Trend analysis

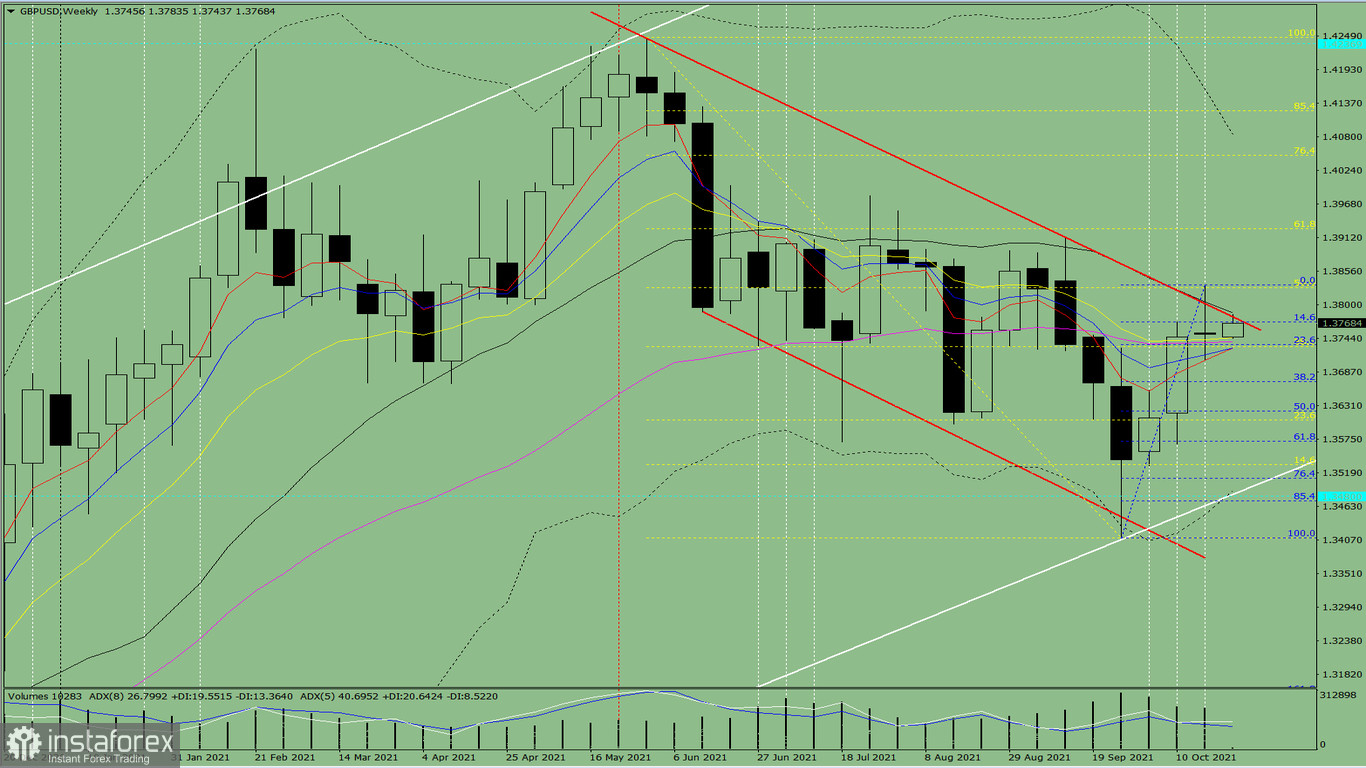

This week, the price from the level of 1.3750 (closing of the last weekly candlestick) is expected to decline to the target of 1.3671 – the pullback level of 38.2% (blue dotted line). Once this level is reached, the upward movement may resume to the target of 1.3828 – the pullback level of 50.0% (yellow dotted line).

Figure 1 (weekly chart)

Comprehensive analysis:

- Indicator analysis - down

- Fibonacci levels - down

- Volumes - down

- Candlestick analysis - down

- Trend analysis - down

- Bollinger lines - down

- Monthly chart - down

A downward movement can be concluded based on a comprehensive analysis.

The overall result of the candlestick calculation based on the weekly chart: the price will most likely move in a downward trend without the first upper shadow (Monday - down) and with the second lower shadow (Friday - up) in the weekly black candlestick.

This week, the price from the level of 1.3750 (closing of the last weekly candlestick) will fall to the target of 1.3671 – the pullback level of 38.2% (blue dotted line). After that, it may rise again to the target of 1.3828 – the pullback level of 50.0% (yellow dotted line).

As an alternative, the price from the level of 1.3750 (closing of the last weekly candlestick) may decline to the target of 1.3733 – the pullback level of 23.6% (blue dotted line). If this level is reached, it is possible to continue its growth to the target of 1.3828 – the pullback level of 50.0% (yellow dotted line).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română