Wave pattern

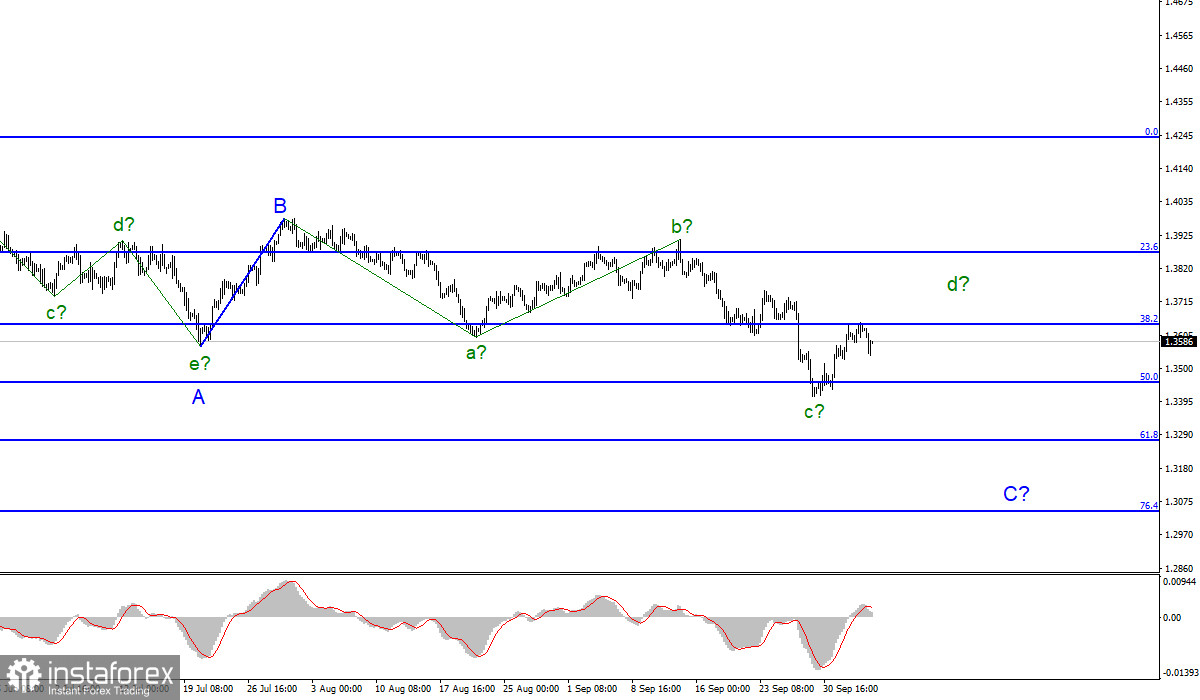

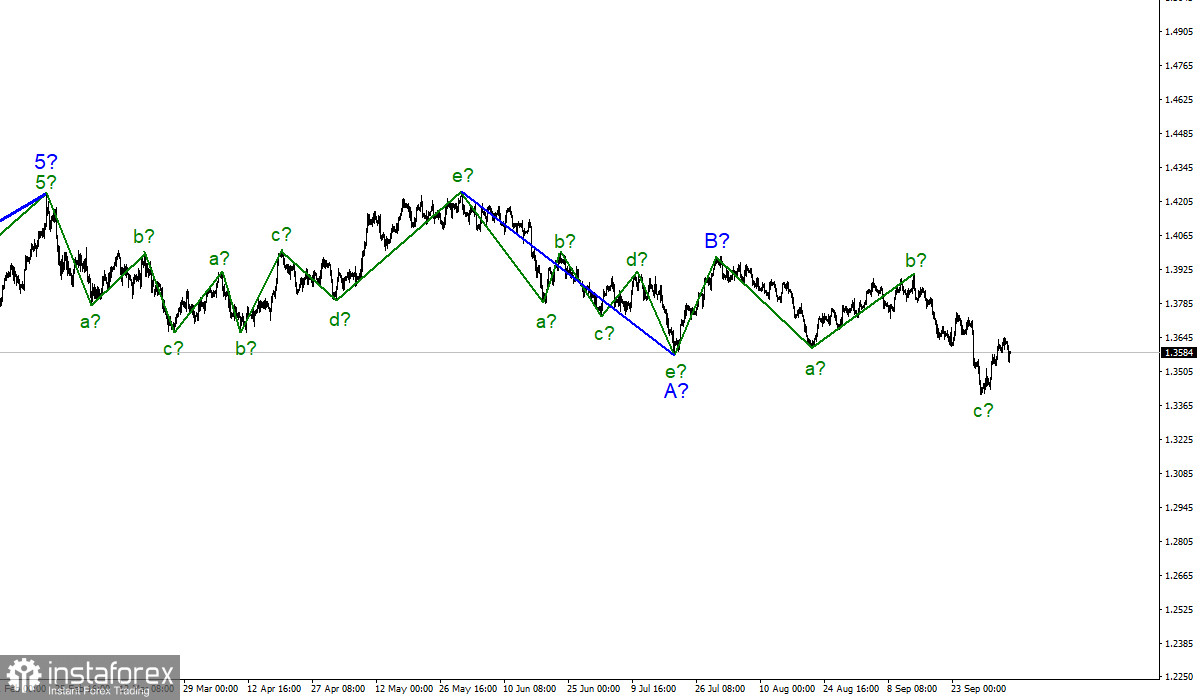

The wave counting for the Pound/Dollar pair has become more complicated and now it is expected to continue building a downward trend section. The instrument declined by 300 basis points over the past week, and also made a successful attempt to break through the low of the previous waves a and e. Thus, adjustments were made to the wave pattern and now it has acquired the form of a downward trend section, which can also be corrective in nature. This assumption is prompted by the internal structure of the proposed wave A, which cannot be called impulsive. Also, an absolutely non-impulsive form is taken by the assumed wave c in C from this section of the trend. At the moment, only three waves are clearly visible in it. However, this is a big problem for corrective structures. Internal wave patterns can be either three-wave or five-wave and take a very elongated form with complications. Thus, given the unsuccessful attempt to break through the 38.2% Fibonacci level, I expect the construction of a new descending wave, possibly the fifth in the composition of c in C.

Pound survived the "fuel shock" and now ignores the economy

The exchange rate of the Pound/Dollar instrument decreased by 50 basis points on Wednesday. However, the movements of the pair were not the simplest and most understandable. At the same time, markets did not pay attention to the data on business activity in the UK construction sector which came out at 52.6 basis points in September with higher expectations. They did not pay attention – because at the time of the release of this report, the downward movement had already stopped and the increase in quotes began. A fairly strong ADP report in the US also did not cause any market reaction. Thus, at this time, the instrument moves according to its own rules and completely ignores the news background.

Let me remind you that the markets have been fiercely working out the fuel crisis for the past week, but soon the fuel crisis itself will be left behind, and the markets are unlikely to still work it out. Something else is affecting the Pound/Dollar instrument now. One way or another, the markets will not be able to miss Friday's Nonfarm Payrolls report. Thus, now I am waiting for a new decline in quotes, and on Friday, first of all, important information about the state of the American labor market.

General conclusions

The wave pattern has changed dramatically. The wave pattern received a downward view, but not an impulse one. Therefore, now I advise you to sell the instrument for each MACD signal based on the construction of wave C, which can turn out to be quite long, with targets located near the calculated mark of 1.3273, which corresponds to 61.8% Fibonacci level. An unsuccessful attempt to break through the 1.3643 mark indicates that the markets are not ready for further purchases of the pound, so now a new downward wave can be built.

The upward section of the trend, which began its construction a couple of months ago, has taken a rather ambiguous form and has already been completed. The construction of the upward trend section has been canceled and now we can assume that the construction of a new downward trend section began on January 6, which can turn out to be almost any size.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română