The EUR/USD pair rebounded as the Dollar Index retreated. It was trading at 0.9928 at the time of writing and is struggling to return higher. Still, the bounce back could be only a temporary one. The DXY maintains a bullish bias despite a temporary rebound.

Fundamentally, the US data came in mixed on Friday. The USD dominated the currency market after the NFP reported better-than-expected data. On the other hand, the Unemployment Rate and the Average Hourly Earnings came in worse than expected.

Today, the US banks were closed in observance of Labor Day. On the other hand, the Eurozone Retail Sales rose by 0.3% matching expectations, Final Services PMI dropped from 50.2 to 49.8, even though traders expected the indicator to remain steady at 50.2, while the German Final Services PMI dropped from 48.2 to 47.7.

EUR/USD Temporary Rebound!

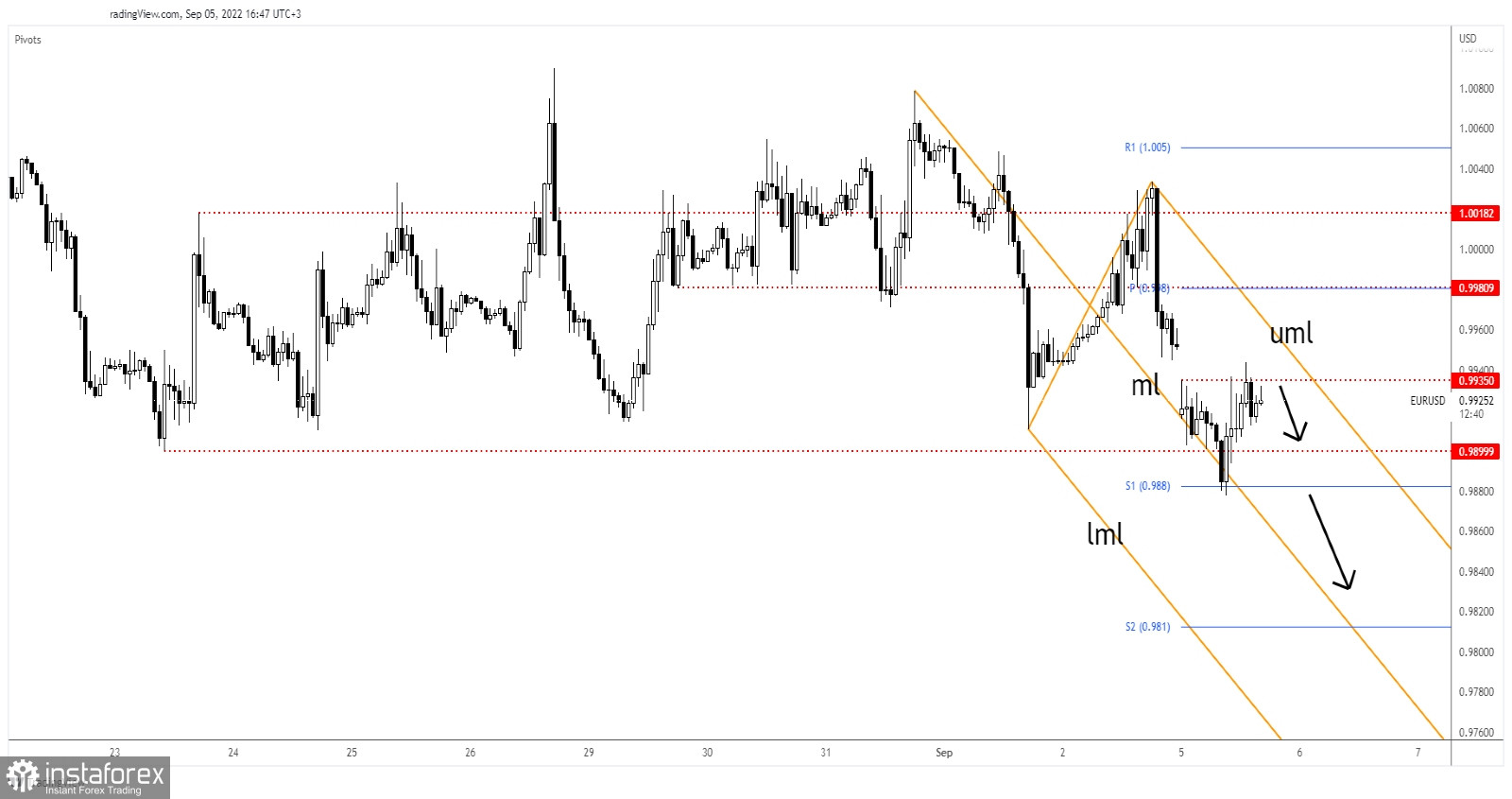

EUR/USD found support on the weekly S1 (0.9880) and has now tried to close the gap. It has found resistance at 0.9935 and now it seems undecided. In the short term, it could move sideways.

As long as the pair stays under the descending pitchfork's upper median line (uml), the price could drop again, the bias remains bearish. Failing to close the gap could announce a new sell-off. A larger growth could be announced only by a valid breakout above the upper median line (uml).

EUR/USD Forecast!

Staying below the upper median line (uml) and making a new lower low, a valid breakdown below the S1 (0.9880) could activate a deeper drop and could bring new short opportunities.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română