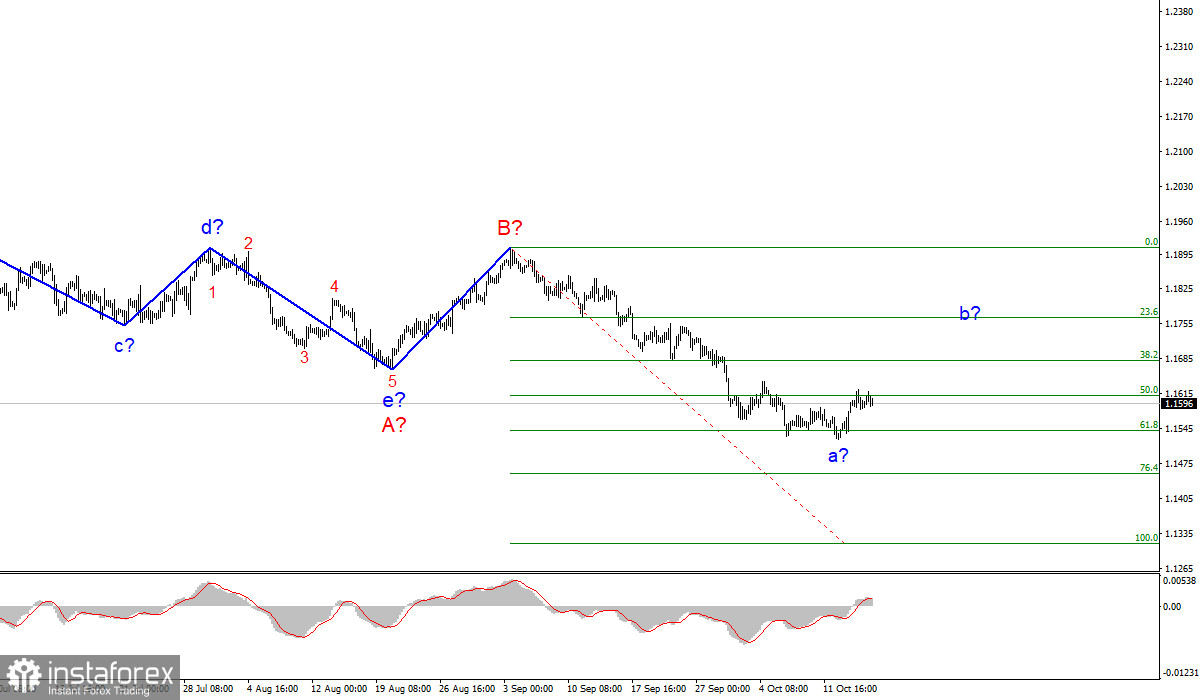

Wave pattern.

The wave marking of the 4-hour chart for the euro/dollar instrument suffered certain changes after the quotes fell below the low of the previous wave. The construction of the downward trend section has resumed. Thus, the trend section a-b-c-d-e, formed from the very beginning of the year, is interpreted as wave A, and the subsequent increase of the instrument is interpreted as wave B. If this assumption is correct, then the construction of the proposed wave C has now begun and is continuing, which can take a very extended form. Even if it takes a three-wave form, then given the size of its first wave, it will still turn out to be very long. If so, the decline in the quotes of the European currency will resume in a week or two or three. If not, the entire wave marking, which still looks quite complicated and non-pulsed, may require additional adjustments. It is a problem with correctional structures – they can change very often and easily.

A quiet Friday with no activity.

On Friday, the news background for the euro and the dollar was expressed by only a couple of reports in the United States, which did not cause any emotions in the markets. Nevertheless, I would like to note that retail trade volumes in September increased slightly more than the markets expected. However, the consumer confidence indicator from the University of Michigan, on the contrary, turned out to be worse than expected. However, neither the first nor the second report, as I have already said, caused any reaction. The amplitude of the instrument's movements today was 15 basis points. The markets seem to have gone to the weekend a day earlier. In general, the news background now also remains quite weak. Nothing interesting is happening in the European Union at all. There are no events, and there is no news from the ECB or Christine Lagarde. The European regulator, like others, is considering the possibility of reducing the incentive program (PEPP and APP). However, it is acting strictly according to the plan, which implies completion in March 2022. In the case of America, the markets are already tired of endless discussions about when the Fed will begin to wind down its QE program. The issue of the public debt ceiling has been resolved for two months until the beginning of December. Therefore, the markets may follow the adoption of two Joe Biden packages in the near future, which involve significant investments in the social sphere and infrastructure. So far, these bills have not found approval in the Republican camp and any bills that Democrats propose. Let me remind you that the issue of raising the national debt limit was resolved only with the help of "temporary measures." In other words, the Senate and the lower house agreed to raise it, but only by $ 480 billion, which will be enough until the beginning of December.

General conclusions.

Based on the analysis, I conclude that the construction of the downward wave C will continue, but at this time, the correction wave has begun. Therefore, now I advise you to wait for the completion of this wave, and after that - to sell the instrument for each signal from the MACD "down," with targets located near the calculated marks of 1.1454 and 1.1314, which corresponds to 76.4% and 100.0% Fibonacci.

Senior chart.

The wave marking of the larger scale looks quite convincing. The decline in quotes continues, and now the downward section of the trend, which originates on May 25, takes the form of a three-wave corrective structure A-B-C. Thus, the decline may continue for several more months until wave C is fully staffed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română