The underlying PCE deflator in the US rose 0.2% mom in September, which is in line with forecasts. In addition, the annual growth was 3.3%, the lowest since March. The slight decline allowed us to slightly reduce the intensity of inflation expectations, but the respite is unlikely to last long – the employment cost index increased to 1.3%, which is above the forecast of 0.9%. This is the largest quarterly growth in 31 years, reflecting the fastest growth in wages since 1982.

Meanwhile, the completion of COVID-19 additional payments on unemployment benefits may finally increase the supply of labor, if this happens, the pressure on wages may decrease, which, in turn, will cool inflation expectations, but if this does not happen, the problems with the US labor market will be regarded by the market as chronic, which may force the Fed to start raising rates sooner rather than later. Accordingly, the two central events of the week, particularly the FOMC meeting on Wednesday and Nonfarm data on Friday, will be able to dramatically change the market positioning for the US dollar and bring the currency markets out of balance if they differ in any way from market expectations.

The CFTC report published on Friday contains rather contradictory markers of the development of the situation in the currency market. On the one hand, there is an obvious increase in interest in risky assets. All commodity currencies (CAD, AUD, NZD, and even GBP) have improved their performance by forming or increasing long positions, which indicates an increase in interest in risk. On the other hand, with the simultaneous sale of CHF and JPY, the long position on gold increased by 4.26 billion. This is quite a lot.

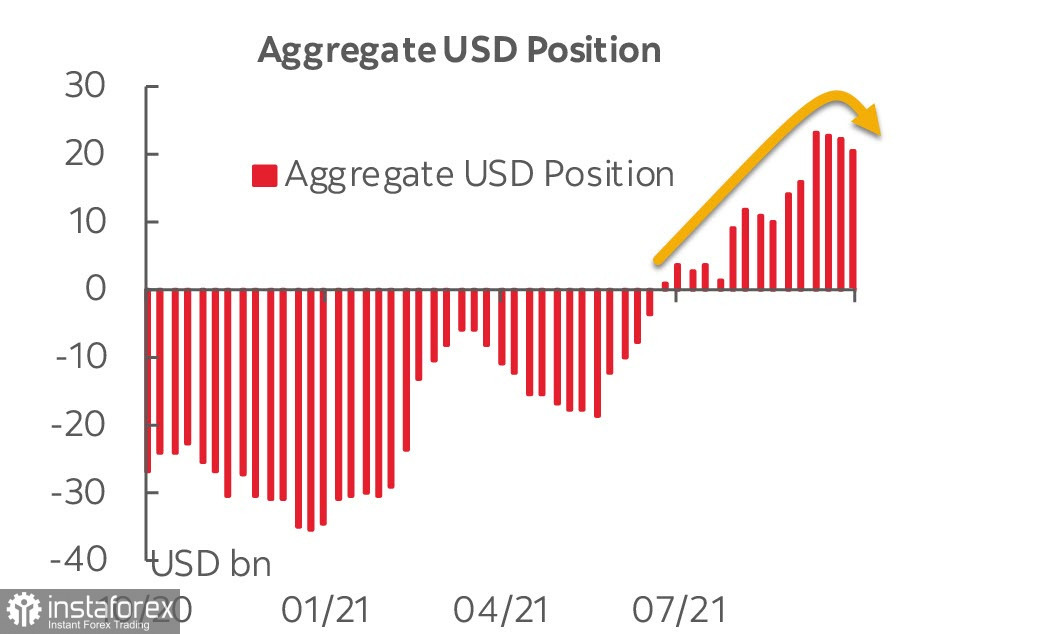

Oil is also in the positive zone. It is possible that the growth of gold and oil indicates that the US dollar is ready for further sales. The dollar's cumulative long position has been collapsing for the third week in a row, this time by 1.783 billion. The decline is not large-scale, so it is too early to talk about a full-fledged reversal of the US dollar towards sales.

It is assumed that the decline in demand for the US dollar is short-term and will not last long. Therefore, strong movements should not be expected before the FOMC meeting.

