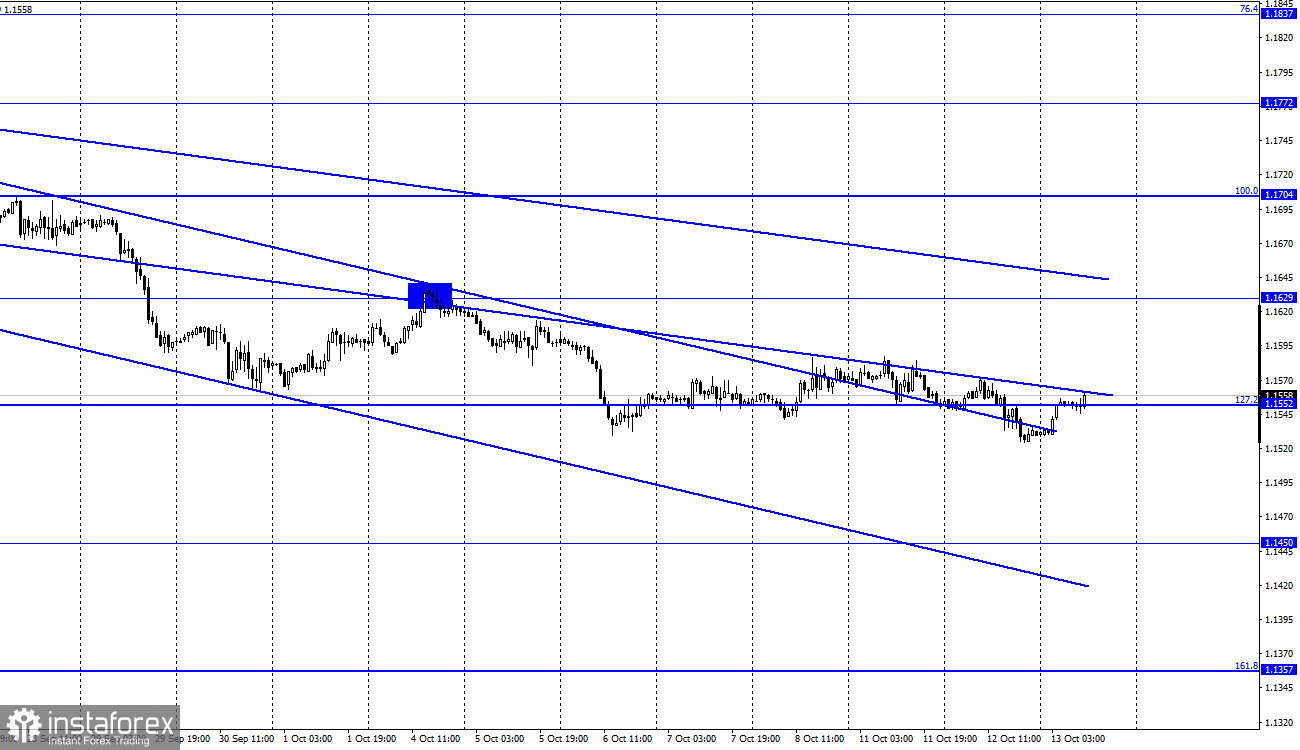

EUR/USD – 1H.

The EUR/USD pair continued to move very weakly on Tuesday, along with the corrective level of 127.2% (1.1552). There was an attempt to resume the process of falling. However, the bear traders gave up very quickly, and the quotes returned to their original position. Thus, at this time, the level of 127.2% even loses all meaning since the course regularly crosses it. Both downward trend corridors continue to characterize the current mood of traders as "bearish." However, the lower corridor is no longer working since quotes have been secured above it. The information background now matches the picture that we see on the charts. During yesterday, traders could only turn their attention to the index of business sentiment from the ZEW institute for the European Union. This index decreased in October from 31.1 to 21.0. Thus, the fall of the European currency yesterday could be related to this indicator.

