Hello, dear traders!

In today's article about the GBP/USD pair, the main attention will be generally focused on the technical picture. However, first we discuss the problems which the British economy is facing at the moment. Besides the COVID-19 crisis affecting the UK economic recovery, there is a labor shortage concerning the EU countries. This is a natural development that took place after the UK exited the EU, or the so-called Brexit. The UK labor market is under pressure due to a significant EU labor reduction.

This leads to a surge in salaries and inflationary pressure. Accordingly, it will be predictable for the Bank of England to start tightening its monetary policy following the US Federal Reserve (Fed) by reducing the volume of asset purchases. I think it is one of the factors which favors the British currency and prevents its plunge against the dollar. Another factor for more or less stable positions of the pound is the technical picture. We are going to consider it right now.

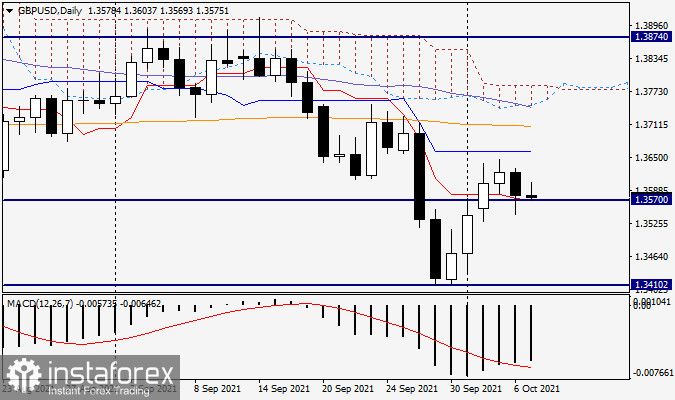

Daily

Despite the GBP/USD pair's decline yesterday, the candle of October 6 has a rather long lower shadow, and the closing price was above the support at 1.3570, which was broken and had acted as a resistance. I may suggest that the red Tenkan line of the Ichimoku indicator, which is very close to 1.3570, played a key role in keeping the price above 1.3570. At the same time there are a lot of strong resistances at the top, the nearest one is the blue Kijun line at 1.3661. Above, at 1.3707, there is a strong orange 200 exponential moving average. Besides, the 50MA and the bottom boundary of the Ichimoku cloud converged at 1.3743.

All mentioned facts present serious obstacles for the possible growth, which the bulls should overcome. Only having passed the above indicated resistances, the pound will continue strengthening with the nearest target of the strong technical level at 1.3800. If the pair again declines at 1.3570 and consolidates below it, the downward trend will likely continue with the nearest targets at 1.3525 and 1.3500. In case the pair climbs the latter level, it might fall to 1.3400, which is another significant level for the market. As we can clearly see on the daily chart, there is a support level at 1.3410. It indicates the minimum trading values on September 29-30.

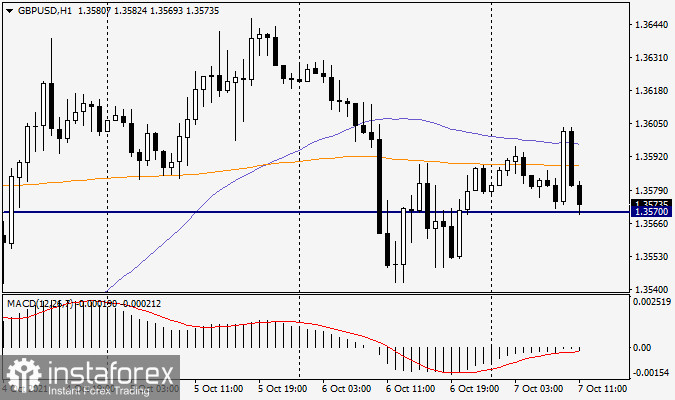

H1

On the hourly chart, the GBP/USD pair is trading flat by completing the article. I believe today positioning in both directions is possible, though with rather modest targets. Notably, the US labor market data, the key event of the week, will be released tomorrow. Besides, the GBP/USD pair is still highly volatile. Traders who plan to buy, should consider opening long positions after the short-term decline to the area of 1.3545-1.3500 and appearance of the reversal candlestick patterns there. It is more reasonable to try selling if similar signals are triggered by the attempts to rise above 1.1600 and (or) 1.1640.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română