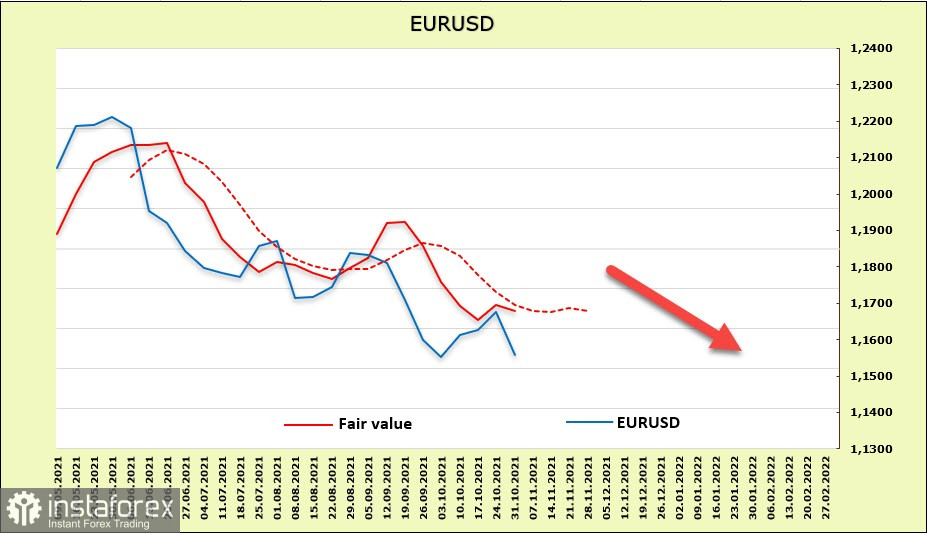

EUR/USD

The euro sharply fell at Friday's closing after its failed attempt to rise amid Lagarde's uncertain comments following the ECB meeting. Taking into account that speculators have not yet resumed buying the euro, there is currently no driver for the continuation of the euro's growth, neither economic nor political reasons are conducive to purchases. The target price is still below the long-term average, and there are no signs of a reversal.

There might be no strong movements before the Fed meeting, but we must proceed from the fact that any hint towards the need to respond to rising inflation following the results of Wednesday's meeting can be used by the markets to resume dollar purchases, and the nearest target of 1.15 will be reached by the end of the week.

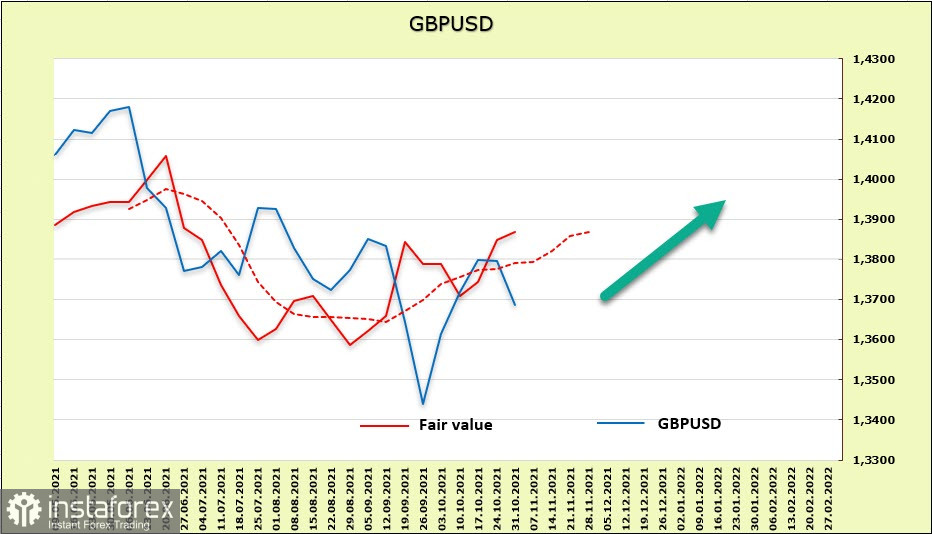

GBP/USD

The pound's net long position rose by 1.147 billion during the reporting week, reaching 1.287 billion. The advantage cannot be said to be significant, but it seems that traders have decided on the future of the pound and expect it to grow.

It is possible that we are seeing expectations about the expected actions of the Bank of England, which will hold a meeting on Thursday. At the moment, there are expectations that the BoC will raise the rate by 0.15%, which is quite a bit to worsen financial conditions but maybe enough to show determination in the fight against rising inflation.

So far, everything indicates that GBP/USD pair will continue to grow after a short correction. The pullback from the October high of 1.3833 has now reached the support of 1.3670, which is 38% of the October growth. Perhaps, a support will be found for the continuation of growth. The next resistance is 1.3620, but a movement towards it looks unlikely. We expect the pound to resume growth towards the nearest target of 1.3910/30, then 1.3980/4000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română