Wave pattern

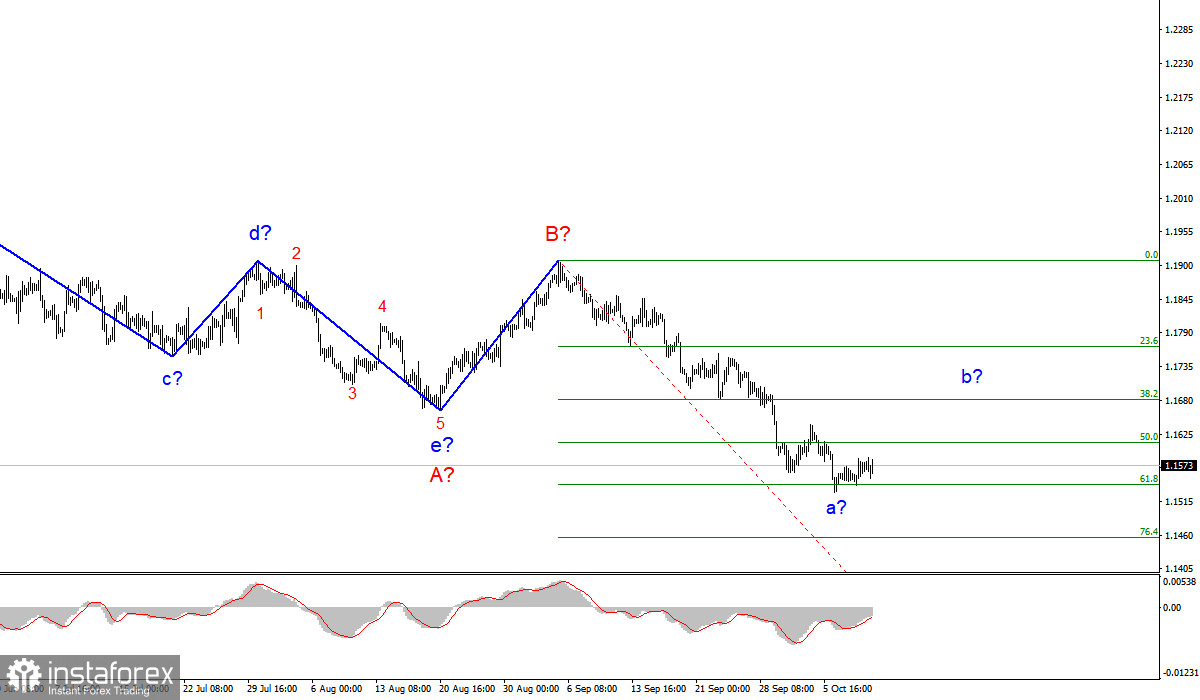

The wave counting of the 4-hour chart for the Euro/Dollar instrument suffered certain changes after the quotes fell below the low of the previous wave. The construction of the downward trend segment has resumed at the moment. Thus, now the a-b-c-d-e trend segment, which has been formed since the beginning of the year, is interpreted as wave A, and the subsequent increase in the instrument is interpreted as wave B. If this assumption is correct, then the construction of the proposed wave C has now begun and is continuing, which can take a very extended form, given the size of wave A and the size of wave a in C. And the whole section of the trend, which originates on May 25, may again take a corrective, three-wave form A-B-C. Thus, the probability of further decline of the instrument remains high, since only one wave is visible inside wave C, but it should turn out to be at least three wave. At the moment, there are no signs of building even a corrective wave b.

American politicians have agreed, but a key agreement is still ahead

There was practically no news for the euro and the dollar on Monday. Thus, the total amplitude of the instrument of 17 points is quite a logical result of a day with zero news background. Moreover, the markets are not actively trading now, even when there is a news background and it is strong. A vivid example of this is Friday, when the Nonfarm Payrolls report alone could cause the movement of points by 60-80, and caused it by 20. Thus, for several days in a row, the very weak recovery of the European currency continues, which may be the beginning of wave b. But even now this wave looks absolutely unconvincing.

