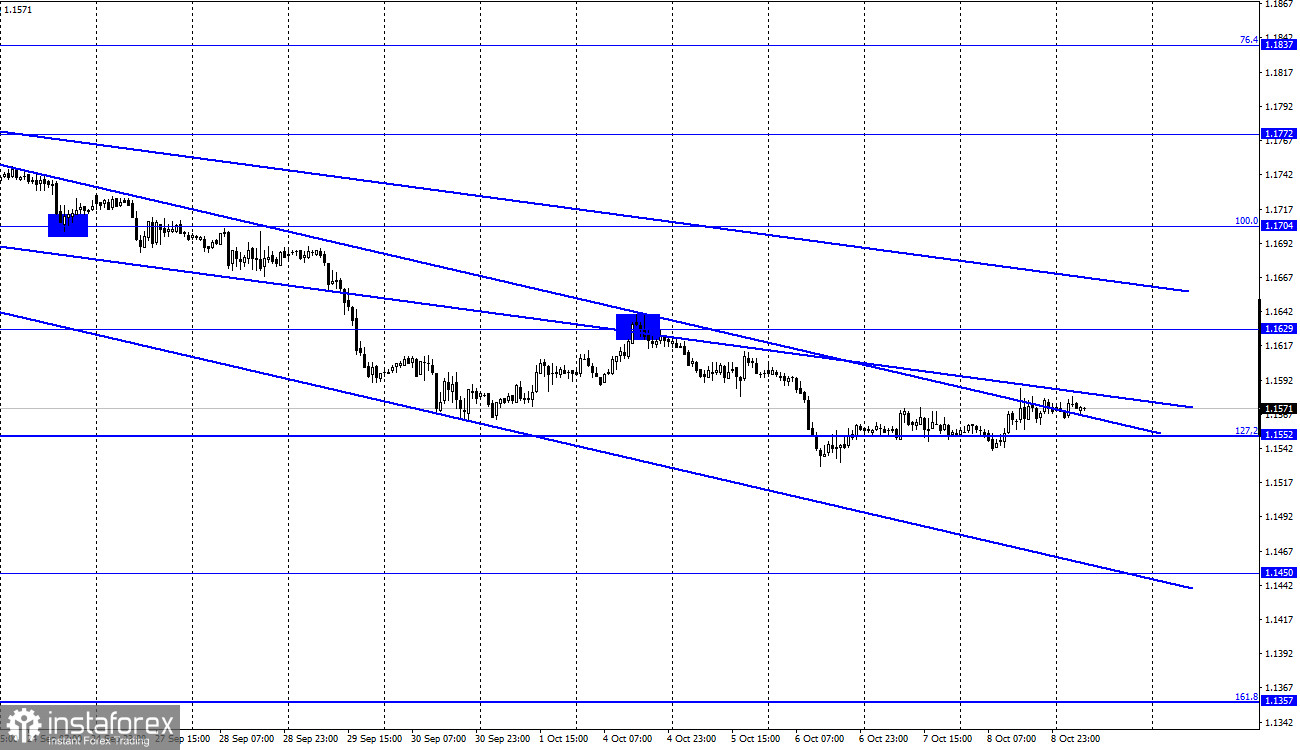

EUR/USD - H1

The EUR/USD pair moved very impressively on Friday, despite the surge of events and economic reports. The pair attempted to close below the 127.2% Fibo level - 1.1552 on the hourly chart, but very quickly resumed the growth process towards the level of 1.1629. I would like to note that now there are two descending trend corridors on the chart at once, but we have already left the lower quote. Thus, it can be assumed that the mood of traders is changing to "bullish," but the decline can still resume at any time.

The US Nonfarm Payrolls report was released on Friday, which recorded 194,000 new jobs outside the agricultural sector, with an expectation of 490,000. This is the second month in a row that traders' expectations have not been met. However, at the same time, the US unemployment rate fell from 5.2% to 4.8%, although traders had expected a decline to only 5.1%. Wages were also encouraging, which rose 0.6% in September, although traders were expecting a 0.4% increase.

