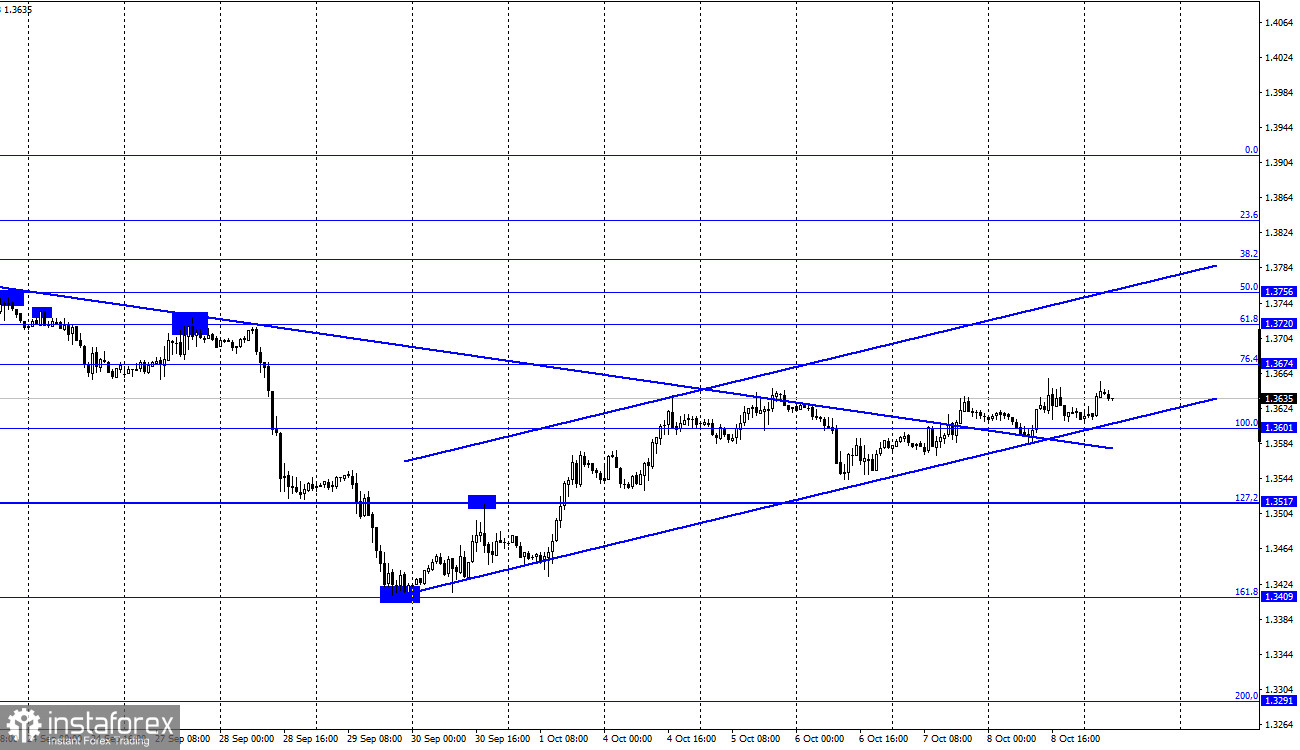

GBP/USD - H1

On the hourly chart, the GBP/USD pair has consolidated above 1.3601 - the 100.0% Fibonacci level and continues to grow towards 1.3674 - 76.4% Fibonacci level. The new upward trend corridor characterizes the current traders' sentiment as "bullish". Consolidation below it will allow counting on the resumption of the fall in the direction of 1.3517 - the 127.2% Fibonacci level.

Growth has weakened over the past few days. The informational background on Friday for the pound was the same as for the euro. The Nonfarm Payrolls report caused a slight increase in the dollar, but it stopped very quickly. I can say that the reaction of traders to this report was rather weak. Traders seemed confused by all the cards by reports on unemployment and wages, which turned out to be stronger than expected. However, the British pound is still continuing the growth process that began at a time when Britain began to recover from the fuel chaos. The pair closed above the downward trend line, so I would say that the pound has good growth prospects. However, the 4-hour chart clearly shows that the British pound has failed to close above 1.3642 - the 38.2% retracement level, already four times. Thus, this level is now preventing further growth of quotes.

