Euro parity still in play ahead of decisive US inflation data, for that common currency came within whisker of $1 this week. Right now, the EUR/USD pair is still moving around the price of 1.0030.

The currency pair EUR/USD is trading below the resistance levels of 1.0125 and 1.0098. The euro to US dollar (EUR/USD) rate has fallen about 1% month-to-date to trade around 1.0030. The decline is comparable to losses last seen for two weeks, when the European Central Bank unleashed its massive stimulus programme.

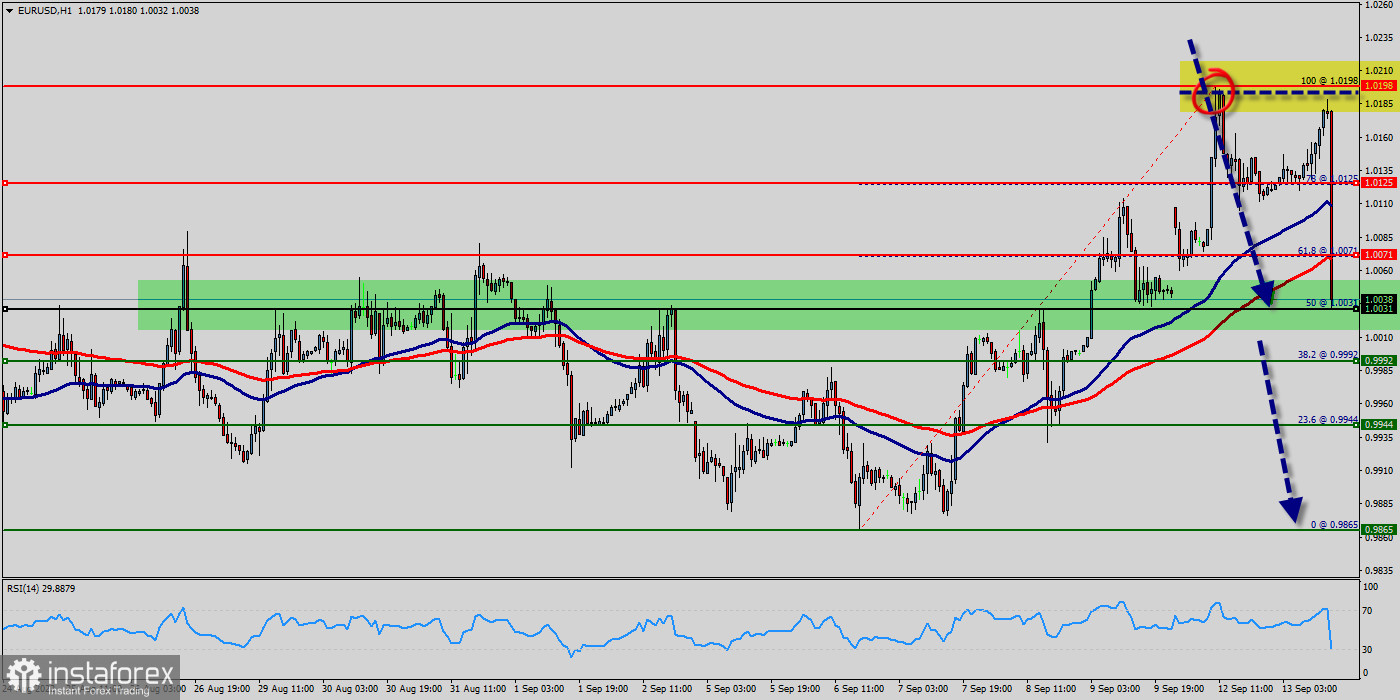

The EUR/USD pair is expected to trade around the spot of 1.0125 and 1.0098 by the end of this month, according to trading economics global macro models and our expectations. Looking forward, we estimate it to trade at 1.0030 in September.

From a technical perspective, the overnight swing low, around the 1.0030 area, now seems to act as a pivotal point, below which spot prices could extend the fall towards the $1 mark. Some follow-through selling would make the EUR/USD pair vulnerable to challenging the valence mark in the near term.

The EUR/USD pair continues to move downwards from the level of 1.0099, which represents the double top in the M30 chart. Yesterday, the pair dropped from the level of 1.0099 to the bottom around 0.9953.

Today, the first resistance level is seen at 1.0125 followed by 1.0098, while daily support is seen at the levels of 0.9992 and 0.9944. According to the previous events, the EUR/USD pair is still trading between the levels of 1.0030 and 0.9900. Hence, we expect a range of 130 pips in coming hours (1.0030 - 0.9900) .

The first resistance stands at the price of 1.0098, therefore if the EUR/USD pair fails to break through the resistance level of 1.0098, the market will decline further to 1 USD.

This would suggest a bearish market because the RSI indicator is still in a negative area and does not show any trend-reversal signs.

The pair is expected to drop lower towards at least 0.9992 in order to test the second support (0.9944). The US Dollar and the Euro are two of the most prominent and well-known currencies in the world.

The Euro versus US Dollar (EUR/USD) currency pair has the largest global trading volume, meaning it is the world's most-traded currency pair. Whether you find the instrument easy or difficult to trade on, it's not a pair that many traders neglect, due to its daily volatility and price movement.

We had already shared in our previous topic that the psychological price sets at the level of 1 USD. The EUR/USD weekly forecast is mildly tilted towards the downside as the pair failed to sustain above the 1.0125 area after several attempts. The EUR/USD pair weekly forecast is mildly tilted towards the downside as the pair failed to sustain above the 1.0125 area after several attempts.

Conclusion :

Downtrend scenario :

On the downside, the 1.0125 level represents resistance. The next major resistance is located near the 1.0030 , which the price may drift below towards the 1.0030 resistance region. The breakdown of 1 USD will allow the pair to go further down to the prices of 0.9992 and 0.9944.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română