In addition, the index of sentiment in the German business environment decreased from 26.5 to 22.3, and the index of the current situation in Germany decreased from 31.9 to 21.6. All three indices from the ZEW Institute have fallen quite a lot. And Germany, let me remind you, is considered the locomotive of the European economy. By themselves, these indices are not important for traders. However, the trend itself is important, according to which the situation in the EU business community is deteriorating. But, as I said, the reaction of traders to these events was very weak in any case. And there was no reaction at all to Christine Lagarde's speech, which unexpectedly appeared yesterday in the calendar of economic events. Thus, traders are now waiting for the report on US inflation today and the minutes of the Fed at the last meeting. Inflation in the US is a very important indicator in itself. Therefore, this report should not be skipped. Under certain circumstances, the Fed's protocol will also be of great importance, although traders usually react very calmly to it.

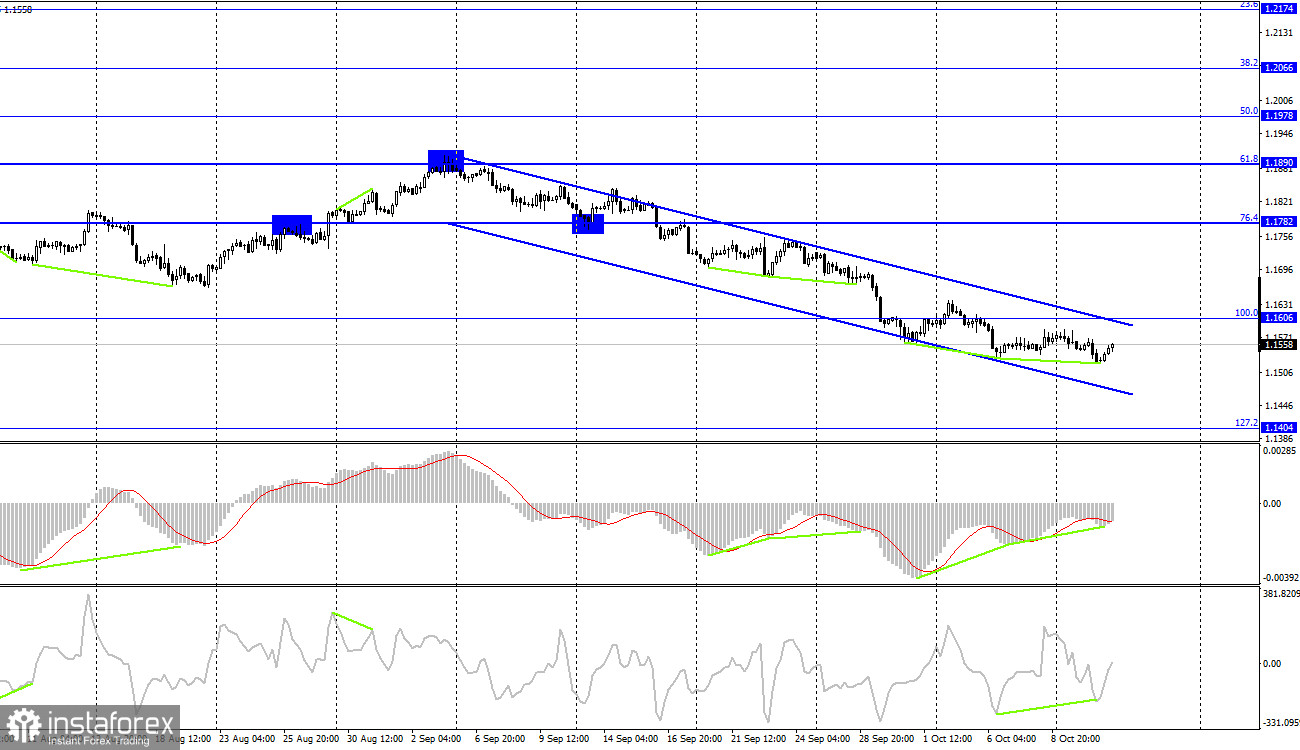

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes closed under the corrective level of 100.0% (1.1606), which allows us to count on the continuation of the fall in the direction of the next Fibo level of 127.2% (1.1404). However, the new bullish divergence in the CCI and MACD indicators warns of a possible reversal in favor of the European and some growth in the direction of the Fibo level of 100.0%. The downward trend corridor still characterizes the mood of traders as "bearish."

News calendar for the USA and the European Union:

EU - change in industrial production (09:00 UTC).

US - consumer price index (12:30 UTC).

US - publication of the minutes of the Fed meeting (18:00 UTC).

