On the eve of the Fed meeting on monetary policy, the stock market in the US and Europe received support on the next wave of corporate reporting. Moreover, the three stock indexes in the United States updated their local highs again.

The topic of the Fed's likely announcement of a decision to start reducing the volume of asset repurchases – corporate mortgage securities and government bonds, continues to be discussed on the market. It is believed that the regulator will still decide to start the process of reducing the volume of asset repurchases with further targeting the start of the cycle of interest rate increases. However, investors are concerned about the firmness of the Central Bank's decision, whether it will back down if inflationary pressure weakens, and the situation on the labor market remains extremely difficult.

We believe that the extreme degree of both an optimistic and pessimistic view of this event has its own problems. For example, there will be an indisputable and final decision that the incentive program will be terminated by the middle of next year, and then, after its completion, the key interest rate will be raised for the first time from virtually zero. In this case, the markets will react with the beginning of a correction in the stock markets and strengthening of the US dollar, and as a result, raw materials and commodity assets will begin to experience strong pressure from the US dollar's strength.

Another option is also possible: the regulator will simply back down, blaming its decision on compelling reasons, for example, the weakness of the labor market and the slowdown in inflation, as well as the need for a gradual reduction in incentives, which may end only by the end of next year. This will clearly push back the first interest rate hike to 2023. Moreover, J. Powell will motivate this at his press conference by a drop in the growth rate of the national economy and the need for a smooth transition from a super-soft monetary rate to a tougher one. In this case, we can expect another surge in demand for the company's shares with a corresponding increase in stock indices not only in the United States but throughout the world. The US dollar will be under pressure

All these are extreme options for the likely development of events. We believe that the Fed will most likely take a neutral position. He will try to somehow soften the regulator's start to change monetary policy. Powell can inform that the bank will act based on the circumstances of the development of events. This alone will be enough for the US stock indices to rush to their maximum values again today, but at the same time, the dollar exchange rate will maintain an uncertain sideways movement in the dynamics of the ICE index. The lack of strict specifics of the Fed will lead to an increase in the uncertainty factor with subsequent ambiguous processes in the financial markets.

Forecast of the day:

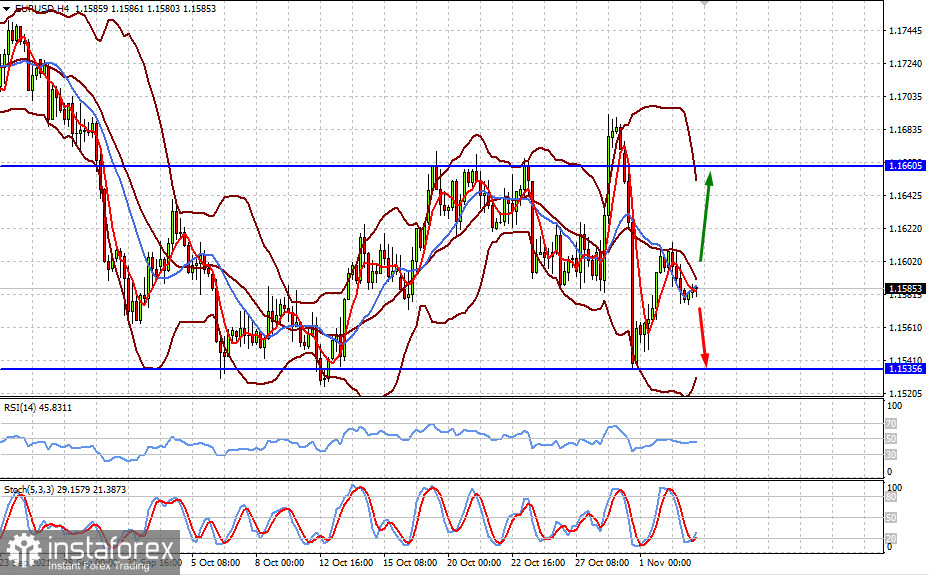

The EUR/USD pair's forecast remains the same. It remains in the range of 1.1535-1.1660 before the Fed meeting and may receive support after the meeting and Powell's press conference amid a mild statement by the Central Bank. In this case, the pair is likely to rise to the level of 1.1660. On the contrary, a strong statement will push the pair down to 1.1535. If the Fed Chairman announces the bank's desire to act according to the circumstances, the pair will continue to consolidate already in anticipation of employment data from the US Department of Labor.

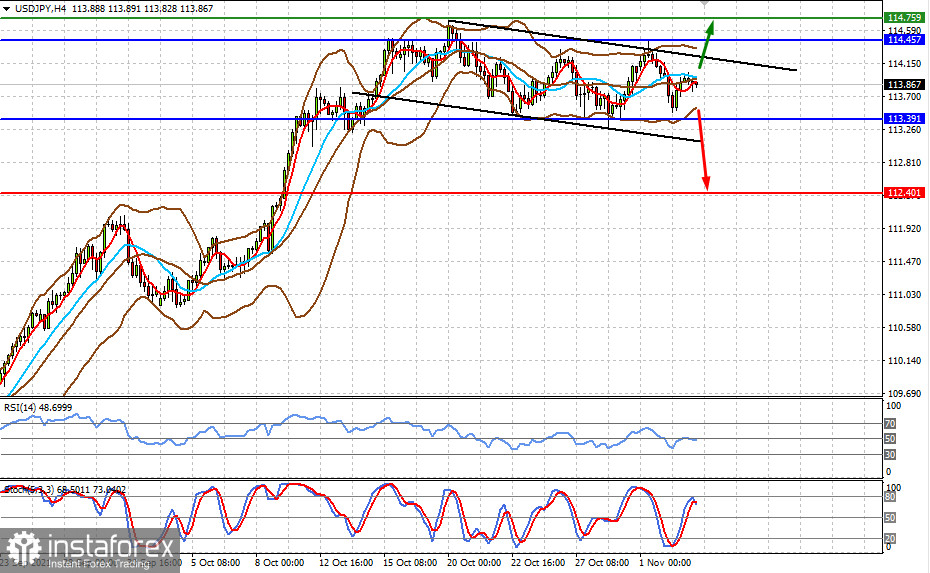

The USD/JPY pair is consolidating in the range 113.40-114.45. Positive news for the US dollar will allow the pair to rise to the level of 114.75, while negative news will lead it to 112.40. Significant movements in the pair can only be expected in the case of a strong statement from the Fed and Powell, and data on the number of new jobs from the ADP.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română