the 4-hour chart with targets at 1.3622 and 1.3573. Now we can keep sell positions open. Please don't forget about a batch of significant news later today that is sure to influence the currency pair. Terms

The Non-commercial category includes major market players: banks, hedge funds, investment funds, private, and large investors.

The Commercial category embraces commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain speculative profit, but to ensure current activities or export-import operations.

The category of Non-reportable positions means small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română