To open long positions on GBP/USD, you need:

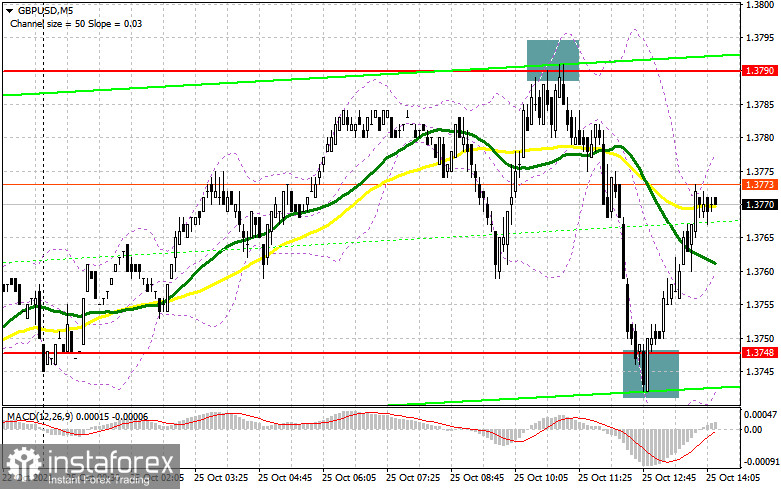

In the first half of the day, one signal was formed for the passage and one signal for the purchase of the British pound. Let's look at the 5-minute chart and analyze the entry points. The formation of a false breakdown at the level of 1.3790 at the beginning of the European session led to an excellent entry point into short positions, which dumped the British pound by 40 points. Then, by analogy with Friday, the formation of a false breakdown at the level of 1.3748, which I paid attention to in the morning forecast, led to a good entry point into long positions. As a result, at the time of writing, the upward movement was about 25 points, and the bulls had every chance of updating the middle of the channel around 1.3748.

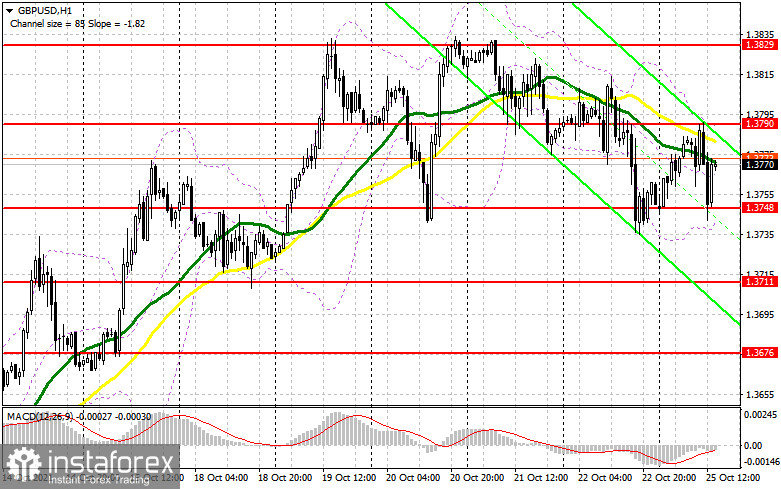

Given that important fundamental data is not waiting for us today during the American session, it is best to trade in a side channel. The primary task of the bulls remains to protect the important support of 1.3748, which they coped with perfectly in the first half of the day. A fairly large number of buyers' stop orders may be concentrated below 1.3748. Only another formation of a false breakdown in the afternoon at this level will lead to the formation of a good entry point into long positions. The goal will be a breakthrough of 1.3790, which was not achieved during the European session. Only a reverse test of this level from top to bottom will give you a new entry point and get to new local highs: 1.3829 and 1.3864, where I recommend fixing the profits. The 1.3910 area remains a longer-range target. In the scenario of the absence of active actions on the bulls in the area of 1.3748, the best option to buy the pound will be a test of the next support of 1.3711. However, I advise you to open long positions there only after a false breakdown. You can watch the GBP/USD purchases immediately for a rebound only from the minimum of 1.3676, or even lower - from the support of 1.3632, counting on a correction of 25-30 points within a day.

To open short positions on GBP/USD, you need:

Sellers have a real chance to end the bullish trend. To do this, you need to fail the level of 1.3748, which you were unable to do the first time. Only a reverse test from the bottom up of this area will form a signal to open new short positions in the expectation of a decline in the pair already by 1.3711, and there you can reach the support of 1.3676. A more distant target will be the 1.3632 area, which will finally finish off buyers. I recommend fixing profits there. If the pair recovers in the afternoon, I advise you to wait for the formation of a false breakdown, as it was at the beginning of the European session in the resistance area of 1.3790, and only then open short positions. I advise selling the pound immediately for a rebound from a larger resistance of 1.3829, or even higher - from a maximum of 1.3864, counting the pair's rebound down by 20-25 points inside the day.

The COT reports (Commitment of Traders) for October 12 recorded a reduction in short and long positions. However, the former turned out to be more, which led to a slight recovery of the negative net position. Despite the bears' relatively active attempts at the beginning of that week to resist the bullish trend, buyers turned out to be stronger, which led to a further increase in the pound against the US dollar. The reduction of several problems with disruptions in supply chains, which shook the pound earlier this month, is now gradually returning to the market players betting on further strengthening of risky assets. Constant speeches and statements by the Bank of England representatives that it is necessary to take inflationary pressure more seriously also add confidence to buyers of the pound. The central bank's meeting minutes last week confirmed the regulator's intentions to take seriously the option of raising interest rates already during the November meeting – a bullish signal for GBP/USD. Therefore, the only problem that stands in the way of buyers of the pound is the US Federal Reserve System. Although they will not raise interest rates, they are also heading for a tightening of monetary policy. However, the British pound looks much more preferable in these conditions. The COT report indicates that long non-commercial positions decreased from the level of 48,137 to the level of 46,794.

In contrast, short non-commercial positions dropped from the level of 68,155 to the level of 58,773, which led to a partial reduction in the advantage of sellers over buyers. As a result, the non-commercial net position was - 11,979 against -20,018. The closing price of GBP/USD remained almost unchanged at the end of the week: 1.3591 against 1.3606.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 daily moving averages, which indicates the bears' attempts to continue the downward correction.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break of the lower limit of the indicator in the area of 1.3735 will lead to a major drop in the pair. A break of the upper limit in the area of 1.3790 will lead to a new wave of growth.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română