To open long positions on EURUSD, you need:

In the morning, one signal was formed for the purchase of the euro. Let's look at the 5-minute chart and analyze the entry point. In my morning forecast, I paid attention to the 1.1643 level and advised them to make decisions from it. Even before publication data from the IFO Institute for Germany, euro buyers managed to protect 1.1643 and formed an excellent buy signal from there. The growth was about 20 points, but then the data came out, which turned out to be worse than economists' forecasts, which returned pressure on the pair. The breakthrough of 1.1643 passed without a reverse test from the bottom up of this level, so it was not possible to wait for a good entry point into short positions. Currently, trading is conducted around the level of 1.1618, and another signal may be formed there in the near future to enter long positions.

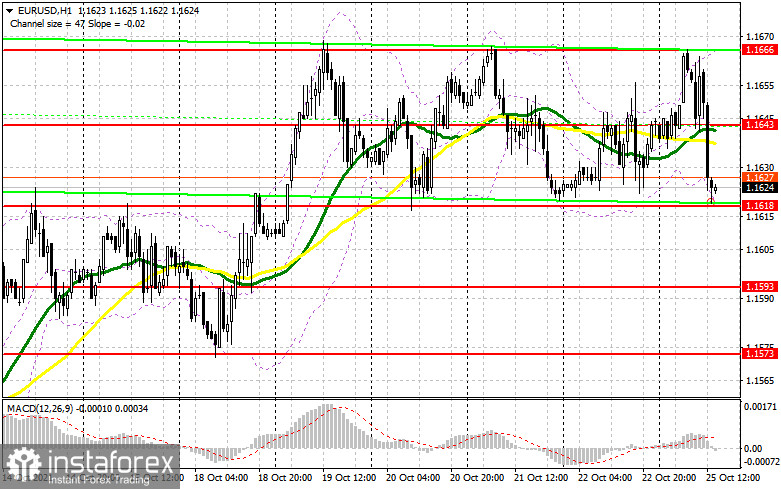

There are no important fundamental statistics during the American session, so the bulls may be able to protect the support of 1.1618. The formation of a false breakdown there forms a good entry point into long positions. If there is no activity of buyers at this level, I advise you to postpone purchases to the area of 1.1593, or even lower - to the minimum of 1.1573, where you can count on a rebound of 15-20 points. An equally important task for buyers will be to regain control over the middle of the channel. Only a breakthrough and consolidation above 1.1643 and its reverse test from top to bottom form a signal to buy the euro, which will allow us to see a recovery to the upper limit of the channel - 1.1666. Only a breakthrough in this area will indicate the continuation of the bullish scenario in the pair observed since the middle of this month. The 1.1666 test from top to bottom will open a direct road to the area of the 17th figure, where I recommend fixing the profits. The 1.1716 area remains a longer-range target.

To open short positions on EURUSD, you need:

Sellers managed to return 1.1643 and expect the pair to continue its downward correction. While trading will be conducted below this range, you can wait for the euro to fall. Any additional formation of a false breakdown at 1.1643 will go into the "piggy bank" of traders betting on a decline in the euro. An equally important goal of the bears will be to break through the lower boundary of the 1.1618 side channel, near which trading is currently underway. Only a test of this level from the bottom up will lead to the formation of a new signal to open short positions and demolish buyers' stop orders located below. It will quickly dump EUR/USD to 1.1593 and open a direct road to 1.1573, where I recommend fixing the profits. A more distant target will be the 1.1542 area. A test of this range will mean a resumption of the bear market for the euro. In the scenario of the absence of sellers at the level of 1.1643, it is best to postpone sales to the upper limit of the channel 1.1666 and open short positions immediately for a rebound based on a downward correction of 15-20 points from a larger maximum of 1.1691.

The COT report (Commitment of Traders) for October 12 recorded an increase in short and long positions. However, the former turned out to be more, which slightly reduced the negative delta. Political problems in the United States of America have been resolved. The latest fundamental reports do not cease to please traders, which indicates that the US economy continues to recover at a good pace. The fact that the Federal Reserve is already seriously considering curtailing the bond purchase program is no longer news that could help dollar buyers at the moment. But the fact that representatives of the European Central Bank began to express concern about the rate of inflation growth, even if not in the same form as colleagues from the Fed - all this allows the European currency to begin to win back positions gradually. This trend may continue in the future, especially in the case of strong statistics on the European economy. However, the larger medium-term demand for risky assets will remain limited due to the wait-and-see attitude of the European Central Bank. The COT report indicates that long non-profit positions rose from the level of 196,819 to 202,512, while short non-profit positions jumped from the level of 219,153 to the level of 220,910. At the end of the week, the total non-commercial net position increased slightly and amounted to -18,398 against -22,334. The weekly closing price dropped to 1.1553 against 1.1616.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 daily moving averages, which indicates a slight advantage of the euro sellers.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A breakthrough of the lower limit of the indicator in the area of 1.1618 will lead to an instant fall of the pair. In the case of growth, the upper limit of the indicator in the area of 1.1666 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română