The entire cryptocurrency market was looking forward to the new working week with great enthusiasm, as the first crypto asset approaches the historical record over the weekend. As of 13:00 UTC on Monday, October 18, the coin has successfully consolidated above the $60k mark and is trading around $60.5k. Due to overcoming such an important milestone, an event occurred in the market that will significantly increase investments in the first cryptocurrency.

According to the world's leading analysts, over 99% of BTC investors are in profit. And this is despite the fact that the asset has not yet reached the April maximum. Therefore a natural question arises: will investors continue to move the coin or is it time to fix profits, which was hinted at by the ambiguous moods of the players during the accumulation period.

The main cryptocurrency is trading near an important milestone of $60.5k, where a support zone will soon be formed for further movement in the $61k-$63k area. It is worth noting that, with such a powerful forcing of the $60k resistance line, daily trading volumes remain at an average level, around $36 billion. This suggests that institutional investors who have completed the accumulation phase and have begun pushing prices upside are behind the current Bitcoin bull rally.

This is also evidenced by the on-chain indicator of the number of unique addresses, which significantly lags behind the current market price of Bitcoin. The same picture is confirmed by the abrupt growth of the volume of transactions in the BTC network. All this once again confirms that it is the institutionalists who are involved in overcoming the $60k mark.

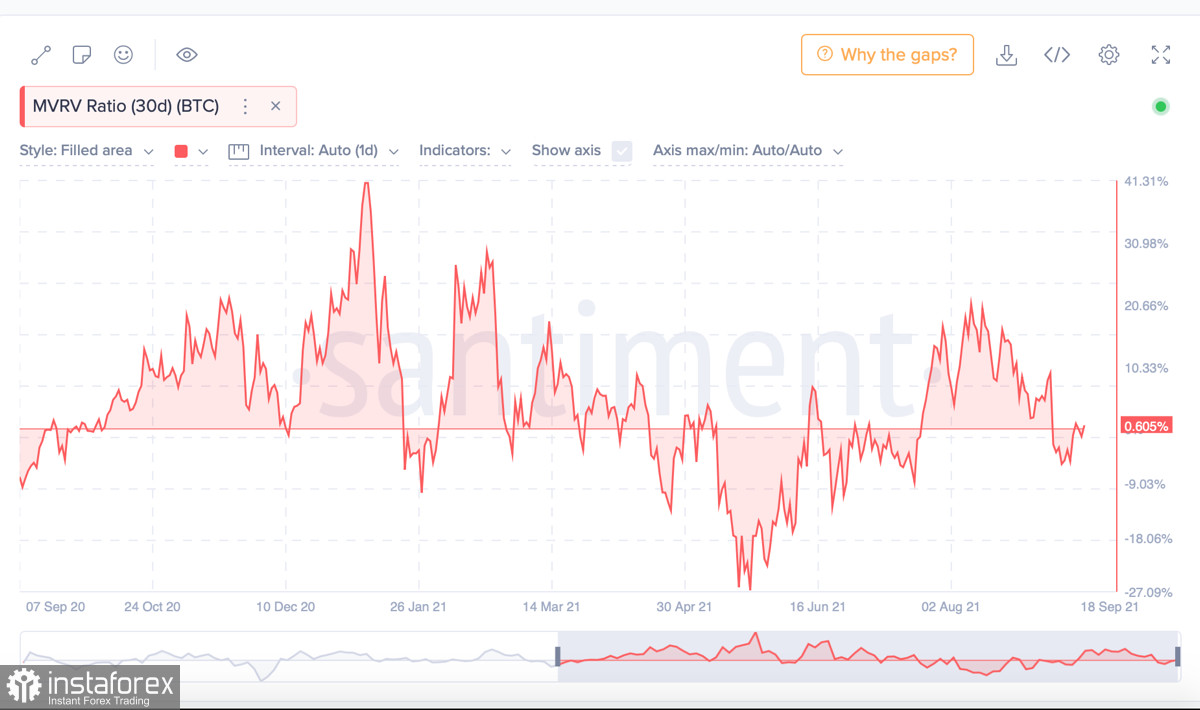

At the same time, the market is just beginning to gain momentum, which can be seen from the indicator of the ratio of the market and realized value of the cryptocurrency. According to this indicator, 99% of all BTC coins in circulation are in positive territory. The main investors in bitcoin made a two-fold profit after purchasing the bitcoin. With investments of more than $3.1 billion, MicroStrategy made a profit of $6.9 billion. Tesla acquired $1.5 billion in BTC and now owns $2.6 billion in crypto. Other major Bitcoin investors have also seen solid capital growth.

