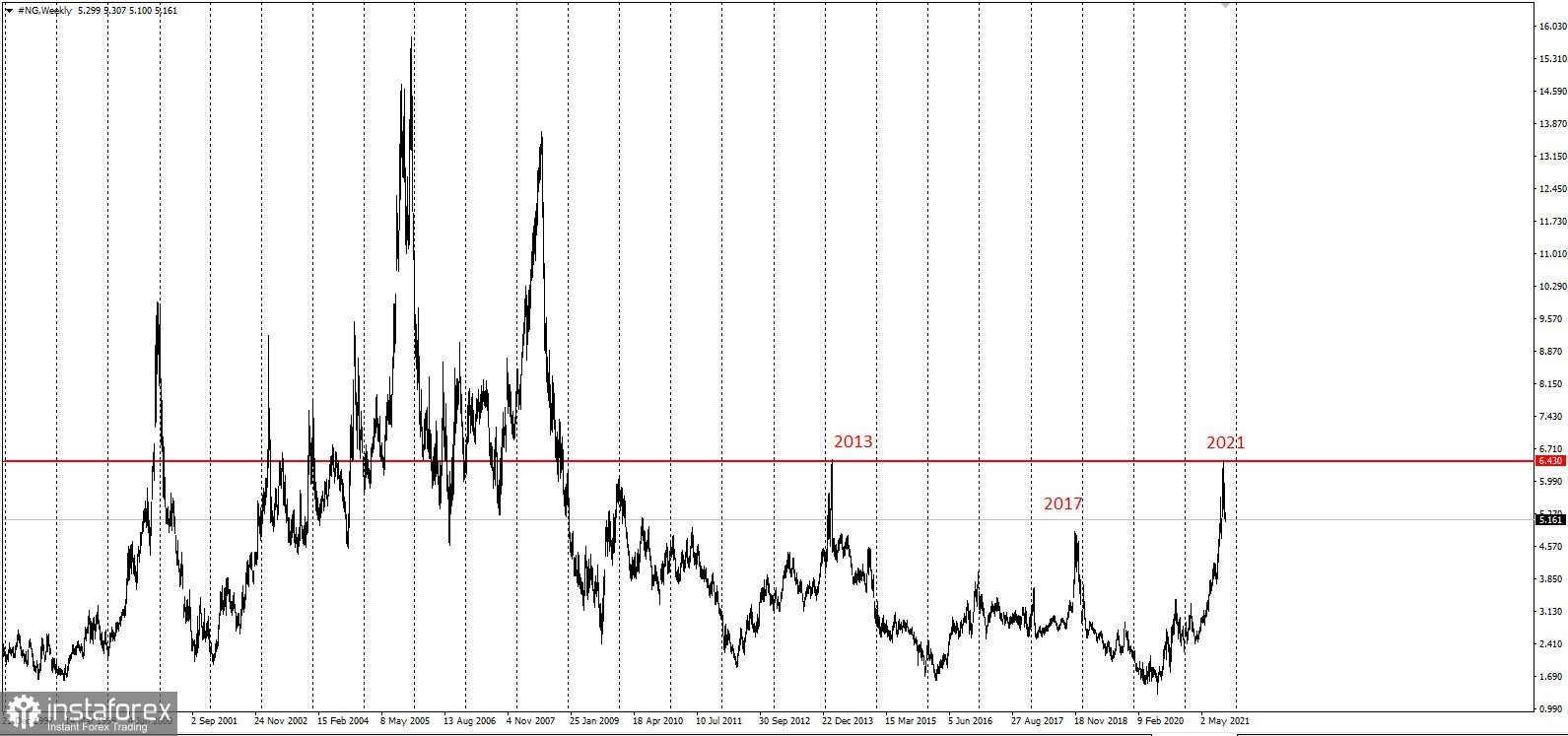

It was reported that winter gas stock did not increase sufficiently enough in the United States. This mounted concerns about adequate supply during the season of peak demand. Consequently, US natural gas futures went up.

Gas prices have already more than doubled this year and winter seasonal demand is just weeks away in large cities such as Chicago that rely heavily on fuel to heat homes. Natural gas futures soared by almost 7% after it became clear that gas held in storage facilities was not sufficient enough. At the close of the trading session on Friday, price growth was curbed by bearish weather forecasts.

Energy prices are soaring worldwide as the looming winter in the northern hemisphere exposes supply shortages of natural gas, electricity, and coal, leaving some factories to lie idle. This may pose a threat to the post-pandemic recovery of some of the world's largest economies as their governments and regulators are faced with pressure when distributing energy supplies to major sectors.

The gas stock change report published in the United States on Thursday logged in an increase in working gas held in storage facilities by just 81 billion cubic feet. Meanwhile, Bloomberg had expected the reading to rise by 92 billion cubic feet. At the same time, the EIA warned that households could face much higher gas and energy bills this winter, unseen since 2007 and 2008.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română