It would seem that the "bears" on EURUSD have exhausted their resources, and the pair is about to turn around as the energy crisis has come to Europe, which can easily turn into an economic and even political crisis. Will consumers, whose pockets have significantly improved, want to vote for the Greens if the latter contribute to a decrease in their well-being?

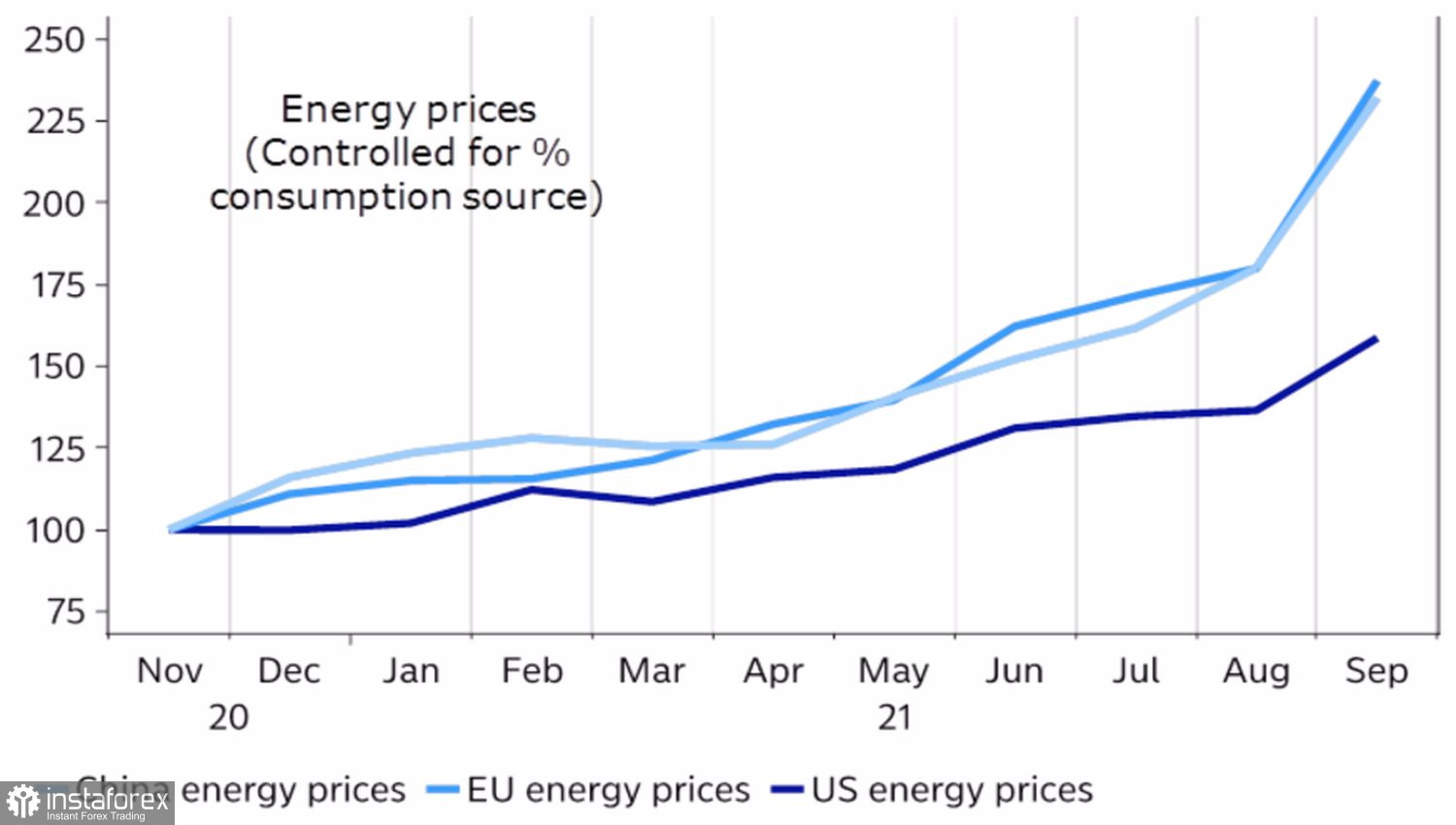

In 2021, wind turbines generated 30-40% less electricity than expected, which, coupled with a sharp drop in gas reserves in the euro area, led to a soaring in gas prices to record highs. The problem is very acute in Germany and throughout Europe, while in the United States, the cost of this type of fuel is not increasing so quickly. This circumstance reduces the risks of stagflation in the US and allows the Fed to normalize monetary policy with a clear conscience.