Meanwhile, US congressmen have agreed on a temporary increase in the government borrowing ceiling, so a technical default is being postponed for the time being. Politicians have decided to raise the current ceiling size from 28.4 trillion to 28.9 trillion. The additional funds will be sufficient for the Department of Treasury until about the beginning of December. And during this time, congressmen will have to renegotiate an increase in the borrowing limit, which will allow implementing various government programs and financing public services for a long period of time.

However, Republicans have so far refused to meet the Democrats halfway, as they believe that Joe Biden offers an option on how to spend money and does not have a clear plan on how to return it. Joe Biden himself said that America has always paid the bills, and the money is intended for the US population, not for him personally.

General conclusions

Based on the analysis, I conclude that the construction of the downward wave C will continue. Therefore, now I advise selling the instrument for each signal from the MACD "down," with targets located near the calculated marks of 1.1454 and 1.1314, which corresponds to 76.4% and 100.0% Fibonacci levels. An unsuccessful attempt to break through the 1.1540 mark, which corresponds to 61.8% Fibonacci level, indicates the desire of the markets to build a corrective wave, but so far the instrument has moved away from the reached lows by only 40-50 basis points.

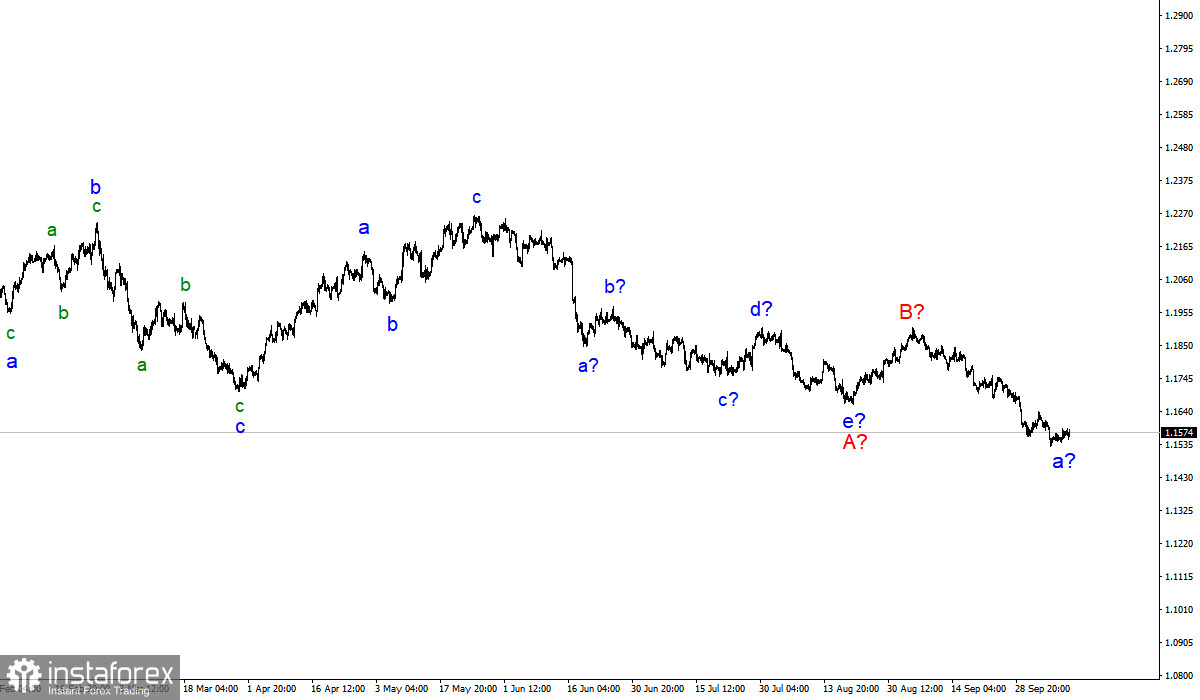

The wave counting of the higher scale looks quite convincing. The decline in quotes continues and now the downward section of the trend, which originates on May 25, takes the form of a three-wave corrective structure A-B-C. Thus, the decline may continue for several more months until wave C is fully completed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română