On the one hand, such impressive returns are positive news, but on the other hand, it may negatively affect the price movement in the near future, because a powerful increase in funds occurred before the establishment of a new historical record.

The growth of bitcoin will likely slow down in the near future since some investors will want to lock in profits. This will put additional pressure on the price of the coin and can provoke or aggravate a local correction. This scenario is indicated by the excessive profits of some companies, such as Hut 8 Mining, which received a sixfold capital gain due to the BTC rally. Small and medium-sized traders will start taking profits, so they will not be able to globally influence the pace of the bullish rally, but they can easily slow it down.

However, profit-taking will likely go more smoothly at this stage, since the on-chain metric reflecting investors' profits has only crossed the zero mark. This suggests that even though most of the coins are in the black, these are not so significant incomes, and therefore the positions of the holders should remain unchanged.

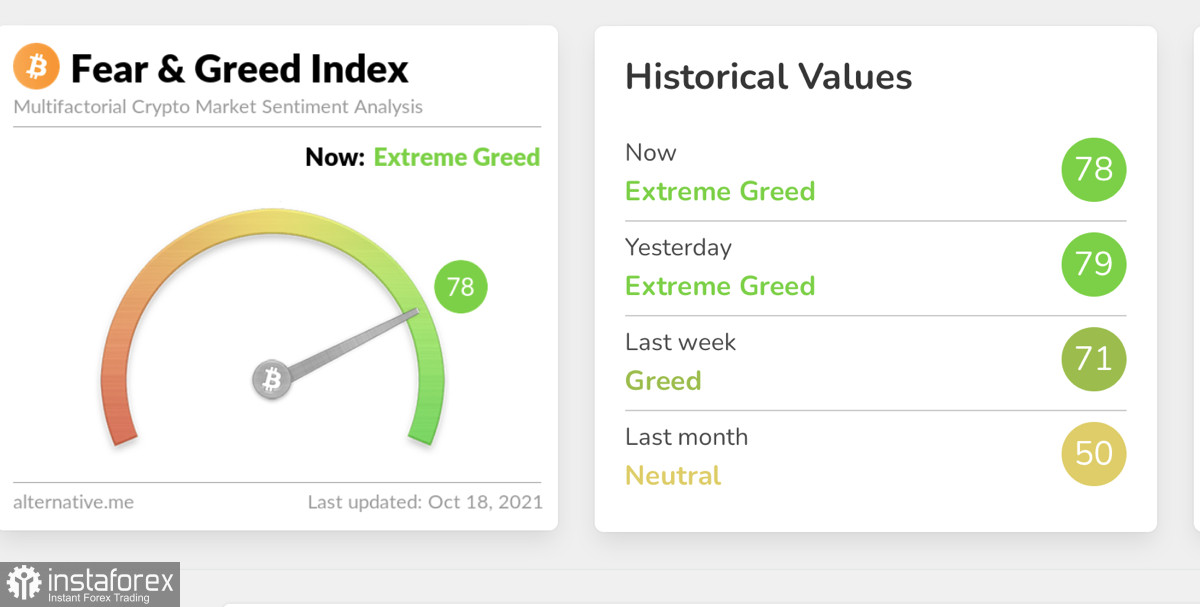

A sharp jump in pressure on crypto quotes will occur when another historical record is reached, when the profits of large companies will increase even more. This can also be facilitated by the retail audience, which begins to enter the coin on the wave of hype. This is also evidenced by the fear and greed index, which crossed the threshold of 75, which also increases the chances of a small correction to cool the market.

As of 13:00 UTC, the daily chart of the cryptocurrency shows clear signals for continued growth. Despite the pessimistic end of Sunday, October 17, when a bearish absorption candle was formed, there is every chance to end Monday's trading day above the $61k milestone. This is indicated by technical indicators: the MACD continues its upward movement, and the stochastic has formed a bullish intersection and begins to grow above the 80 mark.

At the same time, the relative strength index is also growing and trying to overcome the milestone of 60. The price is trying to consolidate above $60.5k, after which it will follow the resistance line at $62.2k. When this mark is broken, the next significant stop of the coin will be a historical record.

In general, the BTC situation suggests that a new maximum will be set this week, but the indicators indicate that the coin is overbought. Therefore, it is worthwhile to make decisions about opening longs more carefully, since price fluctuations may begin on the eve of the absolute maximum.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română