Energy prices dynamics

Europe, on the other hand, is seriously frightened by the prospect of excessively high inflation and a slowdown in economic growth. And central banks don't know what to do. The Bank of England hints at a rate hike, but at the same time, explains that monetary restrictions could ruin an already modest economic recovery. Poland and the Czech Republic have decided to take the risk and tighten monetary policy, but so far, no one knows for sure what will come back to haunt them. There is a severe split in the ECB: the "hawks" are scaring the new regime of high price pressure, the "doves" argue, what could replace PEPP after the program is over?

When the euro area is frightened by the prospect of stagflation, the improvement of the epidemiological situation in the US, Congress' approval of the issue of raising the debt ceiling until December, and the rosy prospects for the fourth quarter, make America a very attractive place for investment. Treasury bond yields are rising by leaps and bounds, and S&P 500 pullbacks are being redeemed. Capital flows from Europe and Asia to North America, the US dollar is strengthening.

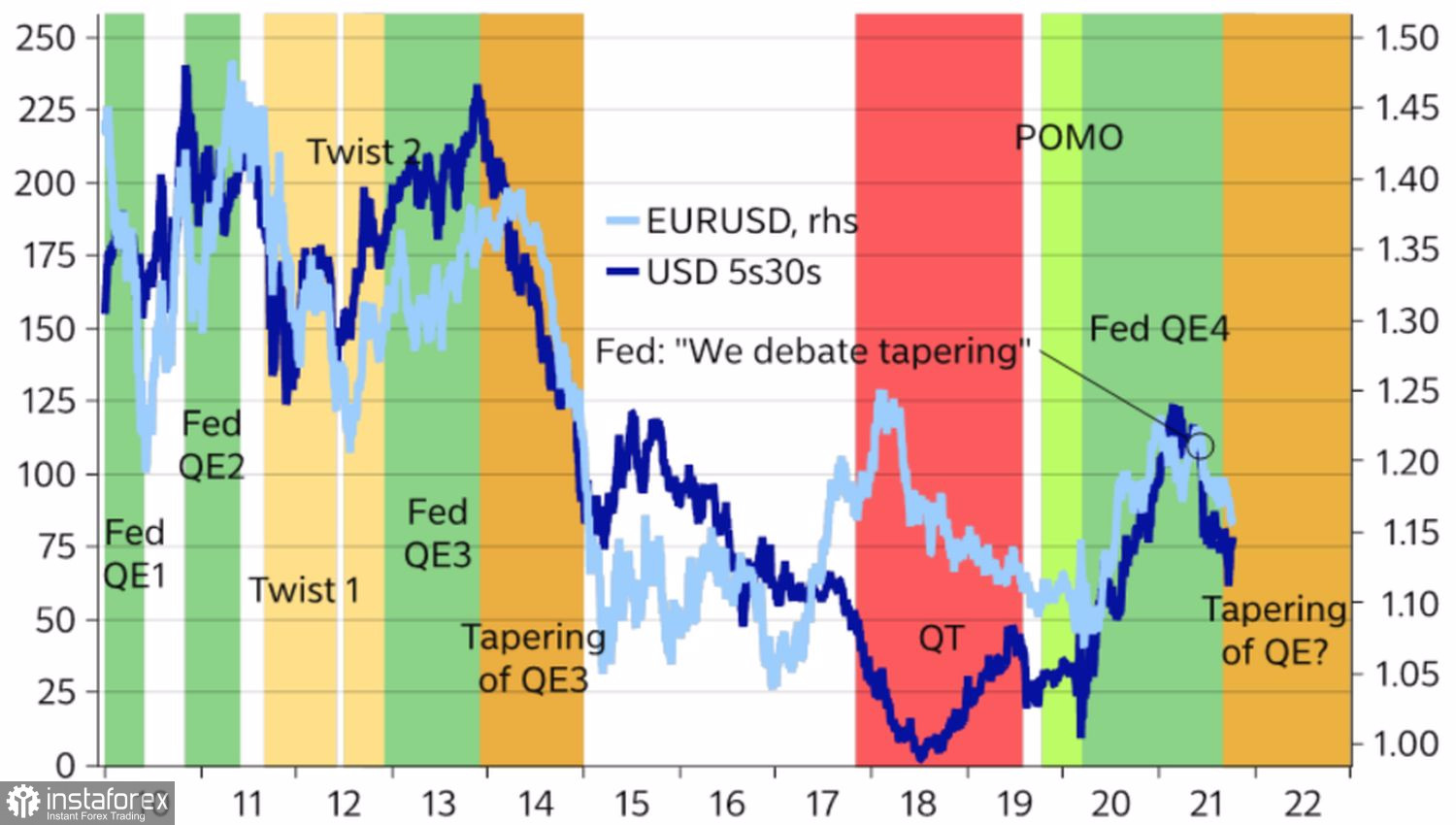

The USD index tends to rise, and EURUSD quotes fall during the normalization of the Fed's monetary policy, which manifests itself in the form of a narrowing of the yield differential of 5 and 30-year bonds

Dynamics of EURUSD and the differential of US bond yields

In this regard, 194,000 in employment outside the agricultural sector of the United States in September makes the markets wonder if this figure will be sufficient to start the process of tapering QE in November. Jerome Powell recently stated that an over-strong report is not required, so after small fluctuations, the market is likely to decide that the Fed will not abandon the plan. All the more so if the statistics on US inflation for September, which is the key event of the week of October 15, shows that the indicator will continue to remain at higher levels.