On October 13, the European Union has already released a report on industrial production, which decreased in volume by 1.6% m/m. However, traders are waiting for the US inflation report and the Fed minutes. The information background today may be average in strength.

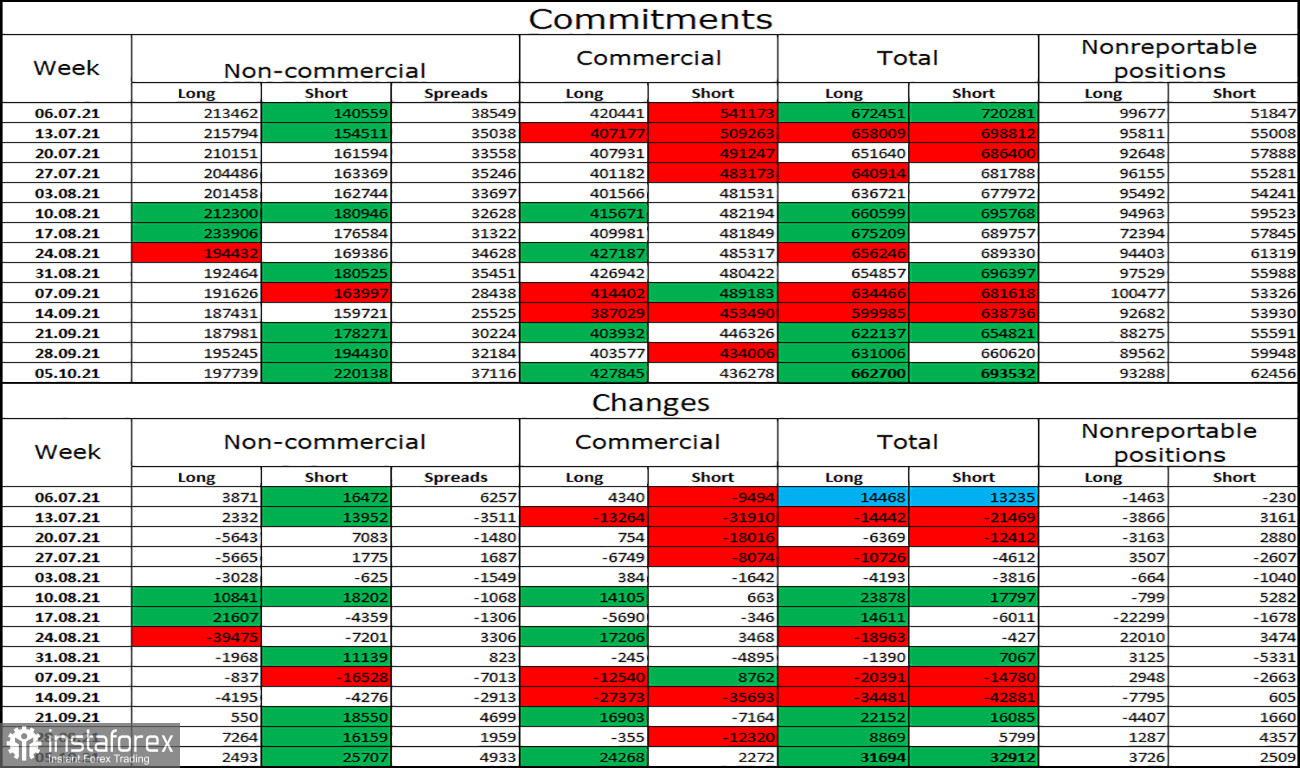

COT (Commitments of Traders) report:

The latest COT report showed that the mood of the "Non-commercial" category of traders changed very much during the reporting week. Speculators opened 2,493 long contracts on the euro and 25,707 short contracts. Thus, the total number of long contracts in the hands of speculators has grown to 198 thousand, and the total number of short contracts – up to 220 thousand. Over the past few months, the "non-commercial" category of traders has tended to eliminate long contracts on the euro and increase short contracts. Or increase short at a higher rate than long. This process continues now, and the European currency, meanwhile, continues to fall slightly. Thus, the actions of speculators affect the behavior of the pair at this time. The fall may continue.

EUR/USD forecast and recommendations to traders:

At this time, the pair's movements are very weak, and there are a lot of signals around the level of 1.1552. However, there is still no movement. I recommend waiting a bit or trading the pair on an informational background.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română