Traders' reactions to all these events turned out to be very weak. The pair rose by 20 pips, then dropped by the same points. It seems that traders simply did not decide which of the reports is more important and which of them should be responded to. While I think the Nonfarm Payrolls report is much more important than unemployment or wages and is very strange, that the American currency did not even fall after reports saw low values. It is now completely unclear what prospects the Fed's stimulus program will have, which is supposed to end in November. But given such weak indicators of the labor market, the Fed may further delay the start of completion of this program.

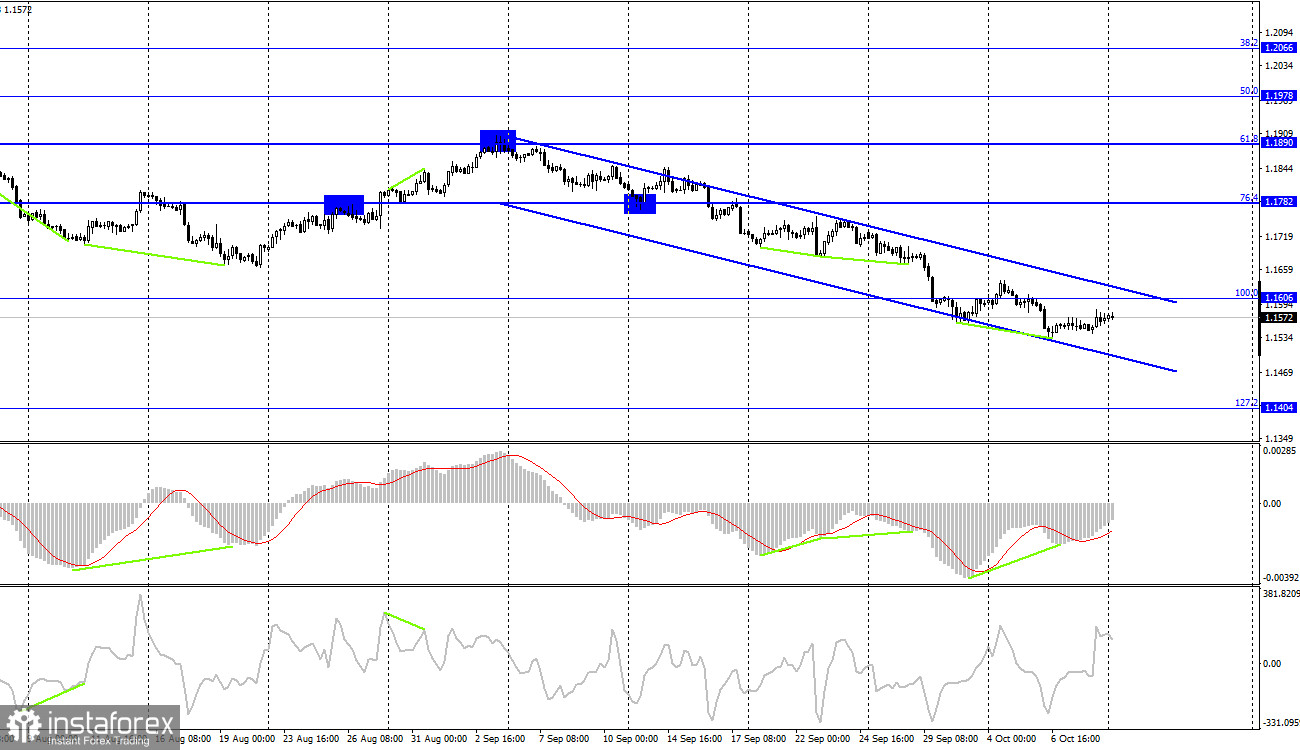

EUR/USD - H4

On the 4-hour chart, the pair closed below 1.1606 - the 100.0% Fibonacci level. Thus, the pair may continue to fall to 1.1404 - 127.2% Fibonacci level. The bullish divergence allows counting on some growth in the pair, but it is already clear that this growth is very weak. Closing above the downward trend corridor will allow us to count on a change in the mood of traders to "bullish" and the pair's growth to 1.1782 - the 76.4% Fibo level.

US and EU news calendar:

On October 11, the EU and US economic event calendars are completely empty. The background information is also absent. There will be speeches by the ECB Chief Economist Philip Lane and FOMC member Charles Evans, but I believe traders will not pay attention to them.