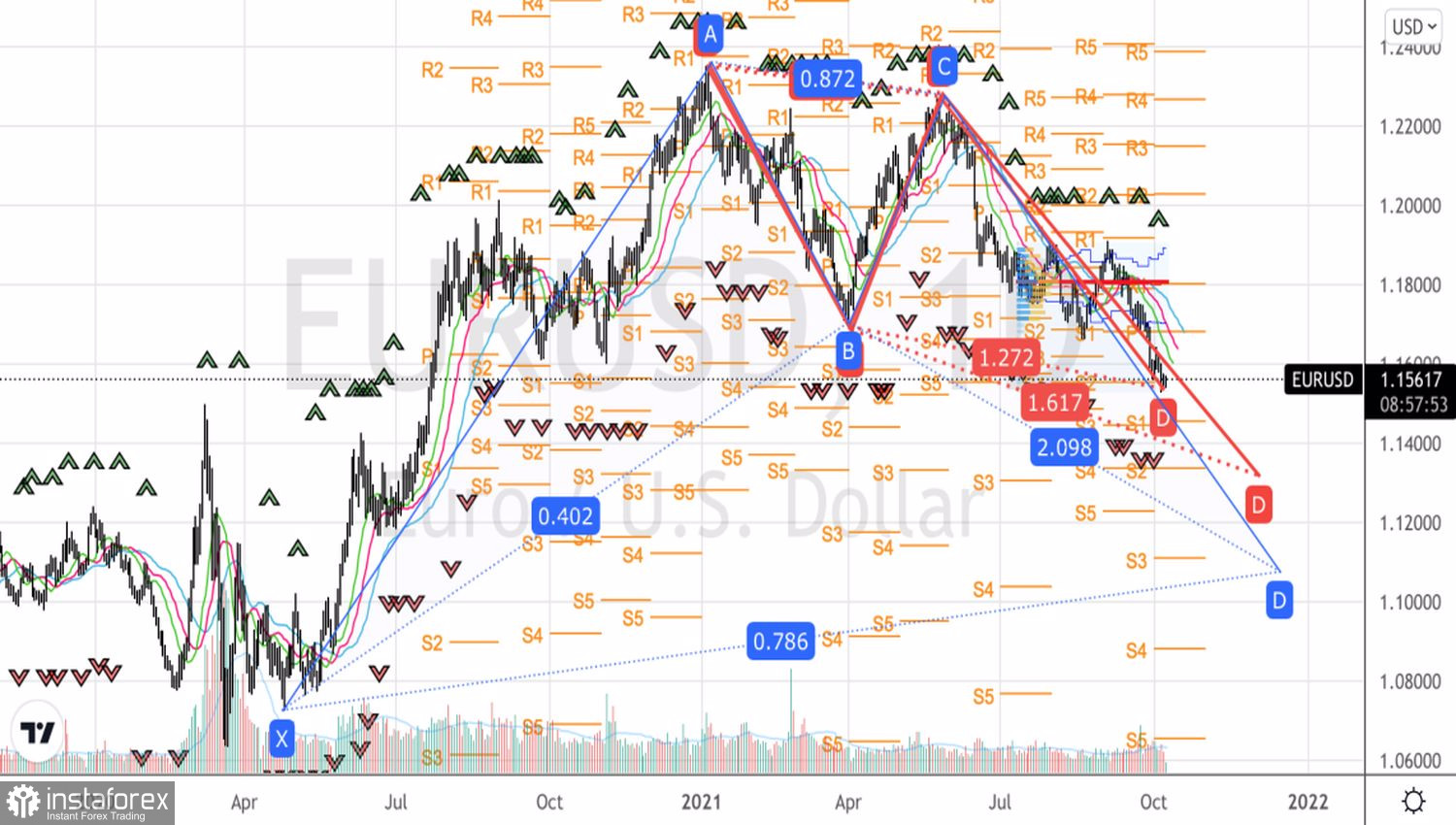

Technically, the further fate of the EURUSD pair will depend on the bulls' ability to hold the levels of 1.1555-1.1565. It turns out that you can expect a rollback after reaching the target of 127.2% according to the AB=CD pattern. On the contrary, a five-day close below these marks will create prerequisites for the continuation of the peak to 1.133 and 1.107 and will become the basis for the formation of short positions.

EURUSD, Daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română