There has been no news from the UK for the past few days. Nevertheless, the fuel situation remains challenging. The media drew attention to this problem and found that a shortage of workers is noted not only among drivers, but also among many other professions, which was usually made up by labor migrants. However, now residents of European countries are in no hurry to go to the UK to work, as the process of obtaining visas and work permits has become much more complicated after Brexit. Thus, according to media assurances, the country may face a shortage of some goods and even greater disruption to supply chains in the near future.

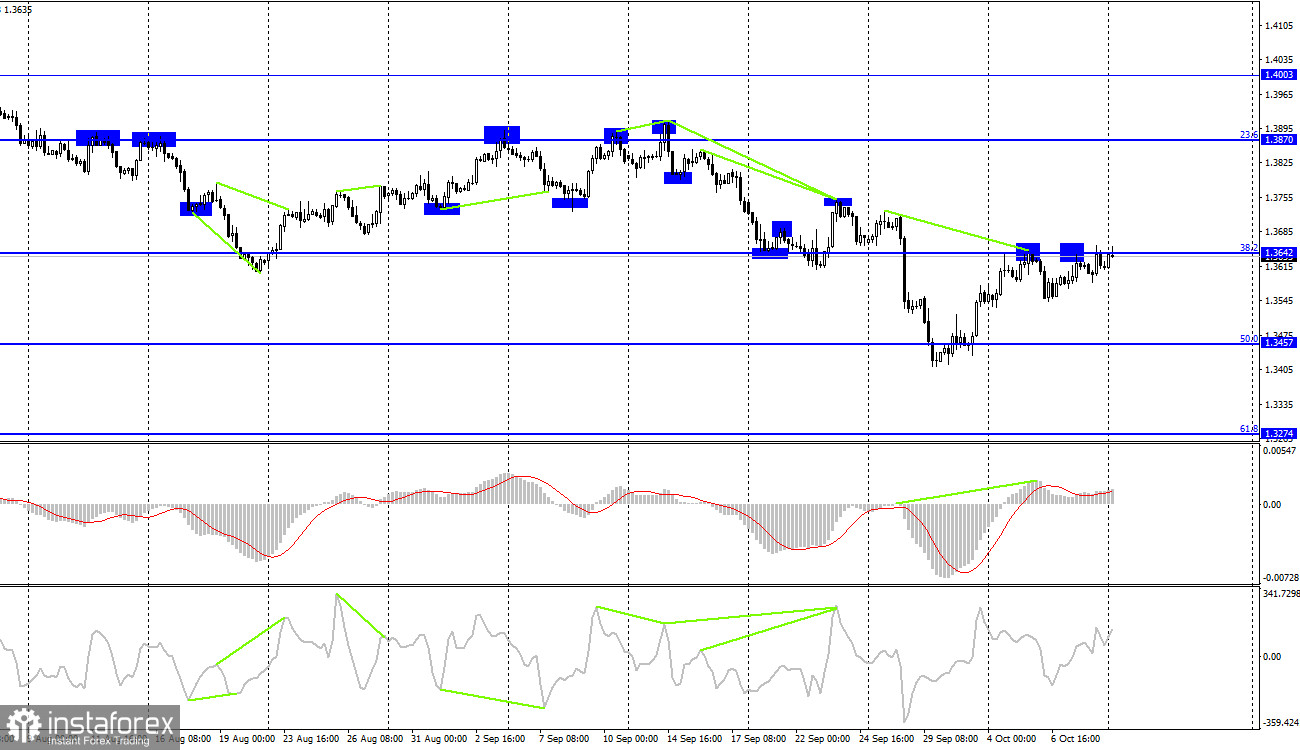

GBP/USD - H4

The GBP/USD pair has completed a new rally towards 1.3642 - the 38.2% Fibonacci level, on the 4-hour chart and is preparing for another rebound and reversal in favor of the US dollar. Also, a bearish divergence was formed in the MACD indicator, which increases the likelihood of a new drop in quotes to 1.3457 - the 50.0% Fibo level. Closing the pair over the level of 1.3642 will work in favor of the British pound and the continued growth to 1.3870 - the 23.6% Fibo level.

US and UK news calendar:

Both the UK and US economic calendars are blank on Monday. Thus, the information background will be absent today for the pound-dollar pair. However, tomorrow, there will be reports on unemployment and wages in the UK.

