A momentous event is taking place in the United States. Today, the markets are awaiting the Fed interest rate decision, the explanatory memorandum and Powell's press conference. The key interest rate will remain unchanged. Markets widely expect that the Central Bank will officially announce the reduction of the quantitative easing program. The process may start as early as November and be completed by mid-2022.

The regulator's view of the future is of key importance, i.e. the assessment of monetary policy prospects concerning the COVID-19 pandemic. Investors will be monitoring the comments to adjust their predictions about the first policy tightening. These changes have the potential to dramatically shift the balance of power in the markets.

The question is how hawkish Jerome Powell's speech will be and whether he will continue to stand his ground. Meanwhile, the issue of acceleration and duration of inflation is becoming more apparent and threatening. Friday's Core PCE data rattled the markets. Currently, there is no trust in the Fed's view that the excessive rise in inflation is temporary. Major investment banks have started to openly discuss an anticipated first rate hike in the middle of next year, that is, immediately after the end of the stimulus cut.

In any case, there are three significant principles that the Fed is focused on. These are inflation, the labor market and the state of the nation's economy. Previously, the Central Bank noted that it was monitoring incoming information and was ready to adjust monetary policy in accordance with new data.

Inflation

The Fed members have repeatedly stated that the regulator will target an inflation rate to be above 2% for a while. Then it will reach 2%. Besides, long-term inflation expectations should be fixed at 2% at that time.

The 2% annual inflation threshold was exceeded in May. Inflation expectations for the next 5 years are about 2.1% per year, while in May it was stated to be about 2.4%. What is actual reading? Consumer inflation jumped from 5.3% to 5.4% per annum in September.

Labor market

It is one of the Fed's main focus areas. Nonfarm payrolls rose by 194,000 in September, they went up 366,000 in August. The unemployment rate was 5.2% in the last summer month, dropping to 4.8% in September. Before the COVID-19 pandemic the rate varied within 4%. However, in April amid the COVID-19 crisis, the unemployment rate jumped to 14.8%, having updated the all-time high since 1940.

Since May, the reading has gradually begun to adjust. According to the June FOMC forecast, the unemployment rate will total 4.8% at the end of this year.

Economy

Vaccination and fiscal stimulus were highly effective as the indicators of economic activity and employment started to improve. The sectors most affected by the COVID-19 crisis have begun to recover. However, there is considerable risk of new waves of the COVID-19 pandemic. Besides, the Delta variant has slowed the economic recovery. GDP grew only by 2% in the third quarter compared to a 6.7% increase in the second quarter. There should be a recovery in the fourth quarter, at least that is the forecast from the Atlanta Fed's GDPNow service. The economy is expected to rise by 6.6%.

Monetary policy

The basic scenario assumes the QE program tapering by mid-2022. However, force majeure is possible. In this case, the reduction process could last for a year or a year and a half if the economic recovery slows down and markets fall. There have been cases in the Fed's practice when the process opposite to tapering has occurred.

Increased market volatility is possible today. The Fed's guidelines on monetary stimulus tapering will produce a negative effect on the stock market and a positive effect on the US dollar.

US dollar

The greenback is likely to get a strong boost to growth. If the Fed decides to cut the program at once, the dollar will be supported by buyers in the coming weeks. The index of the US currency is able to increase to 97,50 before the end of the year. The euro will be hit the most as the ECB will not start to raise interest rates in 2022 as it is expected by markets.

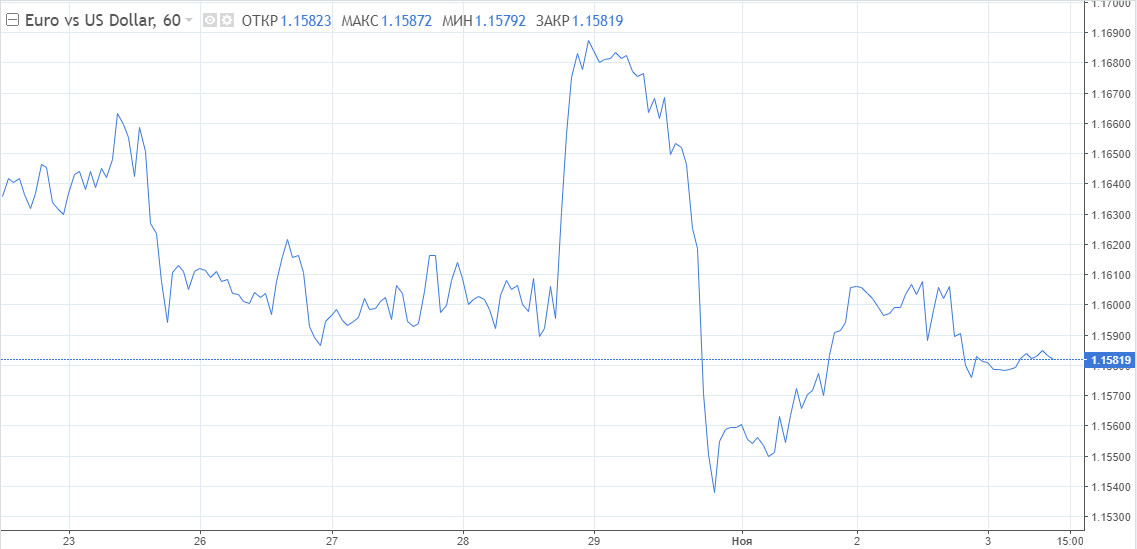

The EUR/USD pair is at risk of falling into the area of 1.12 over the next two months. According to Danske Bank, next year the euro could drop to 1.1000 due to the ECB's lack of confidence.

The currencies of developing countries could be hit badly. At the same time, curtailment of carry trade, fixation of profits from the previous growth and capital outflow to the dollar assets is possible.

However, a strong dollar is unprofitable for the US exporters, which means that the greenback's significant and steady rise is out of the question. The pair EUR/USD will likely return to the area of 1.1400-1.1300.

As for the short-term outlook, the growth of quotations is limited. Sellers of the euro will have more chances in case of breaking the annual low of 1.1520. Besides, the buyers' mood will strengthen above 1.1670.

Support is at the levels of 1.1520, 1.1470 and 1.1430. Resistance is at 1.1615, 1.1670 and 1.1710.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română