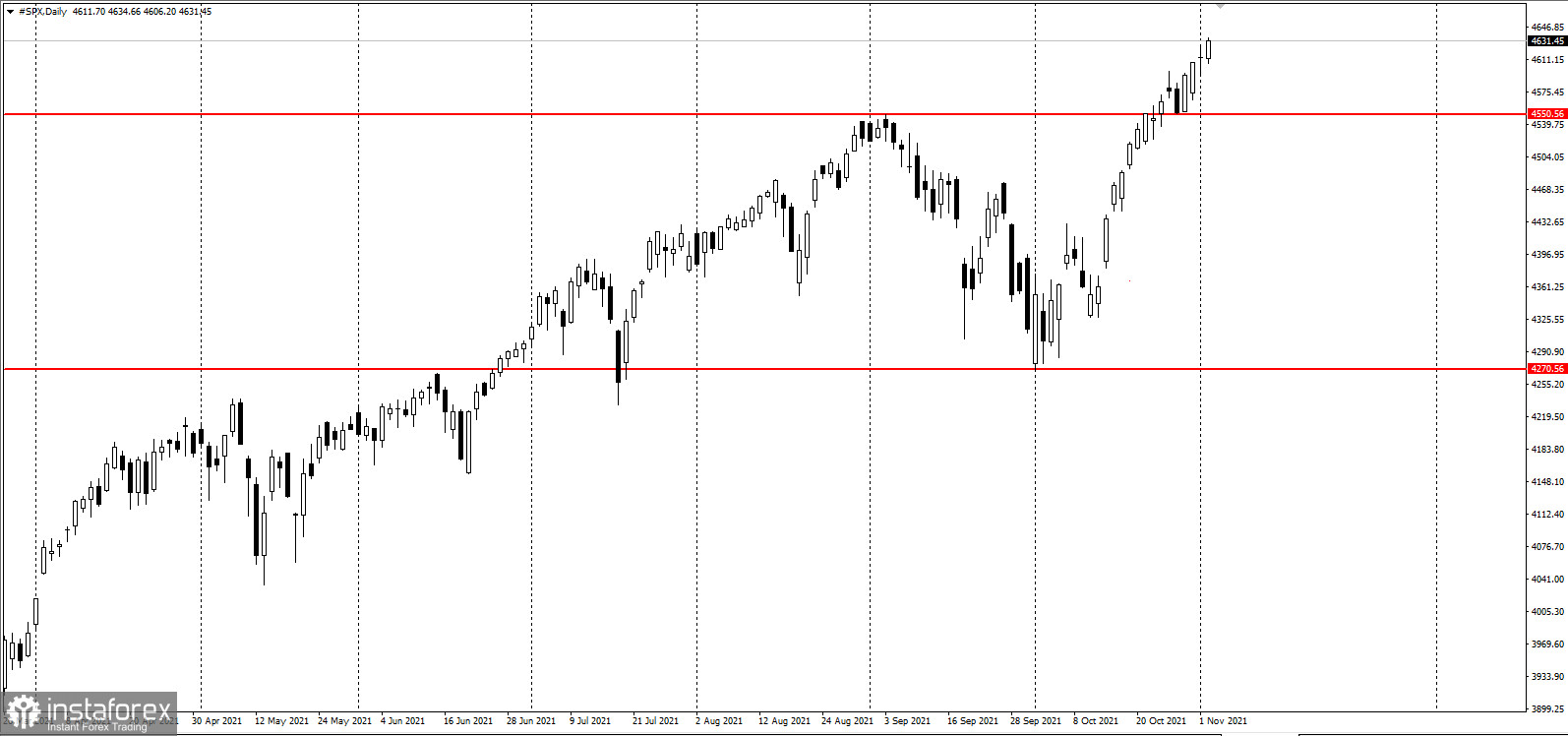

US stocks broke records on Tuesday, continuing the rally that has been going on in the past four days. The main reason was strong corporate earnings despite very high commodity prices and supply chain disruptions.

That being said, no matter what the Fed says or does this week, there is a high chance that the US will have comparatively low rates, which bodes well for stocks.

"While the upside for equities might be slowing versus what we had seen over the course of the last 18 months, the reality is still that there's a solid base for risk assets to continue to perform well," said Ian Lyngen of BMO Capital Markets.

Two-year Treasury yields have also joined the global cut in short-term rates, triggered by the slightly dovish statements of the Reserve Bank of Australia.

Meanwhile, the Fed is expected to taper bond purchases soon and raise interest rates by next year or early 2023.

Win Thin of Brown Brothers Harriman said: "The Fed has managed expectations perfectly in terms of preparing the markets for what is likely to be speed tapering. Most officials seem to agree that it's better to get tapering over as quickly as possible in order to leave the Fed maximum flexibility to hike rates when needed."

Other key events for this week are:

- policy decision of the Federal Reserve, data on US orders and durable goods (Wednesday);

- OPEC meeting (Thursday);

- policy decision of the Bank of England (Thursday);

- data on US trade and jobless claims (Thursday);

- data on US employment (Friday).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română