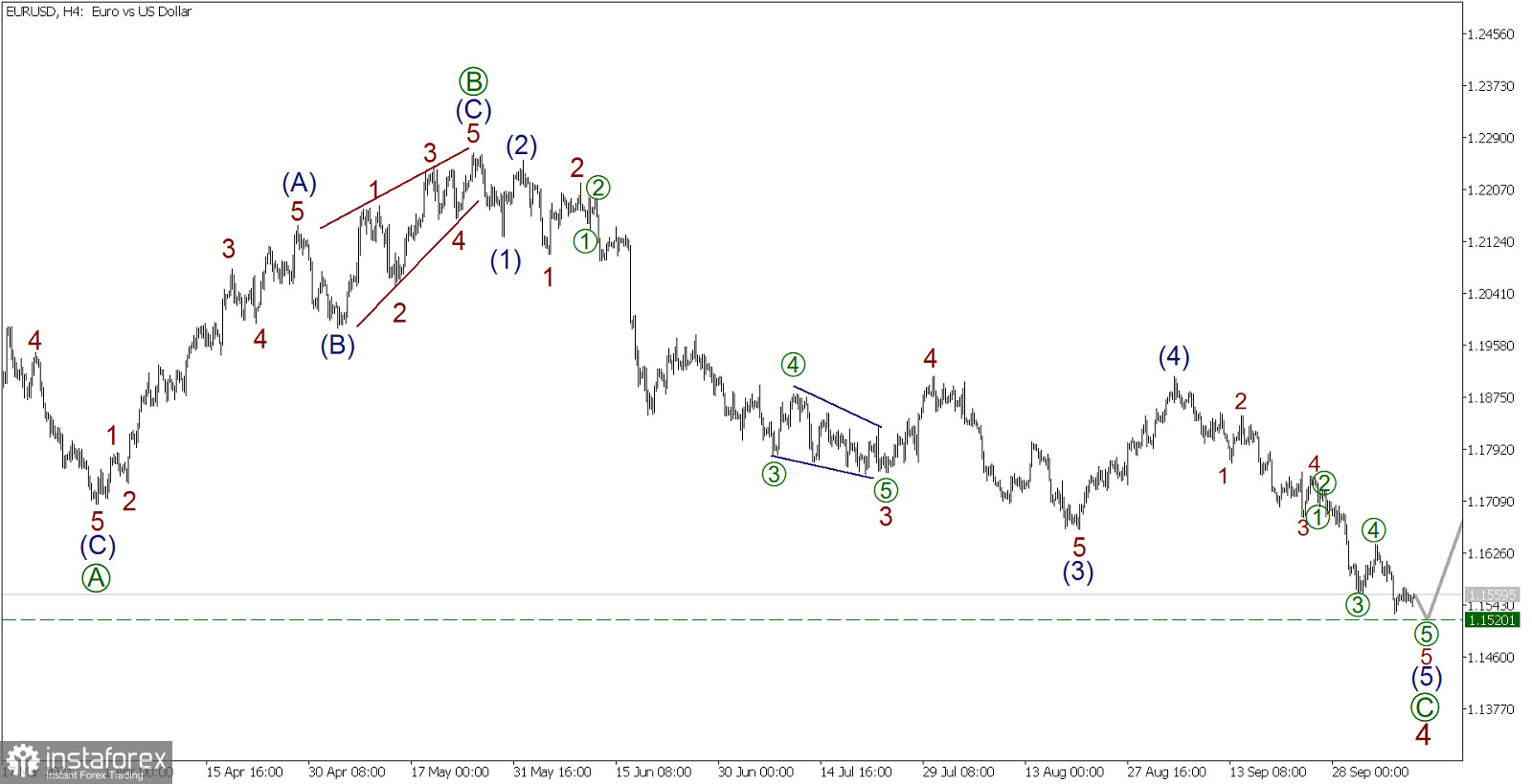

EUR/USD, H4 timeframe:

Let's continue to analyze the situation of the EUR/USD pair through Elliott's theory.

The final part of the large horizontal correction 4 is being formed for the EUR/USD pair based on Elliot's theory. This correction takes the form of a wave plane [A]-[B]-[C], where the first two zigzag waves [A]-[B] are already done, while the one in a downward wave [C] is still under development.

It is worth noting that wave [C] consists of sub-waves (1)-(2)-(3)-(4)-(5). The first four parts are already complete, and the downward sub-wave (5) is in the process of formation. It is assumed that the price will continue to decline in sub-wave (5), that is, to the level of 1.1520 shortly.

Once this level is reached, the price will reverse and start building a bullish trend.

A lot of news is observed today. Lagarde will deliver a speech at 12:10 Universal Time, followed by an article about the figures of people employed in the US Nonfarm sector and a publication on the US unemployment rate.

Currently, it is recommended to consider sales by setting the take profit at 1.1520, or wait for a bullish trend to gain profit on purchases.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română