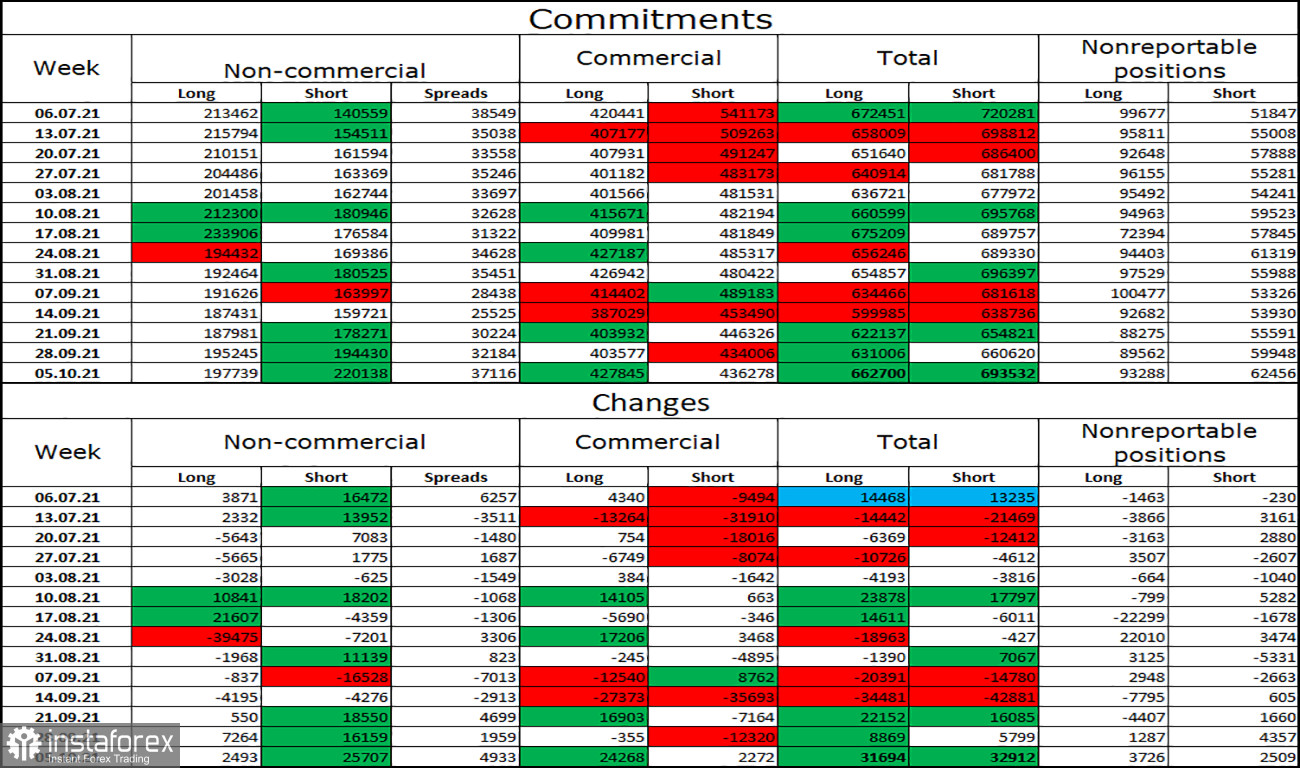

COT (Commitments of Traders) report:

The latest COT report showed that sentiment in the "Non-commercial" category of traders changed dramatically during the week. The speculators opened 2,493 Long contracts for the euro and 25,707 Short contracts. Thus, the total number of Long contracts in the hands of speculators increased to 198,000, and the total number of Short contracts - up to 220,000.

Over the past few months, the "Non-commercial" category of traders has tended to get rid of Long-contracts for the Euro-currency and build up Short-contracts. Or, build up Short at a faster rate than Long. This process continues now, and the European currency, meanwhile, continues to fall slightly. Thus, the actions of speculators affect the behavior of the pair at a given time. The fall may continue.

Forecast for EUR/USD and recommendations for traders:

I recommended new purchases of the pair on the rebound from the level of 127.2% - 1.1552 on the hourly chart with the target of 1.1629. These buy trades can now be held open. I recommend selling if a new consolidation is made below the retracement level of 127.2% - 1.1552 on the hourly chart with a target of 1.1450.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română