EUR/USD

Analysis:

The direction of the euro trend in the main pair since the beginning of June is set by the descending wave algorithm. By the current day, the structure of this wave looks complete. The price has reached the lower limit of the support zone of a large TF. The ascending section from October 29 has a reversal potential and may be the beginning of a counter wave.

Forecast:

A flat is expected on the pair's market today. After the probable pressure on the resistance zone, you can expect a reversal and a decrease in the price to the support area.

Potential reversal zones

Resistance:

- 1.1610/1.1640

Support:

- 1.1540/1.1510

Recommendations:

Trading on the euro market today is more risky and can become unprofitable. Short-term fractional lot sales are possible from the resistance zone.

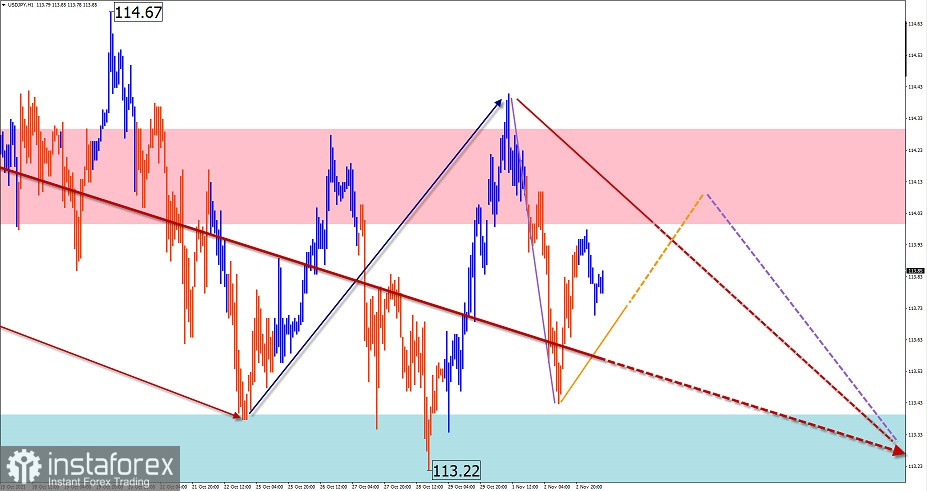

USD/JPY

Analysis:

Since the beginning of this year, the direction of the price trend of the Japanese yen has been setting an upward momentum. Since the beginning of last month, the pair's price has been within the boundaries of strong resistance, forming a flat correction.

Forecast:

In the next day, the general sideways course is expected to continue within the boundaries of the formed price corridor. In the first half of the day, a price rise to the resistance zone is more likely. The descending vector can be expected by the end of the day.

Potential reversal zones

Resistance:

- 114.00/114.30

Support:

- 113.40/113.10

Recommendations:

Trading on the Japanese yen market today is possible only within the intraday. Transactions in small lots from the boundaries of the price channel are safer.

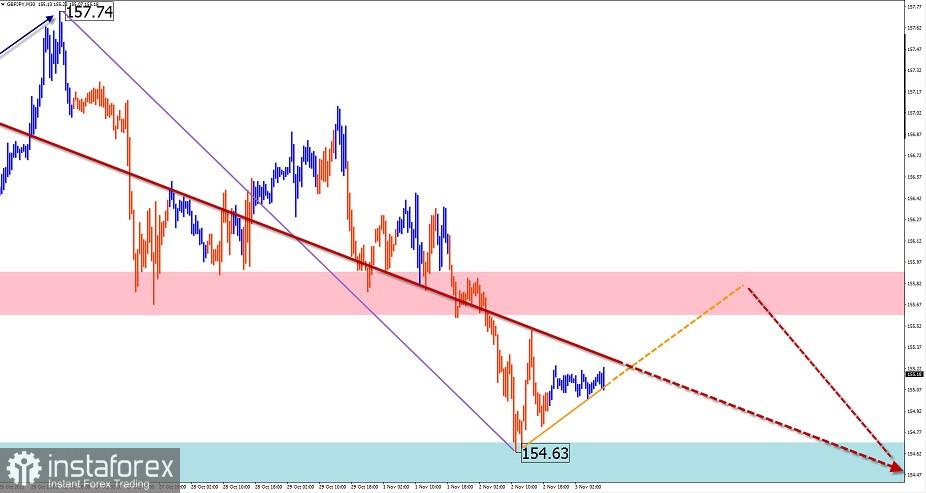

GBP/JPY

Analysis:

The pound/yen pair's market has been dominated by an upward trend over the past year and a half. The unfinished section of the main course counts down from July 19. Since October 20, the pair's quotes have been adjusted downwards.

Forecast:

Today, the price of the pair is expected to move between the nearest oncoming zones. An upward course is likely in the European session. In the area of the resistance zone, a reversal is expected to form and the price will start moving down.

Potential reversal zones

Resistance:

- 155.60/155.90

Support:

- 154.70/154.40

Recommendations:

Trading on the pair's market today is optimal in the form of short-term "pipsing" transactions. Sales from the resistance zone are more promising.

GOLD

Analysis:

Since August last year, a complex wave structure has been forming on the gold chart, most of all resembling a shifting plane. The last wave section is ascending, from August 9. As part of its final part (C), a flat pullback has been forming in the last three weeks.

Forecast:

Today, the movement of the gold price is expected in a narrow price corridor, in the form of a flat. In the first half of the day, you can expect a downward course. At the end of the day or tomorrow, a reversal and a rise in the price to the resistance zone are likely.

Potential reversal zones

Resistance:

- 1795.0/1800.0

Support:

- 1770.0/1765.0

Recommendations:

Selling on the gold market is quite risky and is not recommended. The main attention is proposed to be paid to the search for buy signals in the area of settlement support.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted one shows the expected movements.

Attention: The wave algorithm does not take into account the duration of the movements of the instrument in time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română