Buying Adobe shares is hedged by selling Micron.

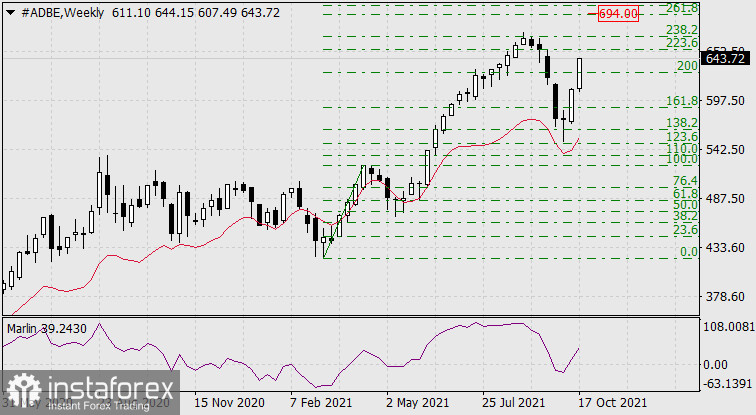

Buying shares of Adobe Systems Incorporated (#ADBE), a software developer.

In the past two weeks, the company's shares have been bullish. The Marlin oscillator is moving in a positive zone. The target is seen at the 261.8% Fibonacci level of 694.00.

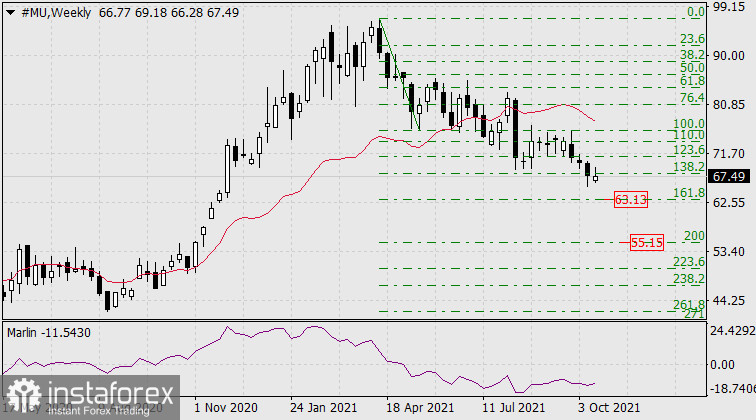

Selling shares of Micron Technology (#MU), a semiconductor manufacturer.

In the previous week, the price closed below the 138.2% Fibonacci level. This indicates weekly consolidation below this level and a high likelihood of a further fall in price. The first target is seen at the 161.8% Fibonacci level of 63.13. In case of consolidation below it, another target will be seen at the 200.0% Fibonacci level of 55.15.

On the daily chart, eight candlesticks consolidated on the Fibonacci line below the Krusenstern line, indicating the possibility of a further price decline. The Marlin oscillator is reversing downward.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română