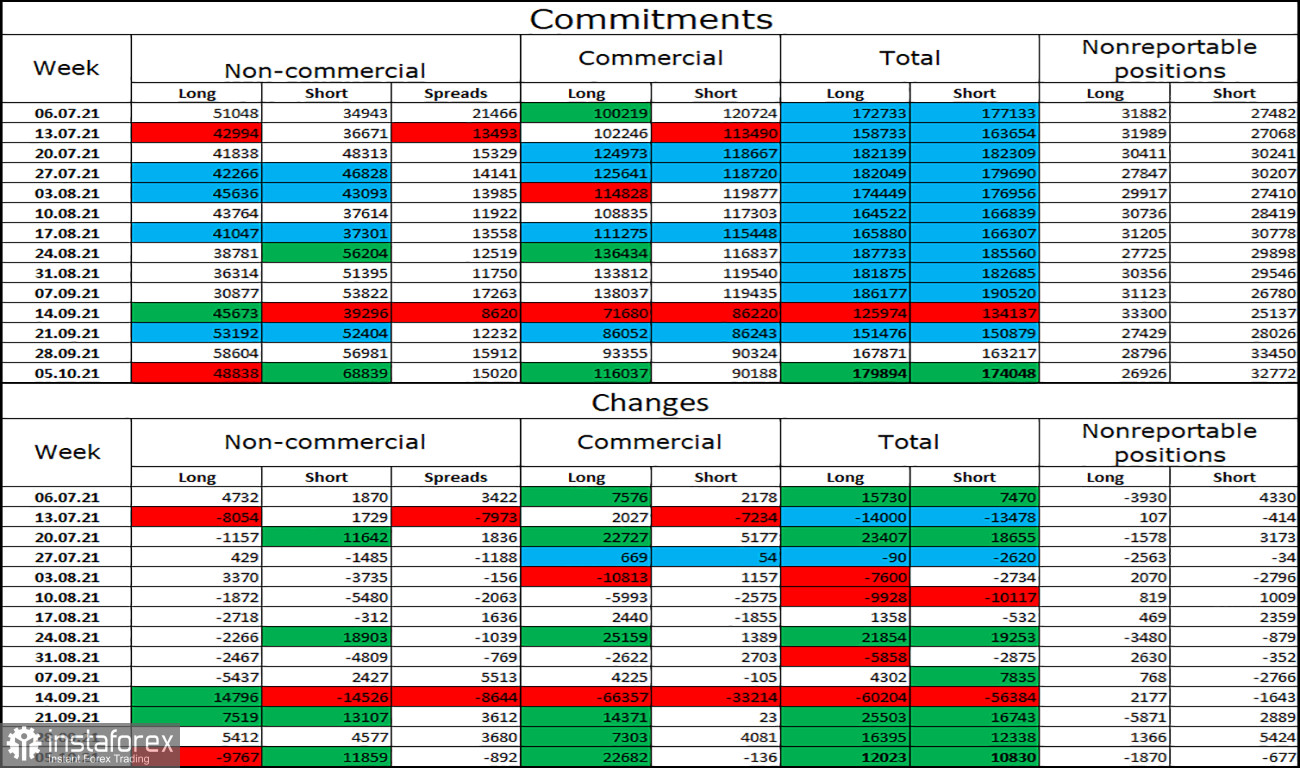

COT (Commitments of Traders) report:

The latest COT report from October 5 in the UK showed that the mood of the major players has become much more "bearish." During the reporting week, speculators closed 9,767 Long contracts and opened 11,859 Short contracts. Thus, the bearish mood has become stronger by about 20,000 contracts. And now the number of Short contracts concentrated in the hands of speculators exceeds the number of Long contracts by one and a half times.

This already speaks of a rather strong "bearish" mood, so we can expect a resumption of the fall of the British pound in the near future. The 1.3642 level could be an insurmountable barrier for bull traders.

Forecast for GBP/USD and recommendations for traders:

I recommend buying the pound when the quotes close above 1.3642 - the 38.2% Fibo level on the 4-hour chart with the target of 1.3720. I recommended opening sales earlier, as the quotes bounced off the level of 1.3642 on the 4-hour chart with the target of 1.3517. These trades can now be held open.

Terms:

"Non-commercial" - large market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română